OKX, the second-largest crypto exchange by trading volume and a leading Web3 technology company, has announced a major development in the FTX bankruptcy proceedings. The company will release approximately $157 million in frozen assets related to FTX and Alameda Research to debtors, in response to a motion filed today.

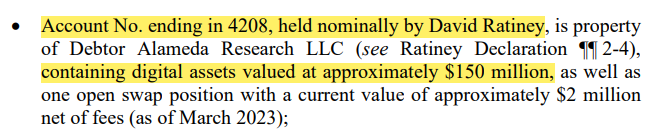

Extracted from Doc 1189 – Motion of Debtors for Turnover of Assets Held by Exchange Entities) Filed by FTX

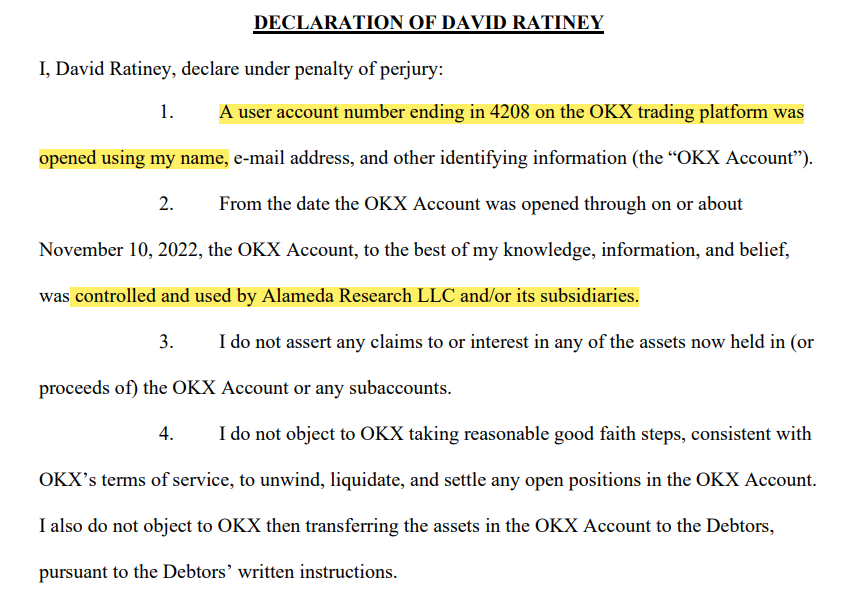

Extracted from Doc 1190 – Declaration of David Ratiney (related document(s)1189) Filed by FTX Trading Ltd.

Cooperation with FTX Debtors and Law Enforcement Officials

OKX welcomes the motion filed by the FTX debtors and will continue to cooperate with them and law enforcement officials to ensure that the frozen assets are eventually returned to FTX users through the bankruptcy process. This move demonstrates OKX’s commitment to supporting the broader crypto community and promoting transparency in the industry.

Implications for the Future of Cryptocurrency

The decision by OKX to release $157 million in frozen assets related to FTX and Alameda Research has significant implications for the future of the cryptocurrency industry. This move highlights the need for greater oversight and regulation in the space and underscores the importance of responsible corporate citizenship.

But

The revelation by FTX employee David Ratiney that Alameda Research LLC and/or its subsidiaries controlled a $150 million OKX trading account using his personal information raises some intriguing questions. How did they manage to gain access? Was it done ethically? Or is there something more sinister at play? The details of this case leave plenty of room for speculation and further investigation.

coinpedia.org

coinpedia.org