BKEX, a British Virgin Islands (BVI) exchange with alleged Binance links, is cooperating with law enforcement to investigate user funds allegedly linked with money laundering.

The company has paused withdrawals to prevent fund misuse during the investigation.

The British Virgin Islands Does Not Regulate BKEX

The exchange claimed it complied with all money laundering policies. Notably, the company is registered but not regulated in the British Virgin Islands.

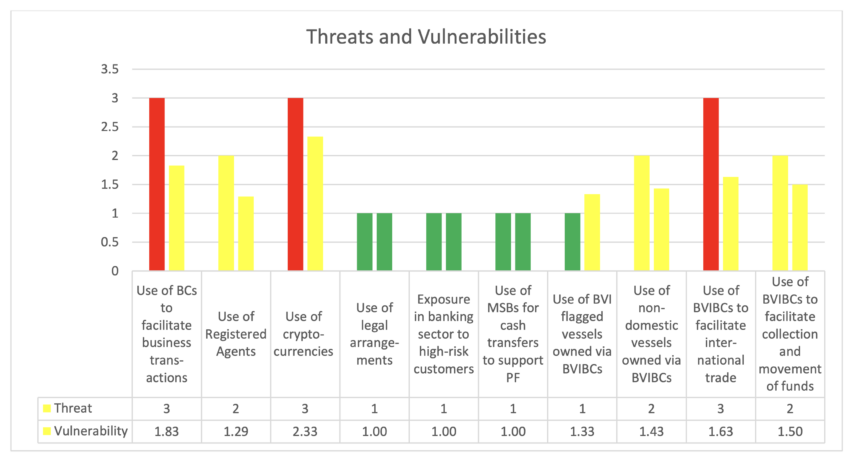

The British Virgin Islands Financial Services Commission (BVIFSC) supervises money laundering compliance in the region. Its license regime considers how a cryptocurrency is used, the business activities of a crypto platform, and Initial Coin Offerings.

Additionally, BVI does not levy corporate or income taxes and requires no reporting on cryptocurrency transactions.

BKEX’s trading volume rose 64% in the last 24 hours to $495 million, according to CoinGecko. The exchange accounts for 1.5% of global trading volumes, with the highest activity originating in South Korea, Venezuela, and Pakistan.

Defunct market maker Alameda Research argued in 2019 that BKEX artificially inflated its trading volumes by mimicking Binance’s order book. Higher volumes can cause it to rank higher on crypto data aggregators like CoinGecko and CoinMarketCap.

Last year, Asian exchange Huobi participated in the BVIFSC’s fintech regulatory sandbox. It later secured an investment business license enabling it to offer crypto derivatives.

The FSC had defunct Singapore hedge fund Three Arrows Capital registered as a professional fund.

Alleged Links to Binance Cause for Concern

The BVIFSC recently admonished companies in the region to carefully observe interactions with countries on the Financial Action Task Force’s grey list, including South Korea.

BKEX’s early links with Binance suggest they may share money laundering scrutiny.

Earlier this year, U.S. Senators accused Binance of being a breeding ground for illicit activity. Chief Strategy Officer Patrick Hillman told the senators that Binance boosted compliance efforts after notable gaps in its early days.

According to Reuters, Binance offered services in high-risk money laundering regions Russia and Ukraine against its own 2020 risk advice.

A recent lawsuit filed by the U.S. Commodity Futures Trading Commission quoted internal messages that people use the exchange for crime.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

beincrypto.com

beincrypto.com