- Mastercard will be launching a stablecoin wallet in collaboration with Stables, a stablecoin platform.

- Stables CEO said that stablecoins would bridge the traditional finance and decentralized finance worlds.

- Earlier this month, stablecoins suffered as Paxos halted BUSD issuance and USDC as well as USDT depegging.

Stablecoins have long been considered the safer option for bringing crypto to the world. However, the recent few instances of stablecoin collapses have raised concerns regarding the same as well. Even so, Mastercard is attempting to widen its reach in the Asia-Pacific (APAC) region.

Mastercard partners with Stables

Mastercard joined hands with an Australian stablecoin platform, Stables, in its attempt to allow retail customers to conduct transactions using stablecoins in the APAC region. The partnership will result in Mastercard launching a stablecoin wallet that will facilitate the service.

Stables at the time of launch will only support deposits and withdrawals via the Australian Dollar. However, the integration will eventually include USD, EUR, GBP and other APAC currencies, as well as African and Latin American currencies.

The collaboration is expected to bolster the confidence in stablecoins, which over the last couple of months has been wavering. The Chief Executive Officer (CEO) of Stables, Daniel Li, in a statement to Cointelegraph, stated,

“Stablecoins will play a pivotal role in the new financial system and will be core to bridging the worlds of traditional and decentralized finance. Stables will continue to work with USDC and Circle as a pivotal part of that ecosystem.”

Stablecoins have not been stable

The collapse of the Terra ecosystem began with the depegging of its stablecoin TerraUSD (UST), which initiated the first contagion of 2022. While the market recovered from that, Paxos halted the issuance of Binance USD (BUSD). The company noted that the decision was taken due to regulatory concerns.

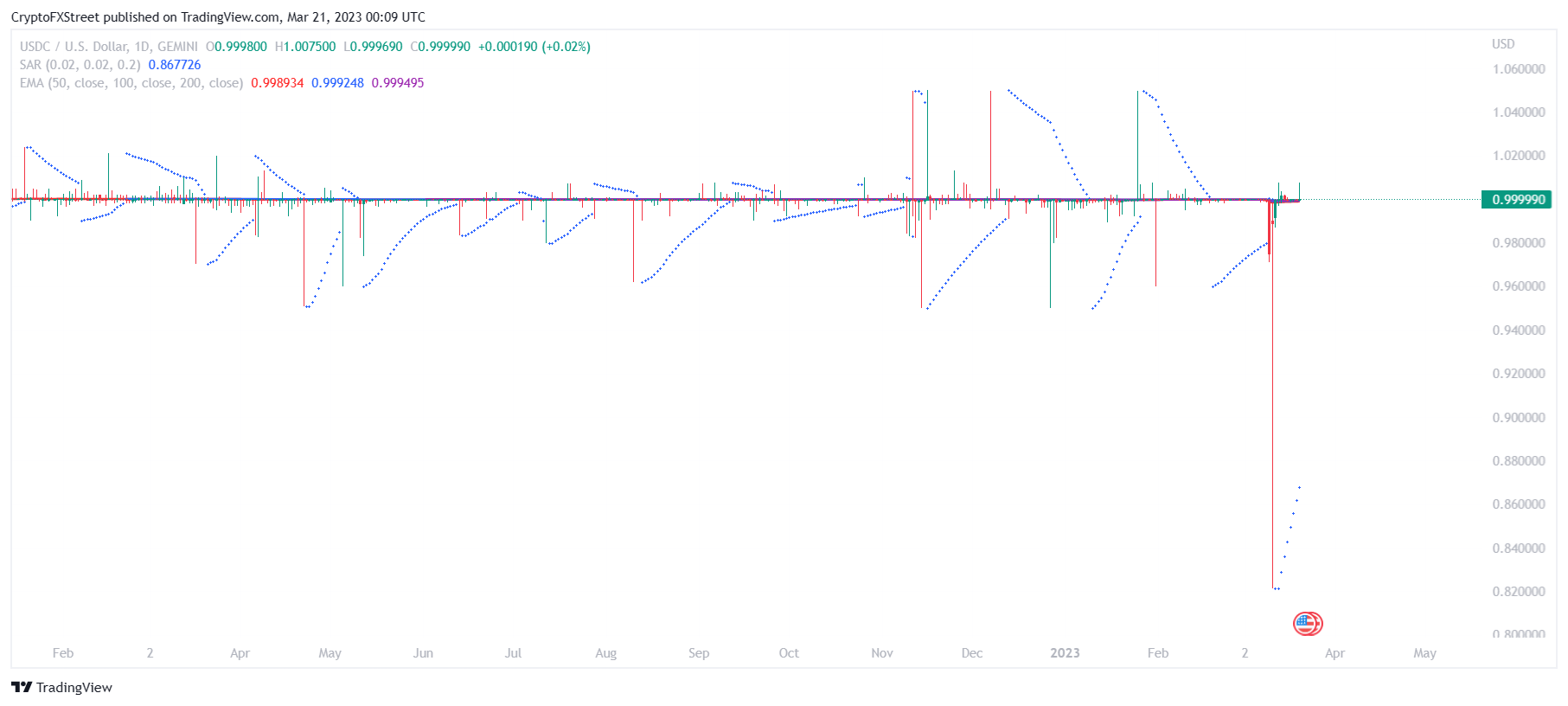

USDC/USD 1-day chart

Furthermore, concerns regarding stablecoins resulted in significant depegging in top coins Tether (USDT) as well as USD Coin (USDC). The latter coin noted a fall that brought the stablecoin nearly below $0.80 before recovering over the next three days to its $1 peg.

fxstreet.com

fxstreet.com