- 1 Misconduct by SBF led to fall in liquidity in crypto and collapse of FTX and Alameda Research.

- 2 In November 2023, Sam Bankman Fried was found guilty and faces a maximum prison sentence of 115 years.

- 3 This misconduct raised questions about the safety and security of all the cryptocurrency exchanges and led to decline in investor confidence.

November 2022 witnessed a sharp decline in the prices of cryptocurrency, a drain of liquidity, and a loss of confidence in the crypto market. These were caused as a result of the collapse of the largest cryptocurrency exchange, FTX.

It further raised questions about the safety and security of customer funds on the cryptocurrency exchanges. This crisis exposed the lack of risk management in the crypto industry.

The extended reasons for the collapse were the mismanagement of customer funds and the risky trading practices of Alameda Research, FTX’s sister concern.

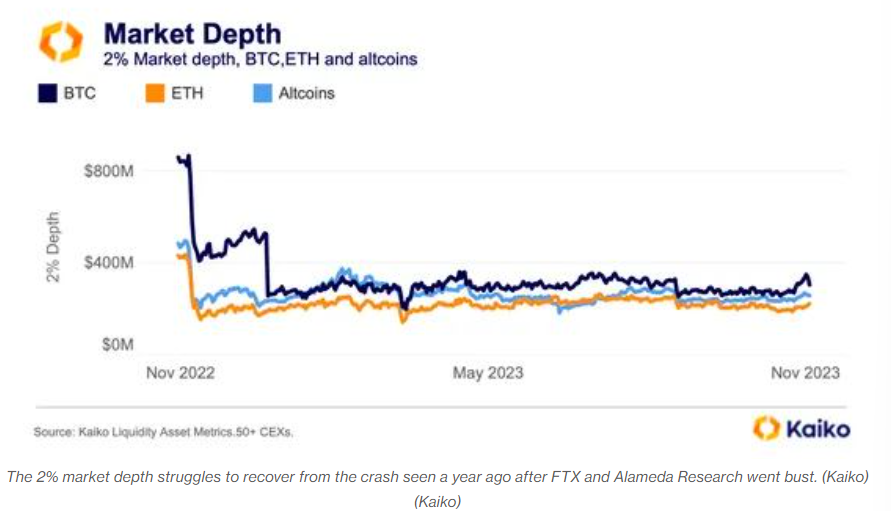

Some of the impacts of this crisis, such as weak liquidity and market depth, are still visible in the crypto market. It reduces the ability of the market to absorb large orders at stable prices.

Highlights of the Incident

FTX had filed for bankruptcy with a debt of more than $3 billion from its creditors. Moreover, FTX was unable to locate customer assets worth approximately $8.9 billion. However, the exact amount of money that the customer lost was difficult to determine.

Some of the customers were able to withdraw their funds before FTX suspended withdrawals. It was estimated that customers lost billions of dollars in USD due to the FTX crash.

This collapse caused a significant decline in cryptocurrency prices. As a result, the total market cap of the crypto market significantly declined from more than $1 trillion in November 2022 to less than $800 billion in December 2022 (a decline of 20%).

Development of Alameda Research and FTX

Sam Bankman Fried saw an opportunity to generate profit by creating a new cryptocurrency exchange with the objective of exploiting the shortcomings of the existing exchange.

As a first step, he established a quantitative trading firm called Alameda Research. It used simple algorithms to trade cryptocurrencies on a variety of exchanges. It was very successful, and it became one of the largest cryptocurrency traders in the world.

After the success of Alameda Research, Bankman Fried launched FTX, a cryptocurrency exchange, in 2019. It was set up with the objective of being more user-friendly and efficient than all the existing crypto exchanges.

FTX provided some of the characteristics that were not available on other exchanges, such as margin trading and derivatives trading. FTX did not address any of the regulatory controls that mainstream financial services trading platforms required.

Fraudulent Activities of FTX and Alameda Research

Bankman-Fried and Caroline Ellison were the CEOs of FTX and Alameda Research, respectively. Bankman Fried controlled the majority of the shares in both companies. Alameda Research also used FTX as its primary exchange.

FTX and Alameda Research, together, were involved in the following fraudulent activities:

Misappropriate use of customers’ funds

Bankman-Fried transferred customer funds from FTX to Alameda Research without getting consent from customers. He further used these funds to cover the losses of Alameda Research and to fund his own personal expenses.

Manipulating the cryptocurrency market

Alameda Research used its huge trading volume to manipulate the prices of cryptocurrencies on FTX. This has enabled the CEO to generate profits from insider trading.

Fraudulent Financial Products

The FTX, under the leadership of Bankman-Fried, offered unregulated financial products such as margin and derivatives trading. The lack of regulations allowed him to cheat customers by selling these fraudulent products without disclosing the risks associated with them.

Revealing FTX Scam and Alameda Gap

In the beginning of November 2022, the scam began to unwind when it was revealed that Alameda Research holds a large position in $FTT, which is a native token of FTX.

This revelation spiked the sale of the FTX token ($FTT), leading to a sudden drop in the token’s price. It raised concerns about the financial health of Alameda Research and FTX. It gave rise to a liquidity crisis at FTX as customers rushed to withdraw their funds from the exchange.

When FTX was unable to fulfill the withdrawal demands, it filed for bankruptcy on November 11, 2022. This collapse and bankruptcy filing have severely impacted the crypto market.

As a result, there was a significant decrease in liquidity within the crypto market, which was coined the Alameda gap by blockchain data firm Kaiko. Alameda Research played a significant role in the crisis, and thus it was named the Alameda Gap.

The Alameda Gap represented a substantial fall in available liquidity, impacting trading volumes and market stability. This event put the industry under a legal and regulatory microscope.

Arrest of Bankman-Fried

United States prosecutors filed criminal charges against Sam Bankman-Fried. As a result, he was arrested on December 12, 2022. His arrest and trial were major events in the crypto industry.

It became the first time ever since the development of cryptocurrency that a renowned crypto developer was arrested and tried on criminal allegations.

He was accused of 7 crimes, including wire fraud against FTX clients, wire fraud against Alameda Research, conspiracy to commit wire fraud against FTX customers, conspiracy to commit wire fraud against Alameda Research, conspiracy to commit securities fraud, conspiracy to commit commodity fraud, and conspiracy to commit money laundering.

On November 2, 2023, he was held responsible for all seven charges and announced a maximum prison of 115 years. He denied all the allegations against him and said that he had made mistakes but did not commit any punishable crimes.

Conclusion: Reforms in the Industry post FTX crisis

The following developments were made in the industry after the FTX crisis:

Increase in Regulation: The Governments across the world have started to develop and implement comprehensive regulations for the crypto space. These regulations will safeguard the interests of investors and prevent fraud.

Increase in Trasparency: The major crypto exchanges have now come forward and offered documents confirming transparency in their operations and financial conditions. This will help investors make informed investment decisions.

Audits: Independent regulators regularly audit cryptocurrency exchanges. It ensures the honesty of exchanges and the safety of customers’ funds.

Investors are also advised to do their own research or due diligence before involving themselves in any cryptocurrency exchange-related activities. Investors should look for transparent, regulated, and reputed exchanges.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

thecoinrepublic.com

thecoinrepublic.com