The decline in cryptocurrency market activity is felt not only by cryptocurrency exchanges but also by companies in the retail trading sector. Robinhood (NASDAQ: HOOD), the American commission-free online trading provider, reported a decrease in total trading volumes in the digital asset market by 38% compared to the previous year. Daily Average Revenue Trades (DARTs) also declined, dropping 33% year-over-year (YoY).

Robinhood Reports Decline in Crypto Market Activity

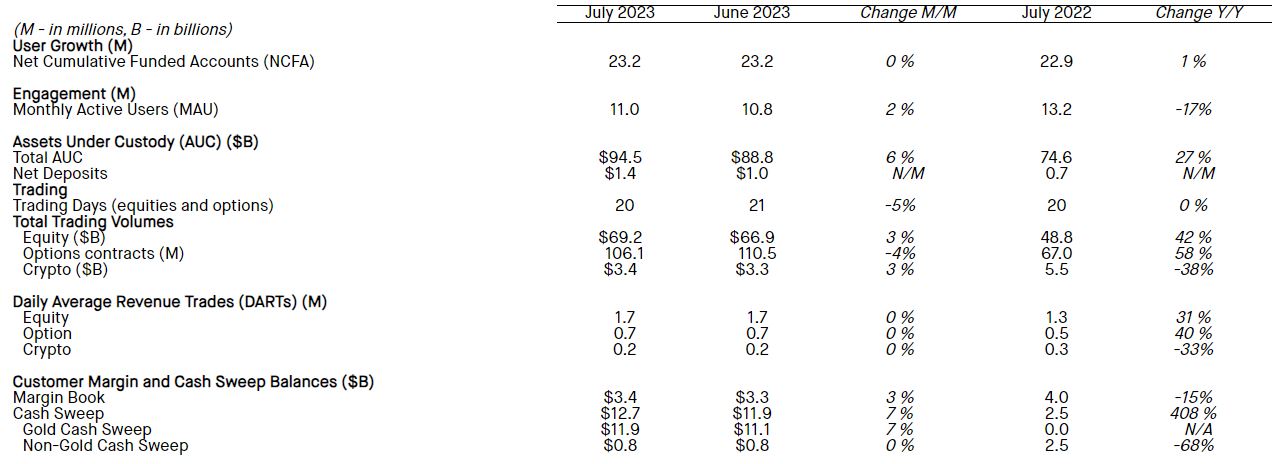

Yesterday (Wednesday) evening, Robinhood released its operational data summary for July 2023. The report shows that although total trading volumes in the crypto market modestly increased month-over-month (MoM) to $3.4 billion, they significantly declined compared to the $5.5 billion reported in July 2022.

However, total trading volumes, including the equity market and options contracts, increased considerably. Compared to June 2023, they grew by 3% to $69.2 billion and increased 42% YoY from $48.4 billion.

The situation for DARTs was similar. The total value increased by 31% YoY from 1.3 million in July 2022 to 1.7 million currently. However, for the crypto sector alone, there was a decline of 33% from 0.3 million to 0.2 million last month.

Growth in Account Numbers and Active Users

Looking at other statistics provided by Robinhood, the platform managed to increase the number of net cumulative funded accounts (NCFA) to 232 million by the end of July. This translates to a growth of around 50,000 compared to the previous month and 300,000 compared to last year.

There was also a slight increase in Robinhood's active client base. The 11 million reported for the last month is an increase of 200,000 compared to June. However, when compared to the previous year's results, there's a noticeable decline of 17% from 13.2 million.

Robinhood significantly increased the number of assets under custody (AUC). On a monthly basis, the growth was 6% to $94.5 billion, and on an annual basis, it was 27% from $74.6 billion. Last month, clients' net deposits amounted to $1.4 billion, which is $400 million more than in June 2023 and twice as much as in July 2023.

Robinhood Battles Decreasing User Activity

The decrease in retail investor trading activity prompted Robinhood to undergo its third round of layoffs within the last year. The pioneer of commission-free trading for individual investors announced in an internal memo that the layoffs would affect 7% of the staff, approximately 150 individuals.

According to the second quarter's results, after posting a substantial net loss of $511 million in the first quarter of the year, Robinhood has bounced back with a net income of $25 million. The American commission-free online trading provider witnessed a revenue surge of 10% to $486 million in the last quarter. However, despite marking its fifth consecutive quarter of revenue growth, Robinhood's monthly active users decreased by 1 million to 10.8 million.

To revitalize activity among the current retail investors, Robinhood pioneered the introduction of 24/5 trading on single-name stocks in the USA. The popular trading platform launched the Robinhood 24 Hour Market service in May. After a testing phase, it is now accessible to all Robinhood users.

This decision to extend the service to all its customers came shortly after another retail trading giant, eToro, integrated extended-hours stock trading into its offerings.

financemagnates.com

financemagnates.com