FTX Trading Ltd. Introduced a new proposal to return billions of dollars to customers and creditors.

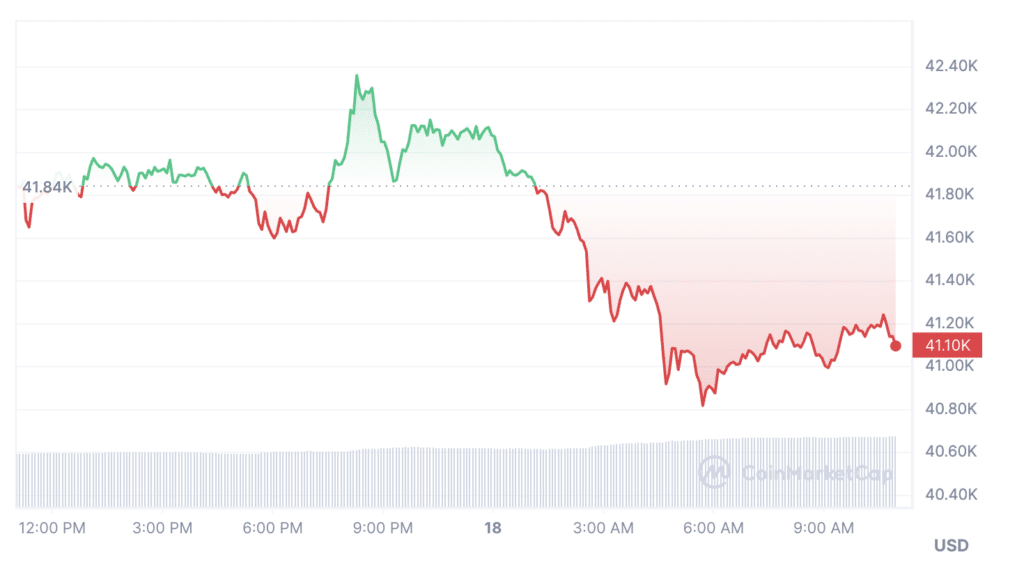

FTX has filed an amended plan of reorganization that will value assets at the rate at the time of the bankruptcy filing—November 11, 2022. At that time, Bitcoin (BTC) was trading at around $17,000; the current price is above $41,100.

In addition, at the beginning of November 2022, the FTT token was valued at approximately $26. It is now trading at $3.70.

FTX is currently discussing how best to end the bankruptcy case of the fraud-tainted cryptocurrency firm. The payout plan calls for billions of dollars in cash to be distributed once most of the company’s cryptocurrencies are liquidated. The plan says that certain classes of creditors can vote on the changes. The authors believe their proposed approach “reflects many trade-offs to create the best, fairest, and most cost-effective outcome.”

One of the creditors noted that the new reorganization plan contradicts FTX’s Terms of Service, making digital assets the users’ property.

FTX Debtors have filed the reorg. Plan

— Sunil (FTX Creditor Champion) (@sunil_trades) December 16, 2023

Most importantly they have ignored FTX TOS that states Digital Assets are the property of Users and not FTX Trading

The plan says that Digital Assets are valued at Petition Date conversion rates (prices) pic.twitter.com/WTj07nlOP5

However, the reorganization plan left some of the most important questions unanswered, including whether FTX will re-launch its defunct crypto exchange, how the company will value some digital tokens, and how much creditors can expect to get back.

The plan is expected to go to creditors for approval in 2024 and then, once approved, to U.S. Bankruptcy Judge John Dorsey for final approval. The primary creditor and client groups in the Chapter 11 case agreed to the overall plans.

In October, representatives of creditors and FTX management approved a plan according to which clients will be able to expect a return of $9.2 billion by mid-2024. That same month, exchange management began considering three options for restructuring the platform.