On 6 October, a U.S. federal court questioned FTX’s former CTO, Gary Wang, to clarify some of the issues surrounding the crypto fraud perpetrated by Sam Bankman Fried and his team during the exchange’s entire lifespan.

What emerged and is most striking during Wang’s testimony is that SBF’s right-hand man had falsified data related to the crypto exchange platform’s insurance fund, which was allegedly used to cover any user losses during settlement events.

The number stated on the exchange’s website was, in fact, significantly higher than what was actually present at the time.

The situation for the former FTX CEO becomes even more complicated, given and considering also the directives he gave to his employees to obscure the company’s losses through Alamea Research.

Let’s see together all the details of the news.

New findings on FTX’s crypto fraud case: Insurance fund value listed on exchange’s website was fake

A few days ago Gary Wang, former CTO of FTX, testified before a U.S. federal court to clarify some points related to Sam Bankman Fried‘s crypto fraud.

Wang, SBF’s classmate at the Massachusetts Institute of Technology (MIT) and co-founder of the now-bankrupt crypto exchange platform, recounted some anecdotes that could further get his old friend into trouble.

In fact, in front of the feds, he claimed to have falsified, under Bankman-Fried’s orders, the value related to FTX’s insurance fund, which would be used to cover any user losses during events of massive sudden liquidations.

The figure, shown publicly on the exchange’s website and repeatedly publicized by the exchange bank itself, had been written in python and simply indicated random numbers in the front-end.

The total amount of real funds available to FTX was significantly less than the published figure. All of this contributes to complicating even more the story of the largest fraud in crypto put in place to date.

Just think that in February 2021, FTX itself had boasted that it had reached the total countervalue of $100 million within its fund to guarantee the losses of its users.

The 5.25 million $FTT we put in our insurance fund in 2019 now makes the fund worth over 100 million USDhttps://t.co/tMYgJOAdqI pic.twitter.com/vQDkmkufD2

— FTX (@FTX_Official) February 14, 2021

During the trial, the prosecution questioned Wang as if the fund amount was accurate. The former CTO of FTX responded as follows:

“No. “First, there is no $FTT in the insurance fund. It is only the USD number. And, two, the number listed here does not match the number in the database.”

