- 1 Bybit has suspended USD bank deposits, and withdrawals will be suspended from March 10, 2023

- 2 A possible reason is that Silvergate Capitals have discontinued their crypto network.

Bybit announced the suspension of USD bank transfers via bank or wire transfers. Without naming the partner, the fourth-largest crypto exchange in the world by volume was announced via a blog post, citing “service outages from a partner.” The partner is supposed to be Silvergate bank.

🚨NEW: Crypto Exchange 'ByBit' Temporarily SUSPENDS Deposits of $USD via SWIFT & Wire Transfer

— HeadlineHunter!🚨U.S. (@HHunter_US) March 6, 2023

▪️Additionally, on March 10th Withdrawals to be Suspended at 12AM

▪️Suspensions occurring due to "service outages from our end-point processing partner until further notice"

The Suspension Notice – Bybit

The March 4, 2023 blog post says that, until further notice, the exchange temporarily suspended the USD deposits via wire transfers. The reason given was service outages from their end-point processing partner. At the same time, it says that the withdrawals would also be suspended from March 10, 2023, 12:00 A.M. UTC.

Blog further says that users may continue buying cryptocurrencies through them using credit cards on their “One-Click Buy” page. Similarly, crypto withdrawals can also be processed. For any queries or difficulties, users are requested to contact the Customer Support team through [email protected], or they would also be available for 24/7 chat through a link on their page.

Bybit trying to hide Partner’s name; Why?

Although, Bybit tried extensively to hide its partner’s name if speculations were true, it Silvergate Capital Corporation. A conclusion can be drawn because the California-based crypto bank Silvergate., also announced shutting down their Silvergate Exchange Network (SEN), which worked as an instant settlement banking service used by numerous crypto firms.

Media tried to contact Bybit regarding details of their partner, but no response. Silvergate, in a filing last week, said that they are not in a position to meet the March 16, 2023, deadline for filing their annual 10-K report, which shows the country’s financial watchdog, the SEC, the financial performance of a publicly traded company. The supposed reason portrayed was regulatory and business challenges.

Why is Silvergate facing the heat?

Ever since its ties with not bankrupt FTX and former CEO Sam Bankman-fried surfaced, the once booming crypto bank is facing serious troubles. On Thursday, Silvergate said about evaluating their ability to continue, as many crypto entities, including Gemini, Crypto.com and Coinbase, already shook them off. And on Friday, Circle announced on Twitter about withdrawing from a few services involving Silvergate.

1/ We maintain relationships with several banking partners. We are sensitive to the concerns around Silvergate and are in the process of unwinding certain services with them and notifying customers. Otherwise, all Circle services, including USDC are operating as normal.

— Circle (@circle) March 2, 2023

Silvergate bank allegedly held some accounts of FTX, Alameda, Sam Bankman-Fried and other officials of not bankrupt crypto exchange. Team SBF used these accounts to move customers’ funds internally, buy condos, and beach houses, fund Coachella and lead a lavish lifestyle on the Bahamas islands.

Although the bank is not accused by the SEC or the court of any wrongdoing but is certainly in the cross hairs of the authority, they are trying to determine if the bank had any prior knowledge of the financial fraud. Referring to the fact that they must have been vigilant and should have known something.

As per the earnings report released in January, the company has reported net losses of $949 million.

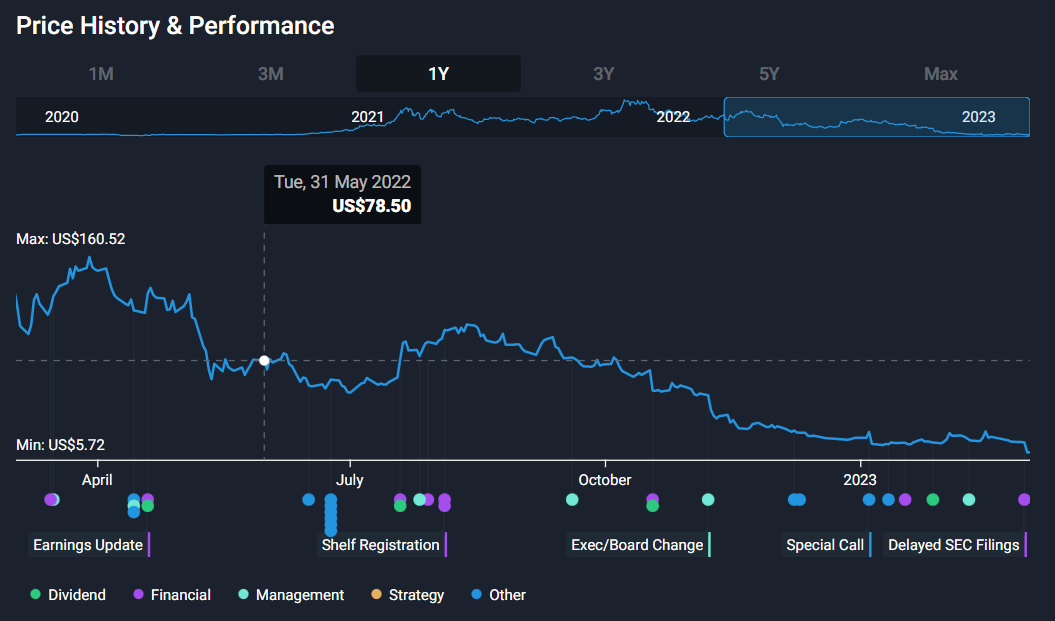

At the time of writing, Silvergate Capitals (SI) was trading at %5.77, with a fifty-two-week change was negative 94.20%. At the same time, the bank’s revenue was negative $833.08 million, with a massive drop of 1791.15%, and the EPS also dropped by 27.27% to $0.48.

thecoinrepublic.com

thecoinrepublic.com