Recently, CCData released the latest edition (March 2024) of its Exchange Review research report.

CCData is a trusted source for comprehensive data and analytics tailored to the ever-evolving cryptocurrency market. They go beyond simple data collection, meticulously organizing and analyzing vast datasets to unlock valuable insights for institutions and individuals navigating this space. CCData offers real-time market tracking, reliable pricing information, in-depth derivatives data, and carefully constructed indices for informed decision-making. Their FCA authorization highlights their commitment to accuracy and regulatory compliance.

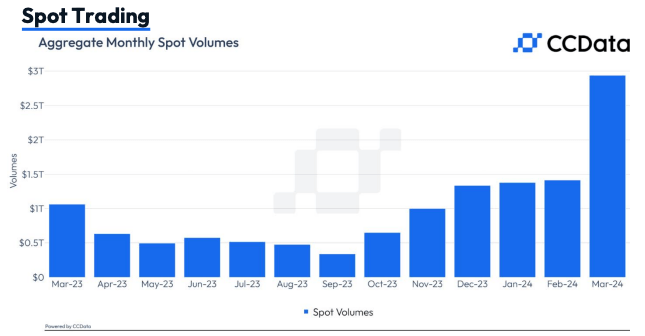

CCData’s Exchange Review research report delves into the intricate world of cryptocurrency exchanges, dissecting key metrics like trading volumes across spot and derivatives markets, the interplay between fiat and stablecoin pairs, and the competitive landscape. The report sheds light on the evolution of exchange fee structures and provides a>

Derivatives trading volumes also reached new all-time highs, rising by 86.5% to $6.18 trillion. Despite this surge, derivatives’ market dominance continued its sixth consecutive month of decline, dropping to 67.8%—the lowest market share since December 2022.

CCData’s report highlights that the surge in trading activity coincided with the anticipation surrounding the Bitcoin halving event, as the flagship cryptocurrency surpassed its previous all-time high in March. This event has historically been associated with increased market enthusiasm and price speculation.

Binance, the world’s largest cryptocurrency exchange, experienced a significant uptick in trading activity, with its spot trading volume increasing by 121% to $1.12 trillion in March – the highest spot volumes on the exchange since May 2021, as per CCData’s findings. Similarly, derivatives trading volumes on Binance rose by 89.7% to $2.91 trillion, also reaching their highest levels since May 2021. CCData attributes this surge to investors and traders speculating on the price action following Bitcoin’s approach toward a new all-time high in March. Consequently, Binance’s combined market share increased by 1.04% to 44.1% in March.

CCData’s report also sheds light on the impressive growth of Bitget, another prominent cryptocurrency exchange. Bitget witnessed a substantial increase in trading activity, with spot and derivatives volumes rising by 150% to $90.5 billion and 129% to $794 billion, respectively. As a result, Bitget became the third-largest derivatives venue by volume for the first time since December 2022, overtaking Bybit with a market share of 12.8% in March. The exchange’s combined spot and derivatives market share rose by 1.61% to 9.70% in March, securing its position as the fourth-largest exchange behind Binance, OKX, and Bybit.

The Chicago Mercantile Exchange (CME), a traditional financial institution that offers cryptocurrency derivatives, also achieved new milestones in March. CCData reports that the derivatives trading volume on the CME exchange rose by 60.6% to $155 billion, marking a new all-time high for the platform. This growth was primarily driven by the BTC futures, which saw a 65.4% increase to $123 billion in monthly volume. Meanwhile, the ETH futures volume traded on the exchange rose by 17.8% to $20.1 billion, recording the highest figures for the instrument since November 2021.

CCData’s analysis emphasizes the continued influence of CME on Bitcoin’s price action, with the open interest on BTC instruments rising by 47.1% to $11.7 billion in March. Notably, the open interest on CME’s BTC instruments surpassed that of centralised exchange counterparts, such as Binance, which reported an open interest of $8.53 billion for its BTC instruments.

cryptoglobe.com

cryptoglobe.com