MEXC is among the best crypto exchange platforms specialising in innovative derivatives products. This detailed MEXC review will provide you with all the necessary information related to its trading products, transaction fees, customer support, and many more so that you can determine if it meets your needs.

|

Official Website |

https://www.mexc.com/ |

|

Headquarters |

Singapore |

|

Found in |

2018 |

|

Supported Coins |

370+ |

|

Trading Pairs |

750+ |

|

Deposit |

Free, No minimum required |

|

Transaction & Withdrawal |

Maker: 0%, Taker: 0.200%; withdrawal fees depends on networks |

|

Trading options |

Spot, ETF, Margin, OTC, Futures, PoS Staking, etc. |

|

Application |

iOS, Android |

|

Customer Support |

24/7 live chat & email support |

MEXC Overview

MEXC Global opened its doors in 2018 in Seychelles, East Africa and has recently gained global prominence. It is a high-performance platform with many currencies, minimal trading fees, derivatives and DeFi products.

MEXC is accessible in nearly every country, including those with stringent regulations, such as the United States, Australia, and Canada. It places a significant premium on customer satisfaction, as evidenced by its diverse products and excellent customer service.

Supported Cryptocurrencies

The diversity of available assets is one of the most critical factors for investors and merchants to consider when selecting a crypto exchange. With MEXC, this is not an issue, as they provide investors and traders with over 370 cryptocurrencies and over 750 trading pairs.

You are spoiled for choice, so you can trade, purchase, or sell as you see fit. MEXC supports a variety of cryptocurrencies, ranging from the most prominent and hyped to lesser-known new projects. Before investing a substantial sum of money, evaluating all your options and decisions is prudent.

Deposit & Withdrawal Methods

MEXC has partnered with various third-party merchants to offer its customers diverse deposit options. Besides the most common payment methods, such as Visa, Mastercard, and Bank Transfer, you can use Apple Pay or Google Pay to purchase cryptocurrencies directly.

It is essential to note that fiat payment may vary based on your country of residence. As for cryptocurrency deposits, they are accessible to all users, regardless of location.

Direct crypto withdrawals are possible through the MEXC platform. Fiat withdrawals are not supported, but you can sell your cryptocurrency for fiat using peer-to-peer trading.

MEXC Fee Structure

MEXC Global does not charge deposit fees, but fees will be incurred when purchasing cryptocurrencies with third-party payment providers or credit cards.

Withdrawal fees and withdrawal minimums differ by asset type. For instance, the minimum BTC withdrawal limit is 0.002 BTC at the price of 0.0003 BTC. You can view all specified expenses on the MEXC Global website.

It’s worth noting that purchasing crypto with fiat can be costly. Credit card companies, payment processors, and fiat gateways typically charge fees from 1% to 5%.

The platform employs a tier-based maker/taker fee structure. The standard spot trading commission for both producers and buyers is 0.2%. As of February 2023, the platform charges 0% fees for producers and 0.2% for consumers.

Futures fees for consumers begin at 0.060%, while producers pay nothing. Depending on your 30-day trading volume, you can earn fee reductions.

