- Crypto.com has denied rumors that the exchange engages in insider trading, saying the exchange steers clear of controversial practices.

- The news comes after alleged reports of the company coercing employees to sign statements in its favor.

- According to the platform, most of its revenue comes from its application for retail traders.

- The exchange insists on continuously improving order book liquidity and lowering spreads for a more efficient market.

Crypto.com has denied allegations that the exchange condones insider trading, citing a stern resolve to steer clear of controversial practices. The articulation comes after five people close to the matter, unnamed for obvious reasons, told Financial Times that the cryptocurrency platform had commissioned internal teams to engage in the crime.

Crypto.com denies proprietary trading involvement

Crypto.com, a leading crypto exchange, has challenged claims that it promotes proprietary trading, underscoring its commitment to industry best practices.

https://t.co/17N3mLbKbV Refutes Accusations of Proprietary Trading (Report) #Cryptocurrency #AANews #CryptoNews #cryptocom https://t.co/Hnj2BOItKf

— Crypto Mak (@crypto__mak) June 19, 2023

For the layperson, proprietary trading occurs when a trader trades stocks, bonds, currencies, commodities, derivatives, or other financial instruments with the firm's own money instead of its depositors' money to make a profit for itself.

Crypto.com becomes a victim of accusation

In coming forward to make this assertion, the company aims to stamp out rumors spread that five anonymous persons allegedly told Financial Times.

FT Exclusive: Singapore-based https://t.co/rbakzFfZxE deploys internal teams to trade tokens for profit, raising questions over potential conflicts of interest https://t.co/gLQjmQfdnm

— Financial Times (@FinancialTimes) June 19, 2023

Reportedly, they said the crypto platform tasked internal personnel to participate in several illegal activities, including propriety trading. Further, they claimed the exchange went forward to coerce company staff to deny such claims.

Specifically, one of the five said:

Crypto.com executives made employees sign sworn statements that the firm is not involved in such actions. [They were also asked to] say there is no internal market maker type operation.

A second person among the five also alleged that Crypto.com runs a separate proprietary trading desk with branches in several other locations. Reportedly, the team leading this deployment is committed to making money rather than delivering on the roles of an exchange.

Crypto.com takes a stand, dismisses the claims with clear assertions

Crypto.com defends its position, saying neither the company nor its executives ever asked the staff to deceive market participants, underscoring that its revenue mostly comes from retail traders' applications. The exchange also explained that it has a dedicated trading team that proactively keeps the company in a risk-neutral position.

One of the strategies towards risk neutrality is to hedge trading positions across different venues, including the exchange itself.

Nevertheless, the exchange did not deny that it has a market-making team committed to increasing its liquidity. Rather, the Singapore-based crypto exchange clarified that this unit progressively enhances order book liquidity while reducing spreads. Based on the explanation, this approach helps the company deliver a "more efficient market for all participants."

The exchange also articulated that equality was a crucial consideration for the platform, with every participant being "treated equally."

