The true market cap of OKB, the native token of crypto exchange OKX, is a mystery.

On CoinGecko, the token is worth $12.4 billion, ranking it the seventh largest cryptocurrency. But on CoinMarketCap, OKB is pegged at a ‘mere’ $3 billion.

So which is it?

Calculating market capitalization for a crypto asset seems a simple task. Multiply the circulating supply by the price of the token — right?

But as the case of OKB demonstrates, there are complex factors that ensure the market capitalization of a specific crypto asset may be a far more subjective metric than the cold data suggests.

A deep investigation into the true value of OKB reveals that even a term as simple as ‘circulating supply’ is wide-open to subjective interpretation — and that for investors, the figures presented in good faith by data providers on crypto asset values should occasionally be taken with a very (very) large shaker of salt.

The curious case of OKB’s missing $10 billion

Six months ago, OKB was around the 20th biggest cryptocurrency by market cap, a peer to the likes of Ethereum Classic (ETC) and Litecoin (LTC).

Today, it’s easily ahead of Polygon (MATIC) and Dogecoin (DOGE). It recently flipped Cardano (ADA), having surged more than 200% since November, when FTX was collapsing.

The $10 billion difference comes down to how the two major data aggregators, CoinMarketCap and CoinGecko, calculate OKB’s circulating supply.

Crypto market capitalizations, echoing equities, are found by multiplying unit price by the number of units in circulation (different to fully-diluted value, which focuses on the total theoretical supply).

OKX says OKB’s circulating supply is about 246.6 million, a figure CoinGecko reports.

The math: current total supply is 300 million, minus 53.4 million locked inside OKB’s so-called “buy-and-burn” address, used to store tokens it removes from circulation to boost its value proposition (less supply on the market means more scarcity, and thus more implied value).

CoinMarketCap, on the other hand, says OKB’s circulating supply is just 60 million. The difference between the two supply readings essentially gives us the imbalance in market values.

In the next section of this analysis, we dive deep into the specific mechanics of how OKX’s token raises questions over whether or not it should be counted as fully-circulating.

If you want to skip the analysis and head straight to the conclusion… jump here.

90% of OKB ‘circulating supply’ doesn’t circulate at all

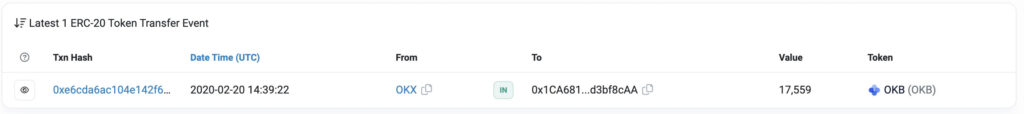

OKX distributed its ERC-20 token beginning with an initial issuance in Apr. 2019.

About 220 million OKB has been sent from an OKX hot wallet to tens of thousands of blockchain addresses that have never seen any transactions at all — except to receive OKB.

Over a three month period starting from late Dec. 2019 and concentrated in a rapid-fire 10-day stint in Feb. 2020, streams of brand new, but since totally unused, Ethereum addresses received packages of between 100 and nearly 20,000 OKB.

The supply spread across entirely inactive Ethereum addresses amounts to almost 90% of OKB’s claimed ‘circulating supply’ of 246.6 million tokens, and in total is valued at more than $12.3 billion, given the current unit price of ~$50.00.

The OKB was sent directly from the main OKX hot wallet, which the exchange uses to maintain user balances and other operations — the same hot wallet that first received the 300 million OKB ERC-20 supply in 2019.

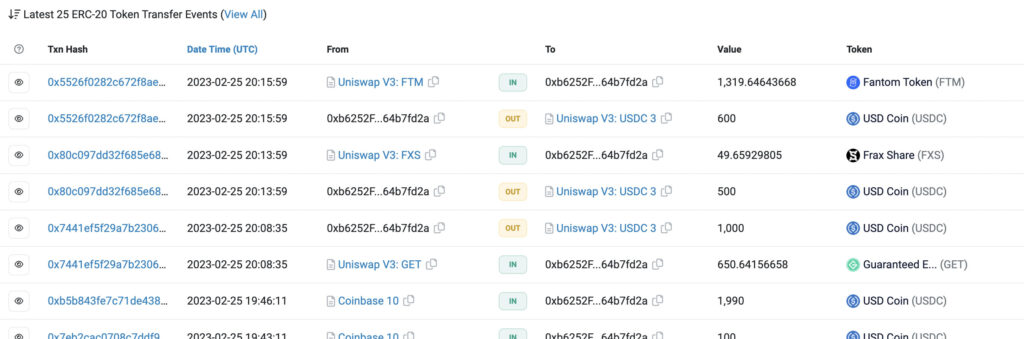

For the purposes of this analysis, addresses and OKB supply were labeled ‘dormant’ if:

- Total OKB received from OKX hot wallet matches the current balance (supply only came from OKX, and it’s still there).

