- Binance has directed prime brokers, including FalconX and Hidden Road, to gather client details to identify US investors as it looks to enhance compliance.

- The world’s largest cryptocurrency is still under pressure from the US after admitting to financial violations late last year.

In an effort to enhance compliance, Binance has directed prime brokers, including FalconX and Hidden Road, to gather client details to identify US investors. This is one of the initiatives undertaken by the world’s largest crypto exchange to enhance compliance and regulatory measures.

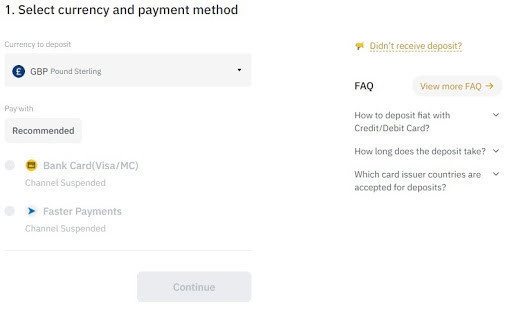

Binance hopes to implement a stricter verification process to prevent US investors from accessing the exchange. Prosecutors have accused Binance of targeting US customers without complying with US legislation.

As CNF reported, Binance pleaded guilty to charges relating to anti-money laundering (AML) laws. Binance and it’s then CEO, Changpeng Zhao ‘CZ’, secured a settlement of $4.3 billion with the U.S. Department of Justice (DOJ). Additionally, CZ agreed to step down, with Richard Teng taking over as CEO.

Although the exchange witnessed some turbulence, most notably, record withdrawals, it has rebounded and shown its strength and commitment. Recently, the exchange has celebrated exceeding $100 billion in user assets. This is evidence of investors’ trust in the exchange, which has seen it remain the most popular crypto exchange in the world.

In addition to taking measures to deter US investors, insiders have revealed that the exchange has enhanced its criteria for listing new digital tokens. According to Bloomberg, Binance said:

Binance is fully committed to compliance and has made public how it assesses end users who can access the Binance platform. By making its standard transparent, Binance gives clarity to enterprises who want to access its market-leading liquidity.

Another significant step is that the exchange has taken a proactive stance against potential insider trading and corruption on its platform. The exchange announced a significant reward ranging from $100,000 to $5 million for individuals who provide credible reports on such activities.

The recent crypto price surge has boosted the exchange, with new investor interest driving traders to its platform. However, with the admission of guilt and the collapse of FTX, investors are now keen on the platform of choice.

The exchange’s associated token, Binance Coin ($BNB), has staged a comeback in the past couple of hours. After losing the fourth rank to Solana (SOL), the digital asset has regained its footing. At the time of writing, $BNB is trading at $532 after a marginal drop in the past 24 hours.

$BNB has distinguished itself as a leader in the digital asset market following March’s upward trend. As highlighted by CNF, the strong expansion of the Binance Smart Chain (BSC) ecosystem is one of the main factors contributing to $BNB’s explosive ascent. Experts foresee the digital asset setting an all-time high in the 2024 bull market.