Strike, a crypto payments company, has announced its expansion to 65 different countries and the introduction of a new feature that allows the exchange of USDT as well as BTC within the app.

This is a step toward mass adoption of the cryptocurrency industry, especially for those less developed countries that lack a stable and well-established state currency.

Let’s take a look at the details of the news.

Strike expanding to 65 countries: stablecoin USDT also integrated

On Friday, 19 May 2023 at the Bitcoin Conference in Miami Beach Jack Mallers, CEO of Strike, announced that his company is beginning to offer services in 65 different countries spread across 6 continents, expanding from its initial client base in the US, Argentina, and El Salvador.

The news coincides with a redesign of the Strike app interface and the integration of the USDT stablecoin.

Now all users of the crypto payments app can take advantage of the elasticity of exchanges in Tether as well as Bitcoin.

More specifically from now it is possible to send Bitcoin using USDT balance and receive payments in Bitcoin by immediately converting the balance to USDT

. @Strike is now available in 65 countries, enabling 3 billion people easy access to #Bitcoin & Tether USDt. Use the USDt in your Strike account to pay bitcoin or lightning invoices. Send bitcoin using your USDt balance & receive bitcoin payments as USDt in your cash balance. pic.twitter.com/JXVcdb5TNw

— Tether (@Tether_to) May 21, 2023

Strike’s strategic move will serve to more easily land within those countries where there is no strong currency such as the dollar and where there is an out-of-control inflation rate that endangers the purchasing power of citizens.

The introduction of a stablecoin in the application like Tether‘s, which replicates the value of the US dollar, is of paramount importance because it eliminates all fears related to Bitcoin’s volatility and the inability to use it as an everyday trading currency.

At the Bitcoin Conference, Jack Mallers made his vision explicit in reference to the latest update by saying:

“We’re delivering a cash balance that the global south can rely on, and an awesome beautiful punk unconventional black and white brand, as the Fed is driving our own banks insolvent. We made a lot of product changes to support what we hope to become an amazing global money app.”

The ultimate goal of the CEO of Strike is to serve 7-8 billion people and reach countries that do not enjoy well-structured financial services such as those found in the US or more economically advantaged countries.

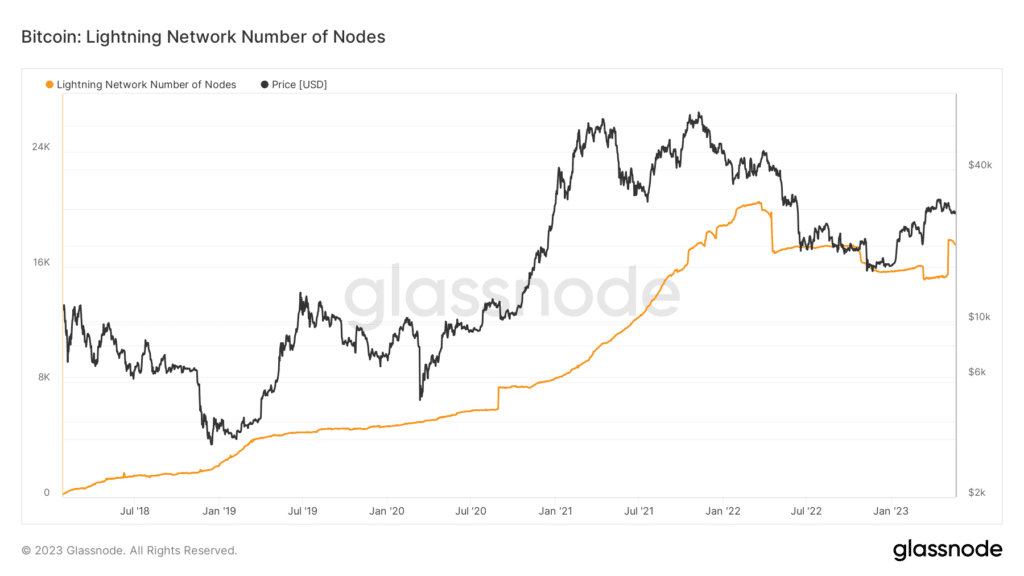

Bitcoin’s Layer 2 network, namely the Lightning Network, will be critical in this process because it enables microtransactions at a negligible cost and with a higher execution speed than major fiat payment providers such as Visa or Mastercard.

The long-term challenge is to expand the reach and number of lightning nodes by allowing more money to flow within these dedicated channels

Strike’s advantage in supporting USDT within the app

As anticipated, the integration of USDT within the Strike app is an important step forward in an effort to incorporate as many users as possible into the cryptocurrency industry.

Bitcoin’s volatility has always been conceived of as a problem by outsiders, who perceive the virtual currency to be too volatile and unable to be leveraged as an exchange asset in payments.