- Outputs are zero (the address has never been used to send cryptocurrency).

- ETH balance is zero (the address does not have any ETH to pay for gas fees).

If we consider this supply not circulating — and thus not part of its market capitalization — it would mean OKB’s true circulating supply is vastly inflated, along with its market cap.

Another 11.1 million OKB is kept inside similarly brand-new Ethereum addresses that have never seen any activity at all, except around Feb. 2020 to receive OKB from OKX and later a small amount of ETH (0.0084 ETH), usually deposited from an address tagged as “OKX: Deposit Supplier.”

For the purposes of this analysis we don’t consider this supply dormant as it has enough ETH to withdraw the OKB tokens.

Another 18% has been “burned,” and the remaining 9% exists between a few OKX hot wallets and other addresses with enough ETH to pay for gas fees.

Excluding the “dormant” supply from OKB’s circulating supply would mean:

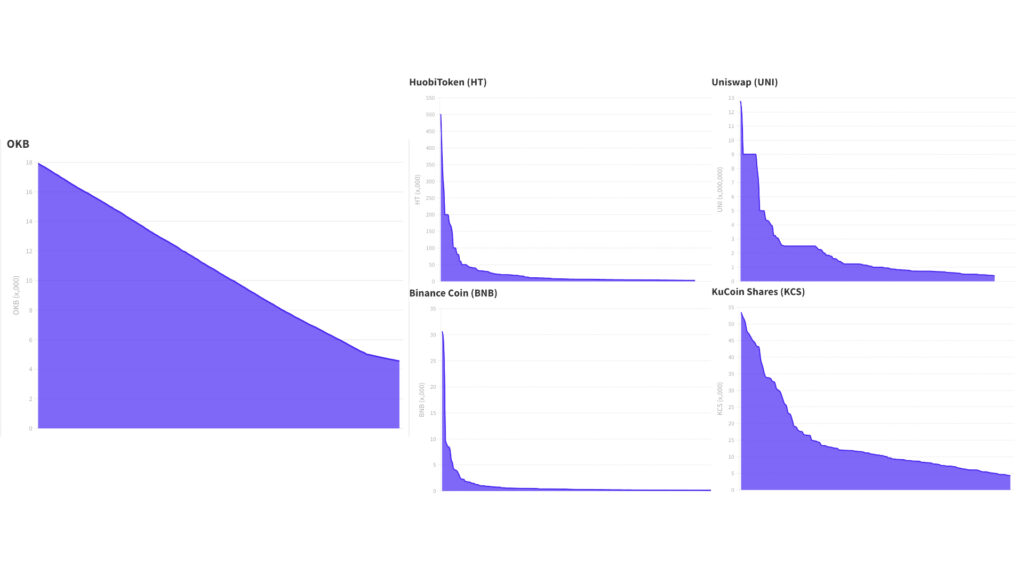

- Implied market value is less than $1.3 billion, currently the 40th biggest cryptocurrency.

- Total market cap would be about 30% less than rival Crypto.com’s CRO offering and 60% more than Huobi’s HT token.

When is circulating supply not circulating supply?

A large percentage of bitcoin’s total supply is also considered dormant — in 2020, nearly one third of the total bitcoin supply hadn’t been touched in more than three years.

But we still consider that dormant bitcoin supply to be circulating. How OKB differs is that a single party controls that supply and that party is also the token’s primary issuer and steward.

(We note OKX’s response to this apparent dichotomy below, specifically their assertion that they hold these balances on behalf of customers and that in the event of a mass redemption event, those tokens could be retrieved from the ~31,000 wallets they describe as cold storage.)

“The circulating supply of OKB is [246.6 million]. OKB is fully circulated, and OKX doesn’t control the performance of OKB in any way,” an OKX spokesperson told Blockworks.

OKX representatives spoke with Blockworks on two occasions to understand the questions we had on circulating supply, and they offered a written response, shared here in full:

“This transfer was part of our tokenomics and security strategy. Based on research conducted by our team for over a year and as a result of user demand and feedback, we made the decision to move OKB from the hot wallet to the cold wallets. Specifically, we saw that the majority of OKB trading that occurred during that time – more than 95% – occurred on the OKX platform.

