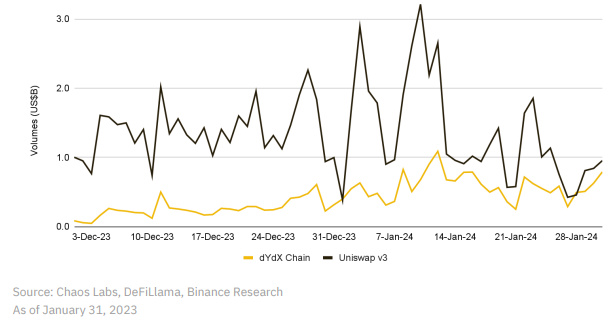

Decentralized exchange (DEX) dYdX exceeded the daily trading volume of Uniswap two times in January, according to a Binance Research report. The DEX peaked at $493 million on January 28, outdoing Uniswap’s $457 million.

The accumulated trading volume for dYdX surpassed $25 billion, with volumes spiking above $1 billion following the approval of spot Bitcoin ETFs. The market closely watched the transition of dYdX from an Ethereum application to a standalone Cosmos appchain. The platform incentivizes active traders through a Launch Incentives Program, currently in its second phase with two more expected.

In addition to dYdX, Jupiter, a DEX aggregator built on Solana blockchain, also experienced a surge in trading volumes, surpassing Uniswap’s 24-hour volume on several occasions. This increase may be partly attributed to the launch of the JUP token.

DeFi gears up, NFTs slump

The overall decentralized finance (DeFi) total value locked (TVL) rose by 4.1% in January, with Manta, Solana, Ethereum, and Arbitrum making significant contributions. Manta’s TVL soared by almost 68% month-over-month, driven by a successful incentive campaign. On Ethereum, protocols like Renzo Protocol, Ether.fi, and KelpDAO substantially grew, offering enhanced rewards for ETH deposits.

Conversely, the NFT market witnessed a 33% decrease in trading volume month-over-month in January 2024, with a notable drop in Bitcoin NFT sales. However, Polygon’s NFT market bucked the trend, recording a 136% increase, largely due to the popularity of the Gas Hero NFT collection from Find Satoshi Labs, which generated over $90 million in trading volume.

cryptobriefing.com

cryptobriefing.com