Robinhood’s latest earnings call revealed a significant trend among its users. Despite the introduction of a variety of Bitcoin ETFs, a whopping 95% of the platform’s crypto trading volume remains concentrated in spot Bitcoin trading.

This preference underscores a continuing inclination toward traditional cryptocurrency trading methods over newer investment vehicles like ETFs.

Robinhood Finds Users More Interested in Spot Bitcoin Trading Over ETFs

Robinhood’s Chief Financial Officer, Jason Warnick, highlighted this trend during the call. He stated,

“About 5% of our overall trading in crypto is through the ETF, with 95% still being on spot trading through the crypto business, and that’s stabilized.”

Warnick’s observation reflects a clear customer preference, demonstrating the robustness of spot trading in the face of emerging alternatives.

The investment platform made a significant move earlier last month by adding all 11 SEC-approved spot Bitcoin ETFs to its offerings. This addition was part of Robinhood’s broader strategy to provide its users with a wide array of investment options.

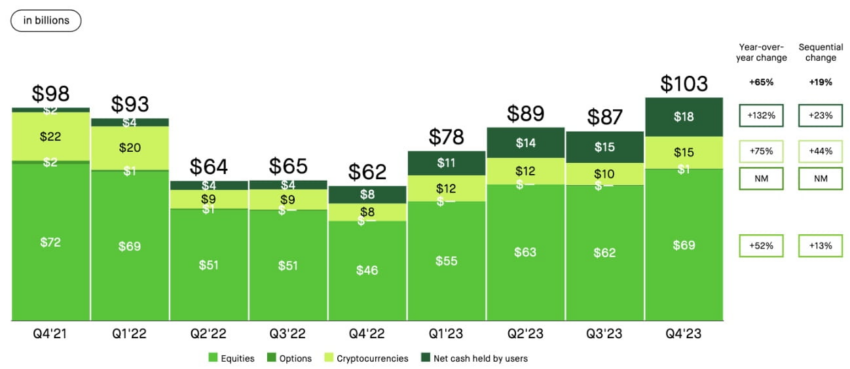

In the final quarter of 2023, even before the Bitcoin ETFs were approved, Robinhood started seeing an uptick in crypto assets under custody. At $15B, this was its highest crypto AUM on the platform since Q1 2022.

Read more: Coinbase Vs Robinhood: Which Is The Best Crypto Platform?

Steve Quirk, Chief Brokerage Officer at Robinhood, expressed the company’s mission, saying,

“Providing expanded access to the financial markets and increasing customer choice are at the core of Robinhood’s mission.”

This initiative aligns with the platform’s commitment to offering diverse trading options to its clientele.

Expanding Its Presence Throughout the European Union

Despite the introduction of these ETFs, Robinhood users have shown a strong preference for direct Bitcoin trading. This trend could be attributed to the direct control and potentially higher rewards associated with spot trading.

Johann Kerbrat, GM of Robinhood Crypto, emphasized the importance of direct Bitcoin trading. He remarked,

“We believe crypto is the financial framework of the future and that increased access to Bitcoin via ETFs is a good thing for the industry.”

Read more: What Is A Bitcoin ETF?

In addition to its efforts in the US market, Robinhood is expanding its presence in the European Union, introducing 26 cryptocurrencies, including prominent tokens like SOL, MATIC, and ADA. This expansion represents a significant step in Robinhood’s strategy to cement its position in the global digital asset market.

The platform’s latest moves and user trends reflect a dynamic strategy. While Robinhood embraces the diversification of its crypto offerings, its user base continues to show a strong preference for traditional trading methods.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

beincrypto.com

beincrypto.com