The decision was therefore made by the technical team to move the OKB from hot wallets to cold wallets. This allowed us to increase the security around the OKB supply, while also allowing users to continue to trade OKB on the OKX platform. It’s important to note, that there is still a supply of OKB which is in hot wallets that can be used as needed to facilitate user withdrawals.

These wallets are currently only being used for storage of OKB and there is no user demand to move the tokens. Should withdrawal demand increase, OKX would add ETH to the wallets to facilitate any necessary transfers.

We have very loyal customers who hold OKB. User withdrawal demand has to date not exceeded the amount held in our hot wallets and that is why these wallet balances remain static.

As stated above, there is OKB in hot wallets to facilitate user withdrawals where necessary. Should withdrawal demands increase, we would simply move the OKB from cold to hot wallet to facilitate any withdrawal request as necessary. Based on our experience and the demands from users over the past several years, we’ve not seen large enough withdrawal requests to move the tokens from the cold wallets.”

Dormant address balance distribution is also unusual: The amount of OKB in each of these 31,000 wallets is very evenly distributed between 1 and 20,000.

By way of explanation, OKX further stated that the balances were not mapped one-to-one, indicating that the 220 million dormant supply represents an aggregate of user balances. It’s not clear how many users the dormant tokens belong to. Blockworks has asked for clarification.

Blockchain data appears to line up with OKX’s explanation: Between Apr. 24 and Apr. 27, 2020 — about two months after 90% of circulating supply was sent to cold storage — 40 million OKB (16% of circulating supply, then worth around $180 million) was pulled from more than 1,400 addresses to the OKX hot wallet. Those addresses share identical activity profiles with the ones still containing dormant supply, except for the outgoing transactions to OKX.

The OKX hot wallet, with a current balance of almost 3.9 million OKB ($196 million), would not see another OKB deposit from cold storage or regular users until nearly nine months later, in Jan. 2021.

The dormant supply was systematically distributed. It would take an equally systematic effort to retrieve that supposedly circulating supply.

According to OKX’s statement, the exchange would need to send a small amount of ETH to pay for withdrawals, access the private keys of each cold storage address, and then send OKB back to its hot wallet, which could then service a surge in OKB withdrawals upon request.

Some amount of the dormant OKB supply is required to back user balance. But it seems not all of it. And the amount in play will constantly morph depending on how much OKB each OKX user has on the platform, which could be used to pay for trading fees, buy NFTs and access leverage products.

This would obviously impact OKB’s true circulating supply. And a lower market cap for OKB would make a certain amount of sense.

No other pureplay crypto exchange token is worth more than $2 billion (excluding Bitfinex’s LEO, a debt token, as well as Uniswap’s UNI, which doubles as a DAO governance token).

Binance’s BNB is also a major outlier. It’s worth significantly more than any other exchange token, with a $40 billion market value. However, BNB also powers the Binance-branded Layer-1 blockchain, BNB Chain, which gives it a use-case beyond reducing trading fees, so they can’t be compared directly.

Nick Bax, head of research at blockchain R&D unit Convex Labs, told Blockworks: “I’ve looked at a lot of exchanges and their cold wallets on-chain and this is the first time I’ve seen a scheme with a distribution of amounts like this. Of course, every custom-made cold wallet is different.”

“It’s reasonable for them to withhold details on their security and private key storage but from a transparency perspective this creates a massive information asymmetry.”

What CoinGecko says

When initially quizzed over CoinGecko’s methods of calculating OKB’s supply, a spokesperson said “From our checks these tokens do meet our definition of circulating supply, as they appear to not be locked and are able to be traded at any time.”

After Blockworks shared this analysis, CoinGecko added that they are currently assessing the information available, which includes reaching out to OKX for clarification to form a more complete understanding.

“At CoinGecko, we are committed to empowering our users with unbiased and accurate information so they can make better-informed decisions. This is why we share our Methodology, including how we calculate circulating supply,” they said.

“We recognize that some data may not be best represented in the same way and we are seeking a more complete understanding before making any decisions.”

What CoinMarketCap says

Which leaves CoinMarketCap, which reports a circulating supply of 60 million OKB (exactly 20% of the amount claimed by OKX), thereby valuing it at a much lower figure than CoinGecko, at $3 billion. (It is also noted that CoinMarketCap is owned by Binance — and that OKX is a key competitor to the world’s largest exchange.)

