Another popular crypto exchange has joined the ranks of digital asset companies that were significantly impacted by the industry downturn of 2022. The Bitstamp's financial report released this week summarizing the past year revealed a fivefold decrease in revenues, a twofold decline in turnover, and a net loss of over €7 million.

Bitstamp Goes from €37 Million Profit to €9 Million Loss

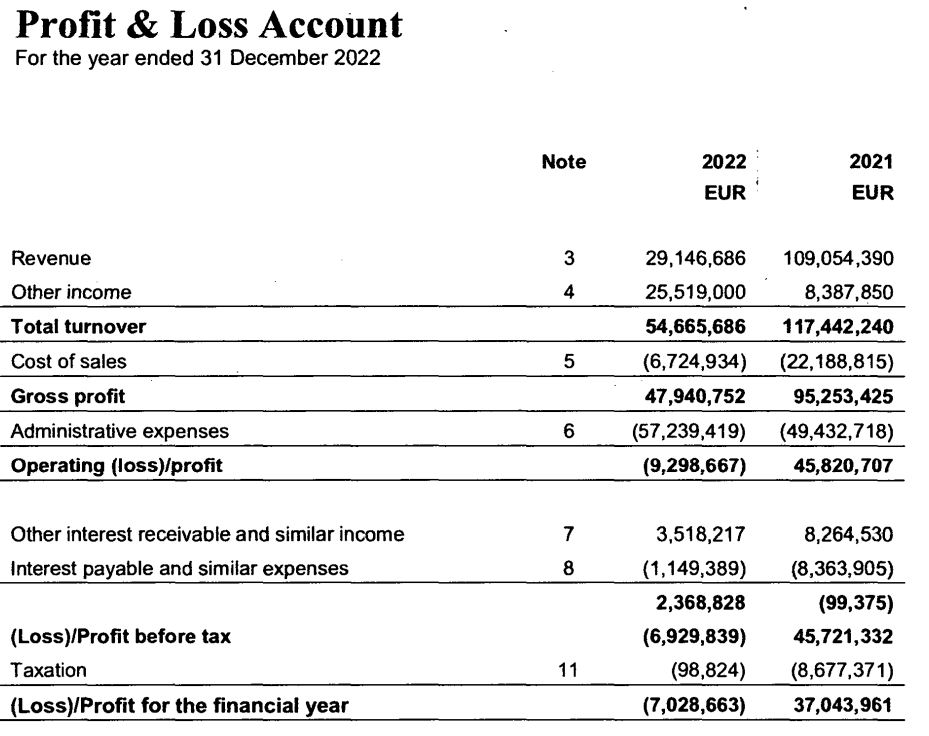

Bitstamp Limited, registered in the UK, published full accounts summarizing the results for 2022. They display substantial declines compared to the record-breaking year of 2021, reflecting how the digital asset market's condition changed over these two years.

In 2021, when a single Bitcoin (BTC) was valued at nearly $70,000, Bitstamp's revenue reached €109 million, with a profit of €37 million. However, in 2022, when BTC's price dropped to as low as $15,000 at its worst, its revenues shrank to €29 million. Simultaneously, the net profit turned into a loss of €7 million.

Other significant financial indicators of the cryptocurrency exchange also depreciated. The total volume fell from €117 million to just under €55 million. At the same time, the company incurred higher administrative costs than in 2021, amounting to €57 million.

As the company admits, such significant declines in performance were caused by "unfavorable market conditions and the reduction in trading volumes." The latter was due to transferring part of the business to three subsidiary companies: Bitstamp USA, Bitstamp Global, and Bitstamp Europe. The report also mentioned the negative impact of the war in Ukraine on conducting business in Europe.

"The company's total assets decreased to EUR 358,901,713 compared to EUR 1,344,442,798 in 2021. This is mainly driven by the lower trading volumes during the year and a consequence of the transfer of business mentioned above," the company commented in the financial report.

As it turns out, the negative effects of crypto winter have not stopped in 2022. The latest reports from publicly listed cryptocurrency companies Galaxy Digital and Riot Blockchain for Q2 2023 show a continuation of the negative trend. Both companies reported a net loss explained by challenging market conditions.

Bitstamp Hunts for Funds and Halts Part of US Trading

The 2022 financial report was published at a time when there is much talk about the cryptocurrency exchange, Bitstamp. The day before yesterday (Tuesday), it announced its plans to seek new investors, launch derivatives trading in Europe, and expand operations in the UK and Asian markets.

Bitstamp's CEO, Jean-Baptiste Graftieaux, revealed that the company is seeking new funding and a strategic sponsor to achieve these plans and rebuild its position as one of the world's largest cryptocurrency exchanges.

According to data from Kaiko, Bitstamp's US branch, which holds a BitLicense issued by New York State, has gained some local market share in 2023. Meanwhile, other popular platforms, such as Binance US, have become less significant, partly due to regulatory issues and lawsuits.

However, it turns out that regulatory problems have also ultimately affected Bitstamp. Yesterday (Wednesday), the exchange announced the suspension of trading for several cryptocurrencies in the US due to legislative issues. The suspension will take effect from August 29, affecting Axie Infinity (AXS), Decentraland (MANA), Chiliz (CHZ), Sandbox (SAND), and Solana (SOL).

financemagnates.com

financemagnates.com