FTX has recently recovered a whopping $7.3 billion in assets and has expressed plans of entirely rebooting itself. At a court hearing on Wednesday, the attorney of the bankrupt exchange stated that the recent recovery signifies an increase of more than $800 million since January. Similarly, the attorney also stated that the now-bankrupt exchange has been thinking about its future for the previous few months, and has been wondering what went wrong under the leadership of Sam Bankman-Fried.

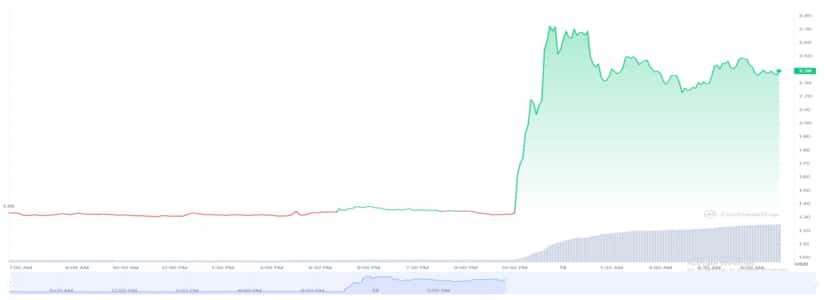

As a result of the revival news, the native token of FTX, $FTT, was subject to a massive surge. At the time of writing, $FTT is trading for approximately $2.44, after its value surged by a massive 76.91% in the previous 24 hours. The total market cap of the token is currently $809 million. The $FTT token traded between the $1 and $2 marks ever since the exchange filed for bankruptcy.

Apart from this, the judge at the recent hearing denied the motion that would grant SBF a reimbursement for his legal fees. The bankruptcy court proceedings also followed the announcement of the debtors that a Swiss court granted a petition involving the sale of the European arm of FTX, FTX Europe AG. It was a part of the exchange’s Chapter 11 bankruptcy filing along with approximately 133 other subsidiaries.

FTX to Strike a Deal with Stakeholders

Keeping in mind how FTX is currently focusing on a brighter future, it is expected that the exchange would soon start negotiations with stakeholders to revive the exchange. Moreover, it is expected that a decision would be made in the current quarter, with the exchange making a comeback by early next year.

Based on the current scenario, it is evident that FTX would require a major chunk of capital to restart the exchange as the existing customer interface had a minor connection to the movement of money. Currently, the exchange using its own money to revive the exchange instead of using the same money for customers is still a topic shrouded in mystery. However, reviving the exchange would require great external funding or even the sale of its own assets.

FTX Had Terrible Cybersecurity

It is a fact that FTX suffered a cyber-attack approximately 24 hours before it filed for bankruptcy, where the hacker fled with almost $432 million and a bundle of digital cash. The amount is still unaccounted for, just like the assets of its customers.

Plus, it was recently revealed that FTX did not have a dedicated cybersecurity staff, despite being responsible for protecting billions of dollars in crypto assets. The exchange never bothered to hire a Chief Information Security Officer, but asked the software developers to handle cybersecurity instead. At the same time, FTX left private cryptographic keys unencrypted and didn’t use multi-factor authentication either.

crypto-economy.com

crypto-economy.com