“Much like you, we subscribe to the adage, ‘don’t trust, verify’ by cross-referencing (blackbox) API figures with on-chain wallet balances,” CoinMarketCap ecosystem lead Aaron K (AK) told Blockworks.

“The figure was verified some time ago. Verification is done on a best efforts basis, and typically entails the completion of this form so that we have some visibility into how their API figures are derived so as to ensure that it does not substantially deviate from our methodology.”

AK then said CoinMarketCap is in dialogue with the OKX team to verify how they’ve derived their “revised and substantially larger” figures in their new API endpoints. “Our decision on whether to update the verified figures will be contingent on their ability to provide the requisite documentation.”

With billions in perceived value riding on these nuances, CoinMarketCap’s AK told Blockworks it focuses on a “risk-based approach and relies on heuristics to estimate the circulating supply for projects.”

“Anyone can tell us that their project has a putative market cap of USD 164 billion and it would be expedient for us to publish that figure without any critical analysis,” they said.

“In fact, many actors in this space have every incentive to resort to all kinds of chicanery to inflate their circulating supply and/or market cap, which could displace honest projects from our rankings page.”

Many crypto projects demand CoinMarketCap allow them to “grade their own homework,” a bid to have their rank on the site dictated by their self-reported circulating supply. “But we still think that it is worth striving to apply a consistent methodology, however imperfect, difficult, or politically inexpedient it may be,” AK said.

So, how does dormant supply kept in cold storage factor into those efforts? Based on Blockworks’ analysis, CoinMarketCap acknowledged grounds to consider revising OKB’s circulating supply figure — although generally it gives projects an opportunity to explain the situation.

“Prima facie, there is a case to be made that the distribution of 89% of OKB from a single hot wallet to brand new wallets in equal sizes are likely to be dormant (and therefore not circulating) due to the lack of transactions and ETH for gas fees,” they said.

Not insinuating foul play

In OKB’s case, CoinMarketCap said it would decide whether to publish an updated verified circulating supply figure depending on its ability to “verify the data with a reasonable level of confidence or assurance.”

“A large jump in notional market cap (and rank) is generally one of the reasons for us to be circumspect in acquiescing to a project’s supply update, even if it means being on the receiving end of public vitriol for ‘ostensibly inaccurate’ circulating supply figures,” K said.

CoinMarketCap offered three extra steps that should be layered into any supply analysis:

- Assuming the asset’s trading venues are equally credible, is the revised figure commensurate with the asset’s liquidity and volume profile? Some analysts have highlighted the massive differences (32x) in order book depth between OKB and DOGE despite the former’s insistence that their capitalization should be reported similarly.

- Do we have reason to doubt the revised figures due to irregularities in the project’s documentation and explanations?

- Do we have reason to suspect that the project is trying to game its ranking through artificial wallet movements and misrepresentations?

“For the avoidance of doubt, we are not insinuating foul play for this particular case, though point 1 alone is sufficient to give us pause in taking OKB’s revised figures at face value,” the spokesperson said.

“In short, we believe that our more circumspect approach, despite being politically inexpedient, lends more credibility to our rankings/figures compared to a certain other data aggregator which claims that cUSDC has a putative market cap of $0.6B despite having a 24 hr volume of … $3.”

They then noted how much harder this process will be as more projects issue tokens across multiple chains, increasing the complexity of supply verification.

A ‘never-ending rabbit hole’

We’ve established that calculating supplies and market capitalizations is harder than it seems. In fact, CoinMarketCap stressed the importance of recognizing that those figures are “fundamentally approximations derived from available information.”

The crypto industry lacks robust standards for evaluating both circulating supplies and market values, to the detriment of investors and other market participants. The $10 billion OKB mystery is one example, but there are likely to be many others.

CoinMarketCap’s AK cited these “heterogeneous standards” alongside the industry’s “general willingness to accept blackbox figures at face value” as primary challenges in its day-to-day operation, with many projects targeting “non-acquiescent aggregators” with FUD (fear, uncertainty and doubt) if they don’t play along.

“Oftentimes, the epistemic standards in this space take the form of ‘It’s in our whitepaper and blog, therefore it must be true. Ergo, your figures are wrong’,” AK said.

Crypto is also rapidly changing, bringing about new issuance models. One example is projects that launch additional wrapped or staked tokens: Do you rank those assets alongside their collateral, even if it means their market values have been effectively double-counted? (The spokesperson cited in-development re-staking protocol Eigenlayer as a platform that would exacerbate this problem.)

