The recent spike in Bitcoin volume traded on South Korean crypto exchanges is not sustainable, according to Bradley Park, an analyst at CrypoQuant. Park’s opinion stems from the fundamental reasons behind the observed change in the investment attitude of crypto traders in the Asian country.

“Aside from the noise of Bitcoin volume on Bithumb, Korean trading habits probably won’t change much,” said Bradley Park, an analyst at CryptoQuant. https://t.co/WSgjyKGgs6 via @business @crypto pic.twitter.com/3wtXvMYG91

— Sidhartha Shukla (@s1dc01n.bsky.social) (@sidcoins) February 23, 2024

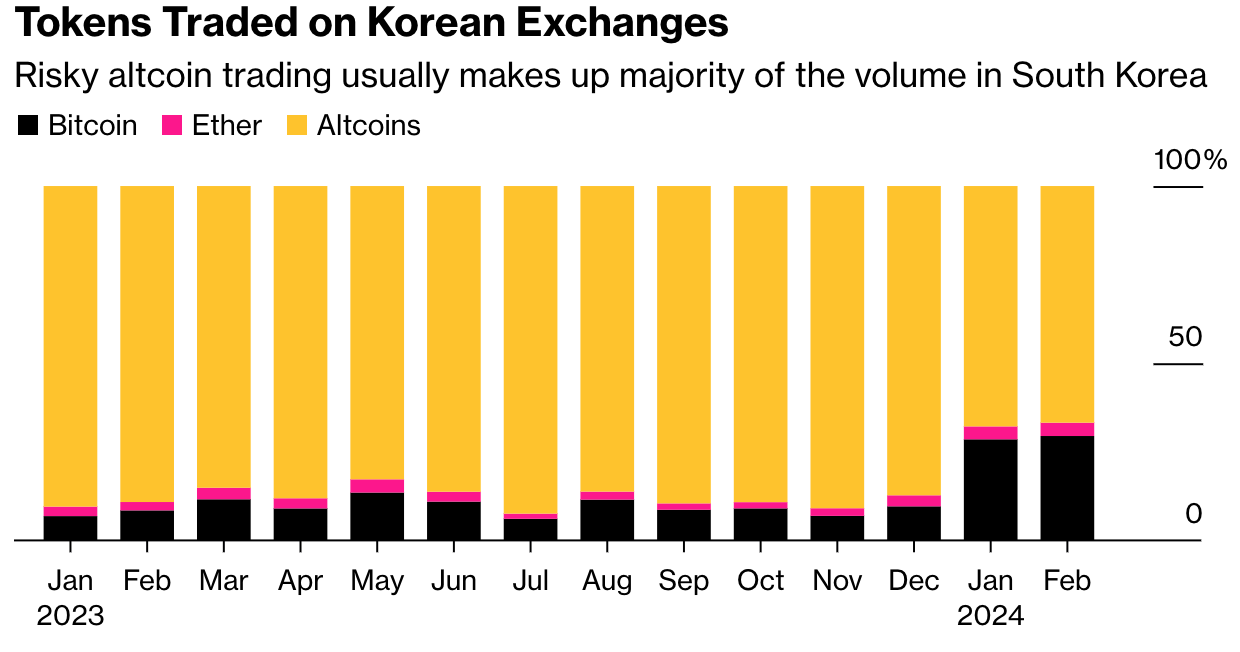

According to CryptoQuant data, Bitcoin trading accounted for about 30% of volumes traded on domestic South Korean exchanges this year. That is a departure from the historical trading pattern among crypto traders in the region. For instance, the highest ratio of Bitcoin volume on South Korean exchanges in 2023 was 13.5%, recorded in May last year.

Further study of the CryptoQuant data shows that smaller tokens in the form of altcoins took the hit and experienced significant deficits in trading volumes. Hence, that category of digital assets that normally makes up over 80% of the trading volume on South Korean exchanges dropped to less than 70% this year.

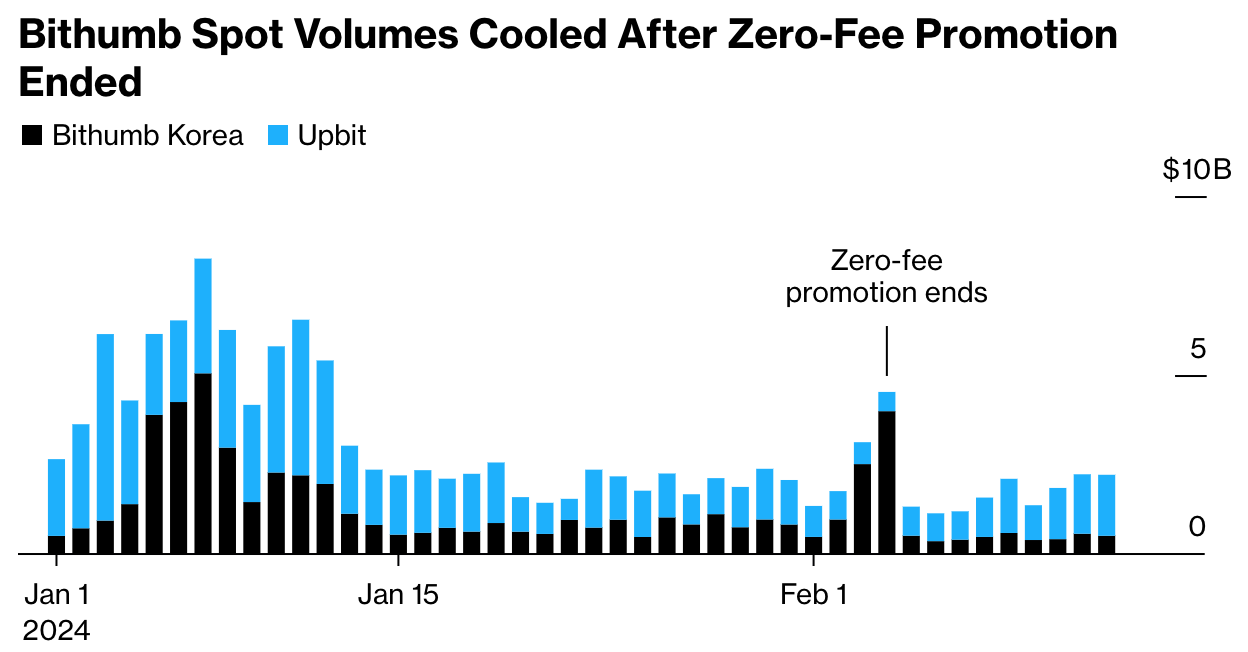

Notably, the surge in Bitcoin trading volume in South Korea coincides with Bithumb’s promotion that erased trading fees for Bitcoin trading on its platform. As a result of the promotion, Bithumb’s market share spiked to 40% from a relatively low 12% in October, when the promotion began.

The swing in market share affected Upbit, a dominant exchange in the region, whose market share dropped from 80% to 54% during the same period, according to data from CryptoQuant. Hence, the Bitcoin volume shift triggered by Bitcoin appears to result from capital flight from Upbit to Bithumb.

As a matter of interest, Bithumb’s no-fee promotion ends this month, and there are signs of trading activity returning to Upbit. Hence, the recent changes in market share and Bitcoin trading volume could be temporal. According to Park, aside from the noise of Bitcoin volume on Bithumb, Korean trading habits probably won’t change much.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com