The point of the argument is that for countries where there is currently a double-digit inflation rate, the problem persists even in state-owned fiat currencies, and indeed is even more serious since these, unlike Bitcoin, only lose value and have hardly ever experienced bullish phases against the dollar in the Forex market.

In any case, with the introduction of the USDT stablecoin, all fears related to Bitcoin’s volatility have finally vanished, given the possibility of using a cryptocurrency that replicates the value of the US dollar, which is also subject to inflation but much more stable than the fiat currencies of African and South American countries.

On this integration, Strike’s vice president of product, Manuela Rios explained the positive impact it could generate in society in developing countries, stating:

“For the people not yet so familiar with bitcoin, but are familiar with 109% inflation, giving them access to a U.S. dollar equivalent stablecoin is massive — now you can save in something that won’t be so quickly devalued.”

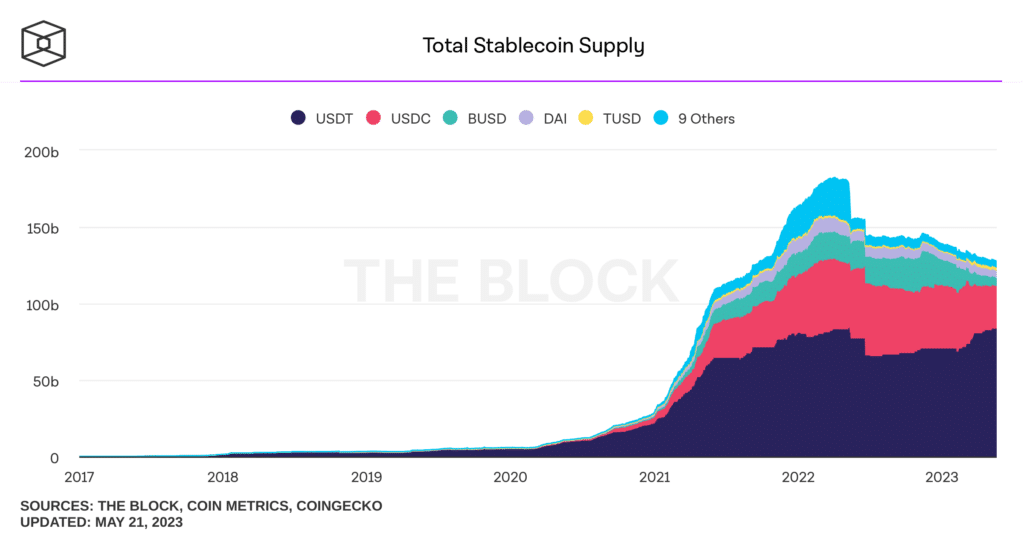

In addition, Tether, the company that manages the stablecoin, is among the elite of the most important and influential companies in the cryptocurrency world, with a very important financial strength.

In this regard, it is interesting to point out that USDT represents the most liquid and utilized stablecoin within the crypto markets, with a market share of 65% compared to major competitors such as USDC, BUSD, DAI, and TUSD, which has increased significantly since the beginning of 2023.

The challenge of crypto payment providers

There are currently a huge number of providers dedicated to cryptocurrency payments besides Strike such as Coinpayments, CoinGate, Moonpay, Wyre, Coinremitter, Bitpay etc.

The international Visa and Mastercard circuits have also prepared to integrate the ability to perform cryptocurrency transactions into their services.

The competition is beginning to pick up, considering the fact that the crypto sector is becoming less and less of a taboo and is increasingly appreciated as a respectable fintech industry.

The main challenge that all crypto payment providers will face is definitely that of user-side simplicity.

Unfortunately, when it comes to cryptocurrencies and blockchain, there is still a knowledge gap that needs to be bridged and that acts as a barrier to mass adoption of the industry.

Terms such as wallets, private keys, addresses, transaction hashes, and block explorers are extremely complicated for those unfamiliar with crypto and even more so for the financially uneducated.

Being able to present products that are intuitive and easy to use even for novices is the main focus that all these companies should have nowadays.

Although innovations are running faster than we can imagine, and new trends such as zk rollups, layer 0, and AI are increasingly gaining the attention of the savvy, in order for crypto to truly become mainstream it is necessary to take a step back and focus on the factors of simplicity and essentiality.

Only in this way will it be possible to grow this market that unfortunately still covers only a niche of individuals and expand to mass adoption.

Secondly, the issues of trust and security also turn out to be crucial in this process, after a multitude of past events have undermined the reputation of the crypto sector by making it appear as dangerous.

In fact, on this front the community is not yet ready: punctually every year an exchange or service that holds crypto for customers disappears, causing harm to users of those platforms and generating distrust of new Web3 technologies.

When all the scum have finally gone out of business, and new regulations come into effect in the US, with only the most serious companies remaining, we will be able to start thinking about expanding the industry to new horizons.

en.cryptonomist.ch

en.cryptonomist.ch