MEXC’s Key Features

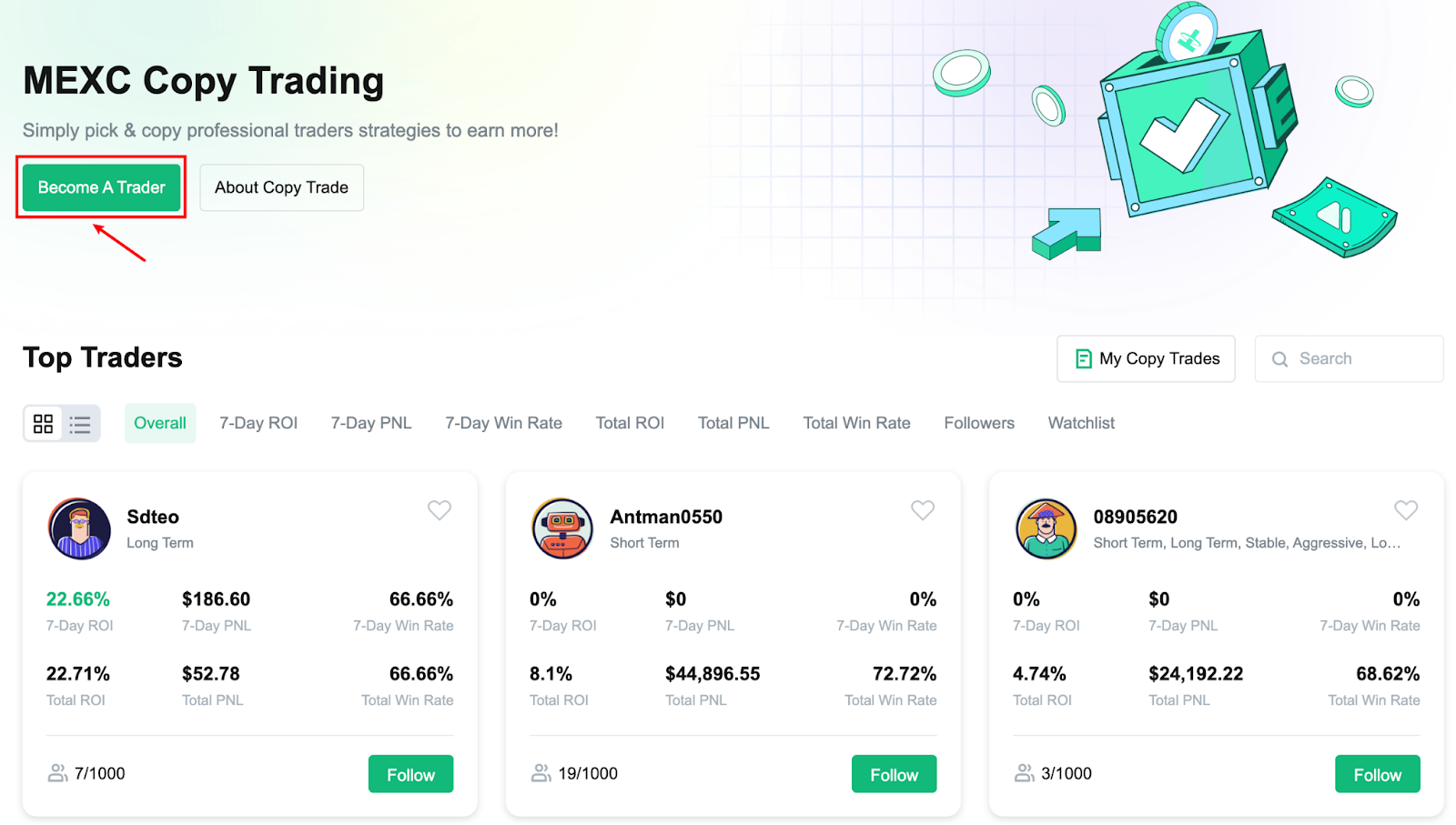

MEXC is a crypto exchange with many features and trading products. The user interface is suited for buying and selling cryptos with high liquidity and trading volume. You can enjoy derivatives such as its margin, Futures and P2P, automated trading bots, and copy trading.

User Interface

The default trading interface of the MEXC exchange displays the “Buy”and “Sell” icons directly beneath the asset. To the left of the ‘K-Line’ and the ‘Token Info’ icon is a constantly changing market order book. You can access an online trading chart that displays the full trading timeframe from one minute to one month.

Though this is the primary trading interface, indicator-savvy traders can access Moving averages and move average exponentials, Bollinger band strategy and the Parabolic SAR. Other sub-indicators, including Moving average convergence and Divergence, absolute strength, and real-time volumes, are also available.

MEXC enables users to change the colours or time intervals of the supported indicators. You can immediately finalise your orders. Because it’s directly connected to the TradingView API, the platform features advanced functionalities geared towards more experienced investors.

