Despite facing regulatory challenges, Binance has retained its position in the industry, with only a marginal decrease in its market share, according to TokenInsight.

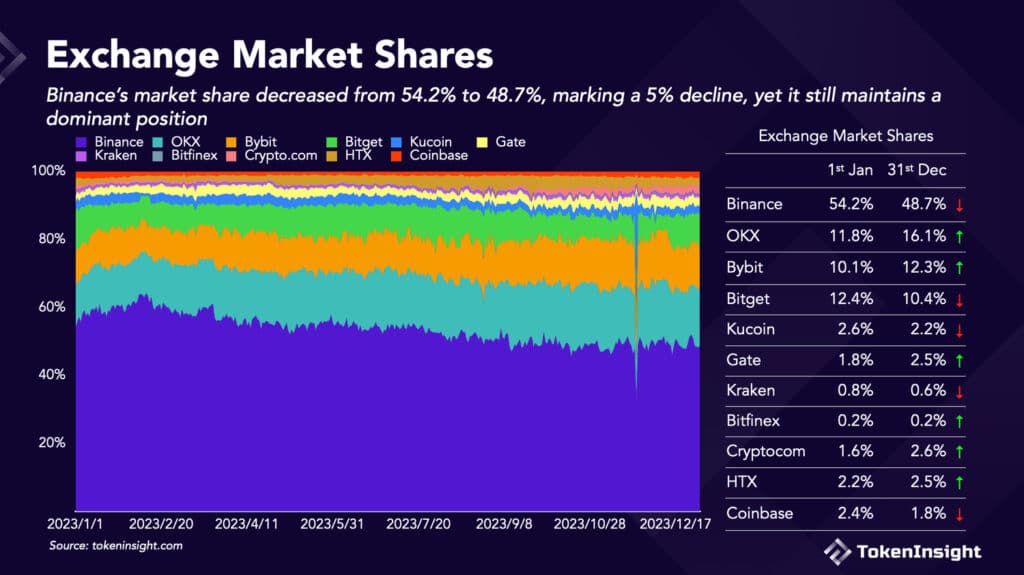

Binance experienced a 5% decline in market share, dropping from 54.2% to 48.7%. This shift followed the decision of Binance’s founder, Changpeng Zhao, to step down as CEO as part of a $4.3 billion settlement with the U.S. Department of Justice, according to recent research from TokenInsight.

As per data, other cryptocurrency exchanges such as OKX and Bybit appeared to be significant gainers in the market, with OKX increasing by 4.3% in market share to 15.7%, while Bybit saw a rise of 2.2% up to 11.6%. Analysts added that despite Binance facing troubles with U.S. regulators last year, traders “do not seem to have lost confidence in centralized exchanges.”

“These events did not have a massive impact on the market landscape as the FTX collapse did in 2022. Traders still prefer the perceived safety of centralized exchanges.”

TokenInsight

In Q1 2023, decentralized exchanges — including Uniswap, PancakeSwap, Orca, and others — reached their peak market share at 2.98%. Meanwhile, Q1 was also the quarter with the largest transaction volume, analysts added. However, in the subsequent two quarters, both trading volume and market share gradually contracted. While there was a slight increase in both metrics in Q4, the overall proportion did not undergo significant changes, as per TokenInsight’s data.

Read more: Binance releases proof of reserves, showing 100% backed assets