Investors are pulling out their funds from Binance following the US securities regulator’s lawsuit against the top cryptocurrency exchange for alleged multiple violation of federal securities laws. The Securities and Exchange Commission (SEC) in a complaint filed on Monday accused Binance of operating illegal exchanges, offering unregistered crypto asset securities and commingling client funds, among other allegations.

Fund Withdrawal from Binance Tops $1B

According to a Dune Analytics chart by 21Shares, a crypto investment product provider, outflow from the trading platform reached about $1.5 billion on Monday (yesterday) with inflow standing at $783 billion and net flow at $701.8 billion. This is in sharp contrast to outflow of $285.8 billion a day earlier. However, by Tuesday (today), outflow or withdrawal slowed down to 587.5 million with inflow improving to about $364.8 million

Data firm Nansen in a tweet on Tuesday also disclosed that users have withdrawn about $1.65 billion in the past 24 hours from Binance via the Ethereum blockchain. This compares to deposits or inflow of $871.7 million within the period. In addition, net flow, or the difference between the total amount of money flowing into and out of the exchange on Ethereum stood at a negative of $778.6 million.

In particular, Nansen said investors on Binance.US, the crypto exchange’s US arm, withdrew about $24.5 million compared to an inflow of $11.5 million and a negative net flow of $12.9 million.

“Over the past hour, netflow on Ethereum continues to be negative at $35.7M on Ethereum - $14.8M in and $50.5M out,” Nasen tweeted.

Netflow to Binance over the past 24 hours is $778.6M negative on Ethereum - $871.7M in and $1.65B out

— Nansen 🧭 (@nansen_ai) June 6, 2023

Over the past hour, netflow on Ethereum continues to be negative at $35.7M on Ethereum - $14.8M in and $50.5M out

Track it here https://t.co/nwTgpXWhZY and filter for "Binance" pic.twitter.com/jnNAN0QKVy

Binance faced a similar withdrawal pressure in February when reports emerged that the SEC plans to sue Paxos, the issuer of Binance USD (BUSD) tokens, over supposed violations of user protection regulations. At the time, Binance saw about $2.8 billion leave its platform within a 24-hour period, CoinDesk reports.

Crypto Prices Drop

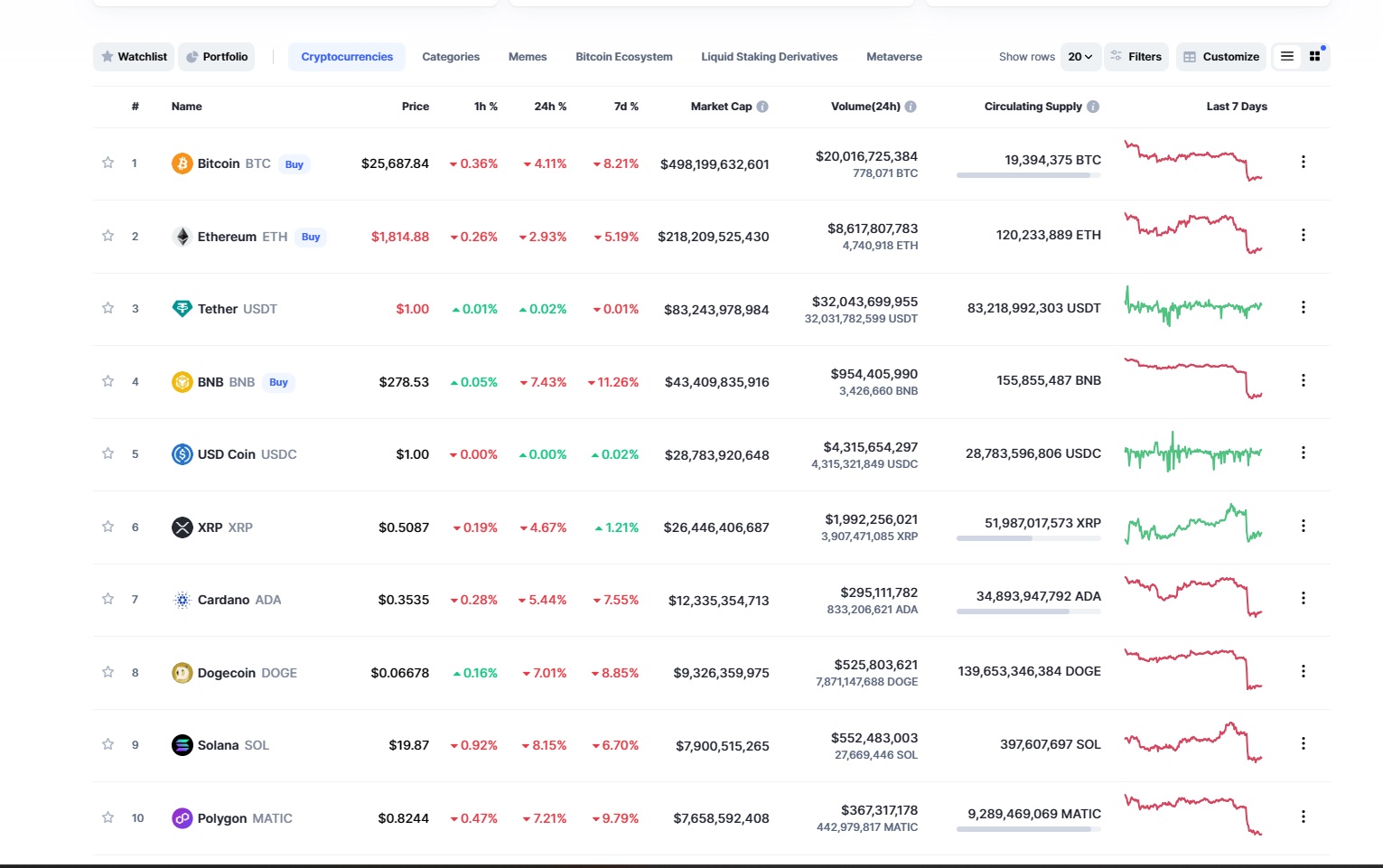

Meanwhile, SEC in its complaint accused Binance of unregistered offering and sale of its token BNB, stablecoin BUSD, and 10 other tokens: SOL (Solana), ADA (Cardano), MATIC (Polygon), FIL (Filecoin), ATOM (Cosmos), SAND (Sandbox), MANA (Decentraland), ALGO (Algorand), AXS (Axie Infinity) and COTI (COTI).

In response to the news, the prices of these tokens have experienced some price drops, according to data on CoinMarketCap. For instance, the price of BNB currently stands at about $279.55, down by 7.33% in the last 24 hours. On the other hand, the price of BUSD only dropped marginally by 0.02% in the last 24 hours to $0.99.

In addition, data on CoinMarketCap shows that the price of the other tokens have slumped between about 5-15% between the said period.

Meanwhile, in its complaint before the US district court in Columbia, SEC claimed that Binance.US provided unregistered profit-generating programmes ‘BNB Vault’ and ‘Simple Earn’ as well as crypto staking products, to US investors. The securities watchdog also accused Binance and CEO/Founder Changpeng Zhao of commingling or diverting customer assets to crypto market markers Sigma Chain and Merit Peak, entities both said to be owned by Zhao.

However, Binance in a blog post published on Monday dismissed the allegations, saying that “all user assets on Binance and Binance affiliate platforms, including Binance.US, are safe and secure.”

Citi chooses NetDania; FMA warns against imposter; read today's news nuggets.

financemagnates.com

financemagnates.com