Amidst the unfolding drama of the FTX exchange's bankruptcy proceedings, a series of captivating developments has taken center stage. From regulatory lawsuits to mysterious fund transfers and the unwavering faith of FTX's affected customers, this comprehensive roundup encapsulates the latest events surrounding the troubled cryptocurrency exchange.

The Securities and Exchange Commission (SEC) has made a significant move by filing a lawsuit against Prager Metis, the auditing firm that was responsible for overseeing FTX's financial operations. The SEC's allegations revolve around Prager Metis's violation of independence rules and its alleged role in assisting clients in breaching federal securities laws.

The Indemnification Clause Controversy

At the heart of the SEC's lawsuit are the indemnification clauses that Prager Metis reportedly included in engagement letters with over 200 customers, including 62 companies registered with the SEC. These clauses required clients to absolve Prager Metis of any responsibility for losses incurred as a result of fraudulent statements made by the company's management.

The SEC contends that these indemnification terms impaired Prager Metis's objectivity and impartiality as an auditor, making it significantly more challenging for the firm to meet auditing requirements effectively. Moreover, the SEC asserts that Prager Metis was aware of these infractions since at least January 2019, yet continued to include indemnity terms in its engagement letters.

This lawsuit against Prager Metis represents a crucial aspect of the broader investigation into the FTX cryptocurrency exchange's collapse. The SEC is seeking a range of legal remedies, including an injunction, penalties, disgorgement of ill-gotten earnings, and other appropriate relief.

The Collapse of FTX and Prager Metis's Role

To understand the gravity of this legal battle, it's essential to revisit the context surrounding FTX's demise. FTX Group, the parent company of FTX exchange, was one of Prager Metis's prominent clients. It was reported in an audit by Prager Metis that FTX's overseas division was poised to generate $1 billion by 2021.

However, the landscape took a dramatic turn when the United States government leveled accusations of fraud against FTX, suggesting that the exchange's staggering $7 billion deficit was the result of a massive fraudulent operation. Additionally, FTX announced its ambitious plans to make a foray into the Metaverse, adding another layer of complexity to the situation.

While Prager Metis is now facing legal action from the SEC, it's crucial to note that these charges do not directly pertain to the company's connections with FTX. Instead, the lawsuit delves into Prager Metis's practices as a whole in its role as the auditor for numerous clients across various industries.

In a bid to preserve public trust and uphold the accuracy of financial statements, auditor independence is paramount. According to the SEC's lawsuit, Prager Metis's audits, reviews, and examinations fell short of meeting these fundamental standards for over three years.

Eric I. Bustillo, the head of the SEC's Miami regional office, emphasized the significance of auditor independence, stating, "Our complaint serves as a reminder that auditor independence is critical to investor protection."

As of now, Prager Metis has not publicly addressed the SEC's allegations. The firm operates globally, with a presence in the Americas, Europe, Asia, and Australia. Its service offerings encompass a wide spectrum, including auditing, tax preparation, business management consulting, forensic accounting, and expert witness testimony.

FTX Hacker Resurfaces with Fund Transfers

In another intriguing development, blockchain records have unveiled that the hacker responsible for stealing millions of dollars' worth of cryptocurrency from FTX during its collapse has resurfaced. Early on a Saturday morning, the hacker initiated a series of rapid fund transfers, marking a sudden and unexpected turn of events in the ongoing FTX saga.

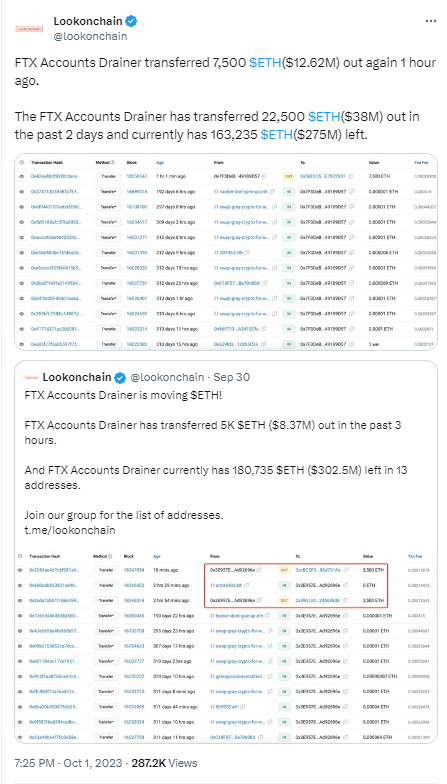

Lookonchain snap | Source: X(Formerly Twitter)

The backdrop of this story stems from a cyberattack that targeted FTX in November 2022. Remarkably, the attack occurred mere hours after the exchange filed for bankruptcy, and its CEO, Sam Bankman-Fried, resigned from his position. The attack resulted in the theft of millions of dollars' worth of Ethereum (ETH) from FTX, leaving the cryptocurrency exchange in disarray.

The recent activities of the hacker, who reportedly possesses over $300 million in cryptocurrency assets, have garnered attention in the crypto community. According to data sourced from the blockchain intelligence platform Arkham, large sums of ETH stolen during the FTX attack have been transferred.

Arkham's data indicates that the hacker employed the smart contract platform RailGun (RAIL) and the decentralized exchange protocol ThorChain (RUNE) to facilitate the transfer of approximately $8 million USD worth of ETH. Notably, this marks the first time that these stolen assets have been put into motion since the cyberattack.

Furthermore, the hacker's wallet, often referred to as the "FTX Exploiter," contains a diverse portfolio of cryptocurrency assets. This includes approximately $1.7 million in DAI (DAI), nearly $3.97 million in Tether (USDT), around $30,000 in USD Coin (USDC), and approximately $43,000 in Binance Coin (BNB). Additionally, the wallet holds approximately $42,000 in Bitcoin (BTC) and roughly $8,500 in Wrapped Bitcoin (wBTC).

The movement of the ETH funds was notable for its division into two segments, with each segment utilizing different mechanisms for the transfer. Approximately 700 ETH were transported via the ThorChain Router, while around 1,200 ETH were moved using RailGun. An intermediary wallet held an additional 550 ETH.

The Role of RailGun and ThorChain

RailGun and ThorChain serve distinct purposes within the cryptocurrency ecosystem. RailGun is designed to provide a secure and anonymous storage solution for tokens and cash intended for use in decentralized financial services, such as lending and borrowing. Due to the confidentiality of transactions, the recipients of these funds may never ascertain their ultimate usage.

On the other hand, ThorChain operates as an intermediary platform that facilitates the movement of tokens across different blockchains. In this instance, ThorChain was used to enable the transfer of assets.

While the recent transfers are noteworthy, it's important to acknowledge that a substantial amount of ETH, approximately 12,500 ETH or $21.1 million, remains within the original hacker's wallet.

The Mystery of the FTX Hacker's Identity

One of the lingering mysteries surrounding the FTX saga is the identity of the hacker responsible for the massive theft. To date, the hacker has remained elusive, avoiding identification by law enforcement agencies. Moreover, the timing of the asset transfers coincides with the impending trial of Sam Bankman-Fried in the United States.

Federal prosecutors have filed multiple charges, including fraud and conspiracy to commit fraud, against Sam Bankman-Fried, the former CEO of FTX. Bankman-Fried has vehemently denied all allegations levied against him. While some executives from his crypto empire, including Alameda Research, have pled guilty to various charges, their testimonies could be used against their former employer during the trial.

As the trial approaches, the cryptocurrency community eagerly anticipates further developments, including potential revelations regarding the identity of the hacker behind the FTX attack.

cryptonews.net

cryptonews.net