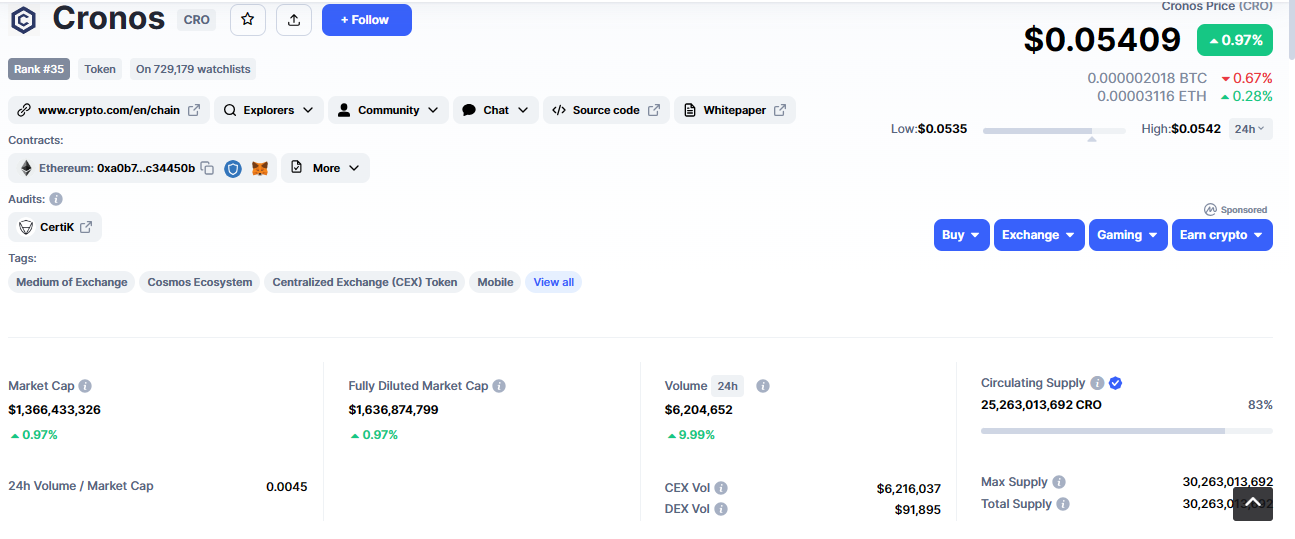

Despite Crypto.com's attempt to extinguish the allegation, the mere existence of the rumor has not boded well for the company, causing stagnation in buyer momentum for the platform's Cronos ($CRO) price as investors wait to see the market reaction to the news.

However, following the exchange's assertions, $CRO has recorded a daily rise of around 1%, with a 10% increase in 24-hour trading volume.

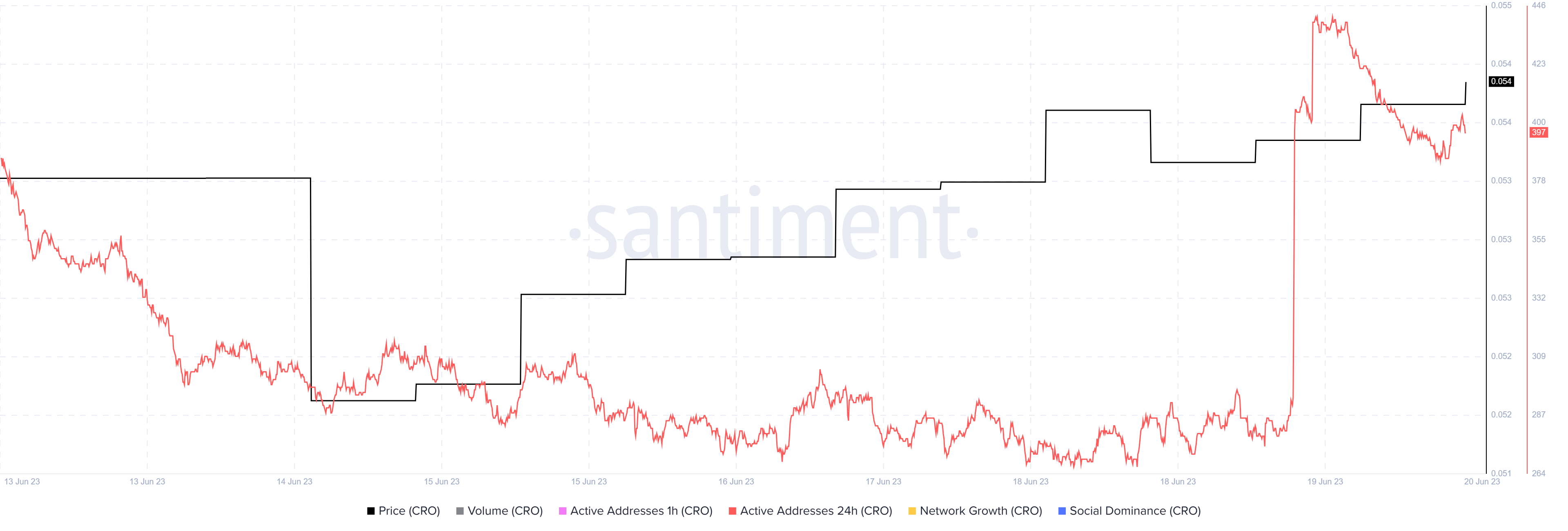

This suggests a revitalized interest in the token among market participants. This is supported by the 5% increase in the number of active addresses over the last 24 hours as show in the chart below.

The 24-hour active addresses metric on Santiment indicates the number of unique addresses involved in $CRO transactions daily, including crowd interaction or speculation for the token.

fxstreet.com

fxstreet.com