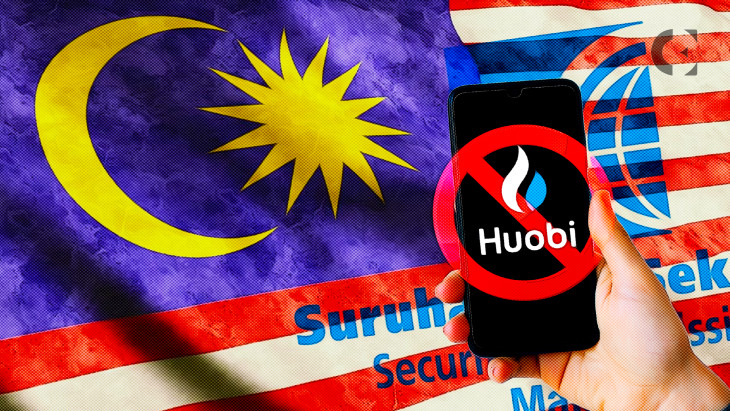

The Securities Commission Malaysia (SC) has initiated enforcement action against Justin Sun’s Huobi Global for illegally operating a digital asset exchange in the country. The securities regulator has also issued an advisory for Malaysian investors, directing them to immediately cease trading on Huobi and withdraw their funds from the exchange.

🔒 SC has issued a public reprimand against Huobi Global Limited to cease operations in Malaysia, disable website and mobile app on platforms like Apple Store and Google Play.

— SC Malaysia (@SecComMalaysia) May 22, 2023

📰 Read the full release here: https://t.co/UY4dVGAHRh pic.twitter.com/Fe6xSqftZr

According to a press release shared by the Securities Commission Malaysia earlier today, a public reprimand has been issued against Huobi and its Chief Executive Leon Li for operating a digital asset exchange in Malaysia without registration. The regulator also ordered the exchange to disable its website and mobile application on platforms like Apple Store, and Google Play.

The securities regulator also directed Huobi Global to stop publishing, circulating, or sending any advertisements through emails or social media platforms to Malaysian investors. CEO Leon Li has been specifically ordered to ensure that the Securities Commission’s orders are thoroughly carried out.

The Securities Commission Malaysia strongly advised investors to only engage with recognized market operators that are registered with the Commission. “Registered RMOs have undergone strict regulatory scrutiny and are required to adhere to strict guidelines so that investors are protected under Malaysia’s securities laws,” the regulator added.

The enforcement action against Huobi Global comes nine months after the Malaysian securities regulator called out the crypto exchange for operating in the country without registration. In August last year, the regulator added Huobi to its Investor Alert List and urged Malaysian investors not to engage with the platform till it gets approval from the SC. At the time, Huobi stated that it was in discussions with the country’s regulators regarding its presence in the local market.

coinedition.com

coinedition.com