Case in point: The staked ETH that contributes to Lido’s stETH’s market cap is still counted in ether’s own figures. CoinMarketCap and CoinGecko rank stETH differently: the former relegates it to its second page, at rank 203, while the latter has it in 12th place.

And even if projects are cooperative, data providers will always have some trust assumptions baked into their analysis — a difficult pill to swallow for those hellbent on verification over trust.

CoinMarketCap listed the following critical questions to ask when determining market values based on a project’s provided information, to evaluate how much trust is required:

- Did they act in good faith?

- Did they reverse engineer their circulating supply figures by artificially shifting assets around to hoodwink data aggregators?

- How do you know whether wallets marked as ‘airdrops’ were sybilled or distributed to random wallets to inflate circulating supply?

- If a project does a ‘fair launch’ and the team buys up more than 50% of the supply in the first second, is that really circulating?

- When probing irregularities, do you accept wordsmithed explanations at face value? What about honest and well-intentioned projects that don’t express their market cap metrics clearly?

Crypto is a fickle market, often powered by hype and opaque tokenomics. It’s been historically easy to map valuation formulas to traditional equities markets, which simply rely on outstanding shares by stock price.

It’s probable that OKB is not a special case, perhaps not even among exchange tokens. Many circulating supplies and market values are probably overstated — or even understated — and resolving those discrepancies demands individualized care powered by strict adherence to transparency.

A framework for realistic market caps is… probably unrealistic

This is an industry wide problem, and ultimately a question of ontology and epistemology, as CoinMarketCap puts it.

Many projects conflate unlocked assets (no restriction on ability to sell) with circulating supply, so CoinMarketCap often tries to layer wallet ownership into the analysis — determining supply kept by private investors, the team, and other tokens designated for airdrops.

“Generally speaking, we would include centralized exchange cold (and hot) wallets in our computation of circulating supply since this is a sound cybersecurity practice that would theoretically allow them to honor their short-term liabilities (user withdrawals),” AK said.

Still, putting an exact number on circulating supply is “epistemically fraught” since there are many edge cases, like privacy coins, that make it impossible to reliably analyze the chain for address balances.

There are also ways to game the system. (CoinMarketCap cited sudden token unlocks, bots and projects lying about wallet ownership as three examples.)

Schrödinger’s coins

So what’s the answer? What is OKB actually worth – $3 billion, $13 billion, or $1.4 billion?

The unsatisfying answer is… all of them, depending on how strict one is with definitions.

It’s true that almost $13 billion OKB exists on the Ethereum blockchain. It’s also true that about 90% of those funds are kept in cold storage managed by OKX.

And if what the firm says is true, any of those OKB tokens could be sold at any time with some effort, if user demand for withdrawals suddenly increases.

Yet it’s not a lie to say that those cold storage tokens are effectively dormant, and that their ownership could hypothetically be attributed to a single entity at the worst case (that could even be OKX itself.)

In this scenario, the randomized balances of 31,000 cold wallets would effectively encrypt the OKB holdings of whales — be they investors, insiders or other early adopters — hiding the true distribution of OKB and identities of key holders.

After the most valuable cold wallets were drained back in Apr. 2020, when 40 million OKB was sent to the hot wallet, the largest token balances not attributable to crypto exchanges have less than 37,000 tokens each, worth less than $2 million at current prices. So, the largest holders must be on OKX itself.

This could theoretically allow those whales to “smuggle” OKB into the exchange amongst user funds, potentially to be sold via the platform to those users. It would amount to cashing out OKB in a manner practically invisible to the blockchain, effectively disguised as fulfilling user withdrawal demands.

It doesn’t look as though this is happening — otherwise those addresses would be active. But the potential is there.

If the OKB in cold storage doesn’t always align with OKX user funds, then dormant tokens are barely different from those kept inside OKX’s burn wallet. Burn wallet tokens aren’t counted as circulating, since they don’t actually… well, circulate.

Dormant tokens fit the same description. In OKB’s case, we’re asked to trust that there are some OKX users out there who own 90% of the supply, currently valued at $10 billion, but who aren’t yet inclined to sell and withdraw those funds — even after three years and one monumental bull run.

As it turns out, market caps are mostly in the eye of the data provider.

Or in OKX’s case, the eye of the exchange behind the token.

Jon Rice contributed reporting.

blockworks.co

blockworks.co