Trading Options

Despite being a centralised exchange, which imposes greater restrictions than decentralised exchanges, MEXC Global features a variety of trading options. Here are several of MEXC’s most popular trading options.

Spot Grid Trading

The MEXC exchange platform uses the quantitative grid trading strategy. A merchant specifies the highest and lowest prices at which they are willing to purchase or sell an asset. They then establish multiple grids and an initial investment amount. Using trading algorithms, it executes transactions to buy at the lowest possible price and sell at the highest possible price.

Multiple aspects of MEXC’s spot grid trading feature are remarkable. It eliminates the stress of manual trading first. Through automation, spot grid trading also reduces trading hazards. The service detects and concludes transactions at good prices.

Margin Trading

MEXC Global is one of the top exchanges for Margin Trading for traders who desire to trade more but need more capital to facilitate their transactions. Margin trading entails obtaining funds for trading purposes.

To borrow funds through MECX’s margin trading option, traders must activate a margin trading account and make a margin deposit. This deposit functions as the loan’s collateral. Traders frequently receive x amount of the initial deposit they make.

Leveraged ETFs

Exchange-traded funds (ETFs) are available for trading on the MEXC exchange. These instruments permit dealers to invest in an asset without actually acquiring it. ETFs closely monitor the price and overall performance of a specific asset or group of assets, making them convenient for entry without complex regulatory procedures.

The MEXC’s leveraged ETF trading enables users to multiply the yield rate of an underlying asset by a predetermined factor, typically three. For instance, if ETH increases by 5%, a leveraged ETF offering three times the return on ETH would increase by 15%. This type of trading is popular with traders because it provides the potential for greater returns while minimising liquidation risks. 3x long and 3x short ETFs are currently supported for a few select currencies on the MEXC exchange.

PUSH (P2P Trading)

The PUSH feature or peer-to-peer (P2P) trading enables users to trade directly with one another, eliminating the intermediary and providing a decentralised trading environment. It’s a vital component of the crypto trading ecosystem, facilitating greater transaction flexibility and security.

MEXC recognises the significance of peer-to-peer trading and has incorporated it into its platform to give users an additional trading option. With PUSH, you can trade crypto assets directly with other users without the intervention of a central authority. This function also enhances the privacy and security of transactions.

Order Types

A market order is a transaction that occurs instantaneously based on current market prices. When merchants place a market order, they direct the exchange to execute the transaction at the asset’s current market price. When a merchant wants a quick transaction, market orders are optimal. Due to the constant fluctuation of market prices, however, the profit margins on margin transactions are unpredictable.

Limit orders are immediate acquisitions or transactions of a particular asset that prioritise cost over velocity. Unlike a market order, which trades a digital asset based on an “on-the-spot price” when the order is placed, a limit order only executes the transaction if a price matching the requested price exists on the order book.

A limit order is advantageous because it prevents a merchant from selling at a price lower than desired. The order may never execute if it does not get a price that matches. Speculators commonly use stop-loss and take-profit orders to avoid such a scenario.

