Coinbase, the renowned United States-based cryptocurrency exchange, has made a strategic move to boost liquidity on its platform by suspending 80 non-USD trading pairs. This significant decision, announced is in alignment with Coinbase’s commitment to enhancing overall market health and consolidating liquidity.

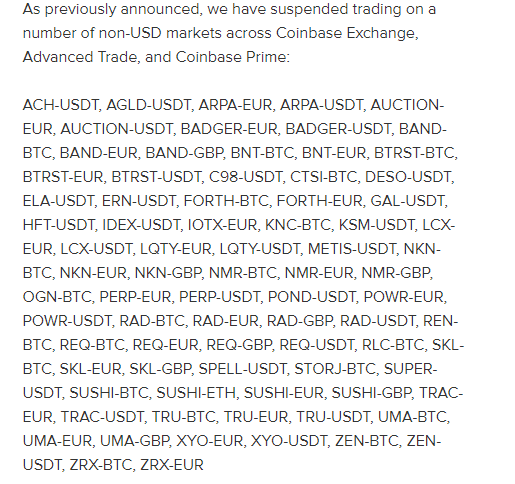

Coinbase’s decision to suspend 80 non-USD trading pairs underscores the exchange’s dedication to maintaining a robust and efficient marketplace. Among the affected trading pairs are those involving prominent cryptocurrencies like Bitcoin (BTC), stablecoins like Tether (USDT), and fiat currencies such as the euro. These pairs were removed from Coinbase, Advanced Trade, and Coinbase Prime platforms at precisely 19:30 UTC on October 16, 2023.

Coinbase justified this move by emphasizing its intention to improve liquidity and enhance market health. Users, however, need not be concerned, as they can still engage in trading these assets through Coinbase’s more liquid USD order books using their USD Coin (USDC) balances.

The exchange sought to clarify that the suspended trading pairs represented only a negligible portion of Coinbase Exchange’s total trading volume, indicating that the impact on most users would be minimal.

Coinbase and Binance grapple with market dynamics

This action from Coinbase is part of a series of measures aimed at optimizing liquidity on its platforms. In mid-September 2023, Coinbase removed 41 non-USD trading pairs for similar reasons, with a focus on bolstering liquidity. Importantly, while numerous USDT-containing trading pairs were suspended, none of the affected markets included USDC, a stablecoin that Coinbase co-developed in collaboration with Circle.

Coinbase’s persistent efforts to improve liquidity are set against a backdrop of declining trading volumes in 2023. According to data from cryptocurrency market data provider CCData, Coinbase’s spot trading volumes for the third quarter experienced a notable 52% decline compared to the previous year. This decline in trading activity reflects a broader trend in the cryptocurrency industry, with other major exchanges also facing similar challenges.

Binance, one of the industry giants, has also encountered challenges in maintaining market share dominance in 2023. CCData’s data shows that Binance’s spot market share has witnessed a steady decline over seven consecutive months. From holding a commanding 55% share of the market in early 2023, Binance’s market share dwindled to 34% by September 2023.

The declining market share of both Coinbase and Binance suggests that factors beyond liquidity are at play in the crypto industry. Regulatory changes, market sentiment, and the maturation of the industry are some of the broader dynamics influencing these shifts.

cryptopolitan.com

cryptopolitan.com