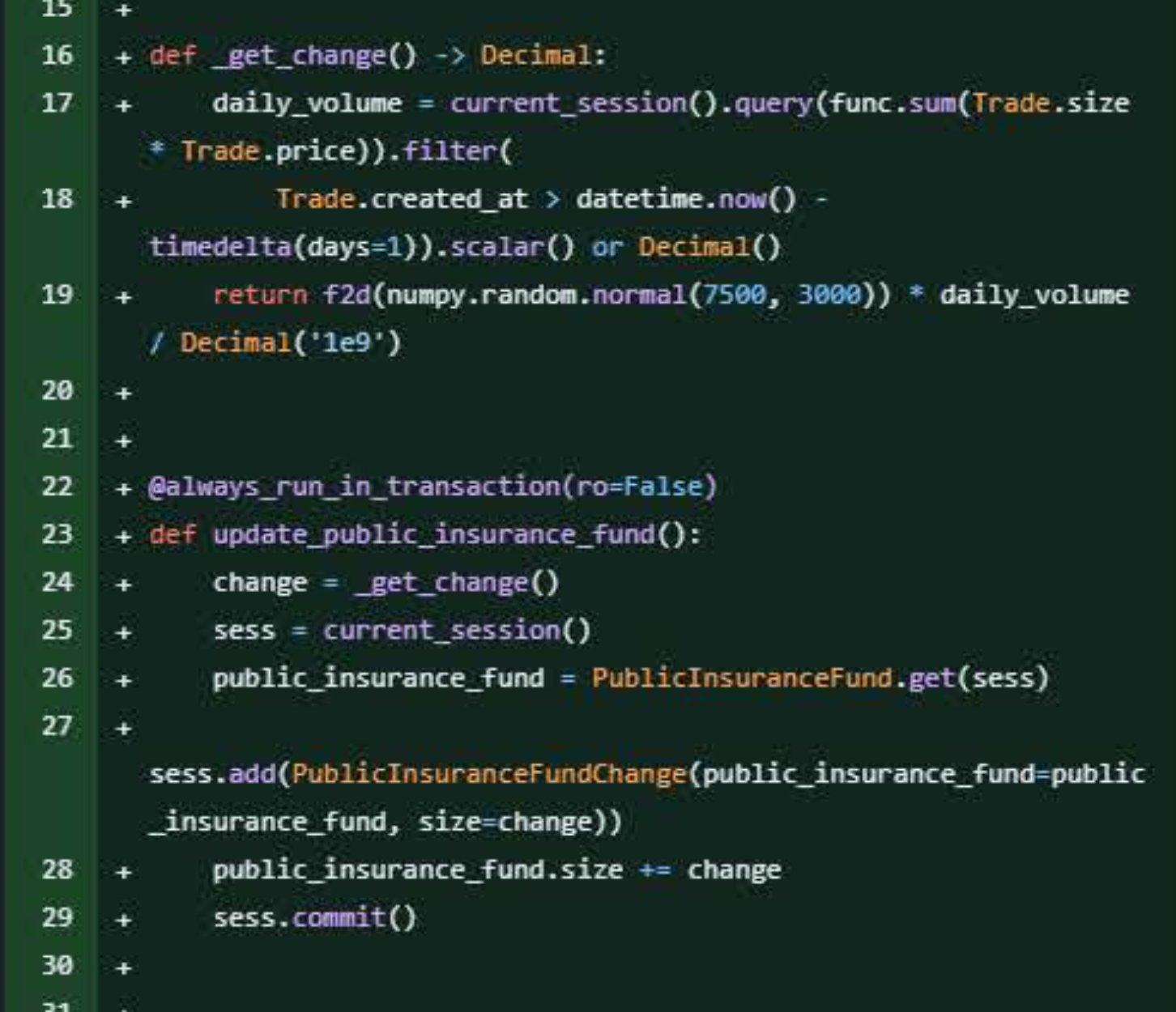

A document from the Oct. 6 trial shows the alleged code used to generate the size of the so-called “Backstop Fund” or public insurance fund”

The prosecution at this point asked how the falsified value of the fund was or was not random, and how the published values were arrived at during the exchange’s final years of operation. This was Wang’s response:

“First, line 16 tells what the name of this function is. Line 17, it gets the daily: it gets the total trading volume of the last 24 hours on FTX. Then in line 19 you take that number, multiply it — then you multiply it by a random number that is around 7500 and then you divide the result by a billion. That is a number that is added to the number displayed on the website.”

While having committed criminal wrongdoing, the one at great risk in this context is Sam Bankman Fried himself, as the CEO of the company during the frauds committed and as the originator of the falsification of the insurance fund data.

The role of Alameda Research and SBF employees in the affair

As mentioned earlier, in this chapter of the FTX crypto fraud, it was not Sam Bankman Fried who wrote the code indicating the value of the exchange’s insurance fund, but ordered Gary Wang to deal with it.

The latter, along with FTX”s former director of engineering Nishad Singh and former Alameda Research CEO Caroline Ellison, had warned SBF of the risks the exchange was taking during 2021 and 2022 given that the company”s outlays were significantly higher than its revenues, which came primarily from the platform”s trading fees.

In fact, at the end of the day, the forgery of the contingency fund represented one of the minor malfeasances enacted by SBF given and considering how FTX’s customers’ capital flowing into the platform was handled.

During Wang’s testimony, it emerged that Bankman Fried had ordered his close associates to implement an “allow_negative” balance function in FTX’s code that would allow Alameda Research (the exchange’s sister hedge fund) to withdraw as much liquidity as it wanted, without any kind of limit.

This was not the end of the story: during the trial it was also discovered that in 2021 a trader had exploited a bug in FTX’s margin system by opening an outsized position in MoblieCoin and causing losses of hundreds of millions of dollars to FTX.

In this case SBF told Wang to have Alameda assume the losses since the latter’s balance sheets were more private than those of the exchange.

So Alameda Research represented a fund with which SBF was able to cover most of the financial crimes it committed, preventing the crypto fraud from coming to light for several years.

Wang, Singh, and Ellison, all three of Bankman Fried’s longtime partners and each owning a share in FTX and Alameda Research followed the criminal mastermind’s directions without ever wavering until 2022, however, coming to concern when they noticed that Alameda owed $11 billion (customer money) to the exchange.

All 3 now face criminal prosecution and locked up in prison for several years along with their MIT friend and partner.

en.cryptonomist.ch

en.cryptonomist.ch