MEXC Earn

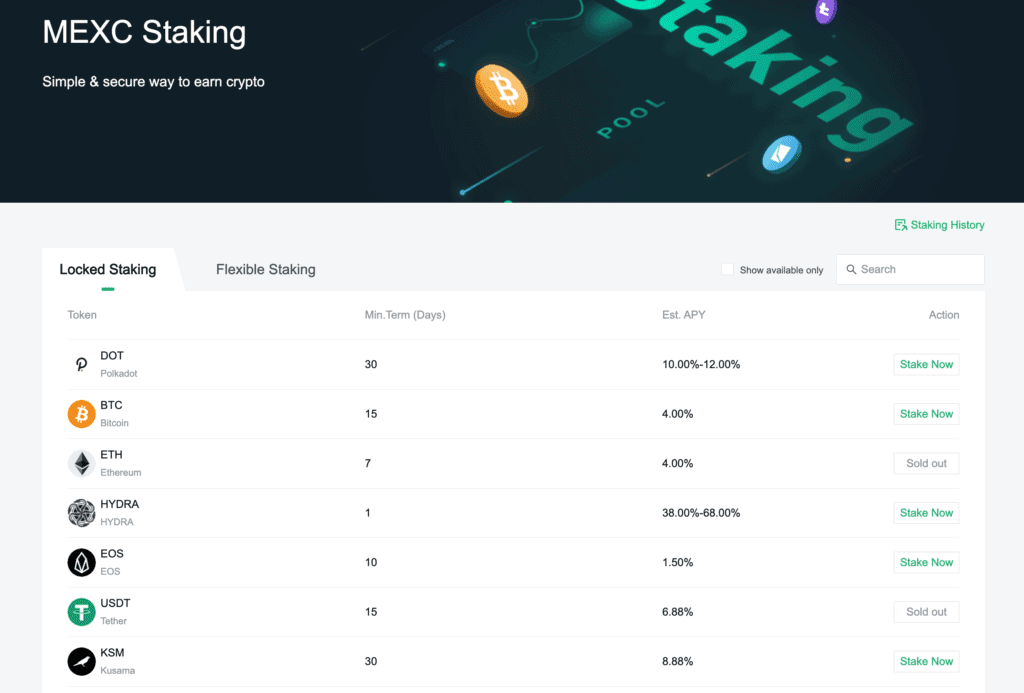

MEXC Global Earn offers several products, such as staking, third-party DeFi services, and trade mining. Trade mining yields benefits for trading specific currencies. Users can also receive pool rewards proportional to their transaction volume.

Staking enables you to generate passive income from your crypto holdings, both on a fixed and flexible term. The fixed staking includes ETH, EOS, USDT, HYDRA, DOT, BTC and KSM, with minimal term days spanning from 1 to 30 days and APYs between 1.50%, and 68%. Flexible staking includes thirty assets with no term limit, but their APYs range from a few basis points to approximately 6%.

While some stakeable assets, such as SOL and ADA, are excluded on MEXC, most platforms don’t support staking, so it’s difficult to complain too much. The flexible APYs are not particularly enticing, while the fixed APYs are better, primarily since the protocols determine them, but competitive nonetheless.

Mobile App

The MEXC Global exchange platform has apps for both iPhone and Android devices. The app functions identically to the desktop version and permits spot trading and margin trading anywhere in the world.

The app is useful for those with a MEXC Global exchange account and allows new users to register for the platform.

Download only the MEXC official app from App Store or Google Play since unofficial fraud applications can access your funds using your information.

Blog/Academy

MEXC’s blog is an exceptional resource for platform updates. In addition to subsections like Industry News and Altcoins, each article is organised and comprehensive. You can check it out if you’re interested in learning more about the space, as it contains a plethora of information on pertinent news and early-stage projects.

If you want to learn more about blockchain technology or trading advice for beginners, you can visit their Academy section, which is essentially the same as the blog but places less emphasis on news and more emphasis on education.

MX Platform Token

Similar to Binance’s BNB token, the MEXC exchange has its own MX token. MX token holders can experience a variety of rights and benefits, such as asset appreciation, revenue reimbursements, voting, supervision, etc.

MEXC rewards system liquidity contributors with 51% of MX via trading mining and token-based rebates. Similarly, the mining incentive mechanism rewards the MEXC community users with the privilege of holding MX.

Its total circulation is 3 billion and will never increase. There are two methods to acquire MX: mining and purchasing. The graph below displays the current MX Token (MEXC Global’s native token) price in US dollars.

MEXC Security

MEXC takes the security of its customers’ funds very seriously. New accounts are required to complete KYC and enable 2FA using a Google Apps authenticator.

The withdrawal procedure is only permitted once the 2FA requirements have been met. Email verification and mobile phone numbers can also be enabled to increase the platform’s security.

MEXC stores user assets in cold storage, which involves storing all data offline on a tangible device. Unless hackers find a system flaw, they are never able to access to hot storage or software wallets.

MEXC also develops sophisticated security risk management and anti-DDOS systems to prevent cyberattacks. As of October 2022, the exchange has not experienced any security issues.

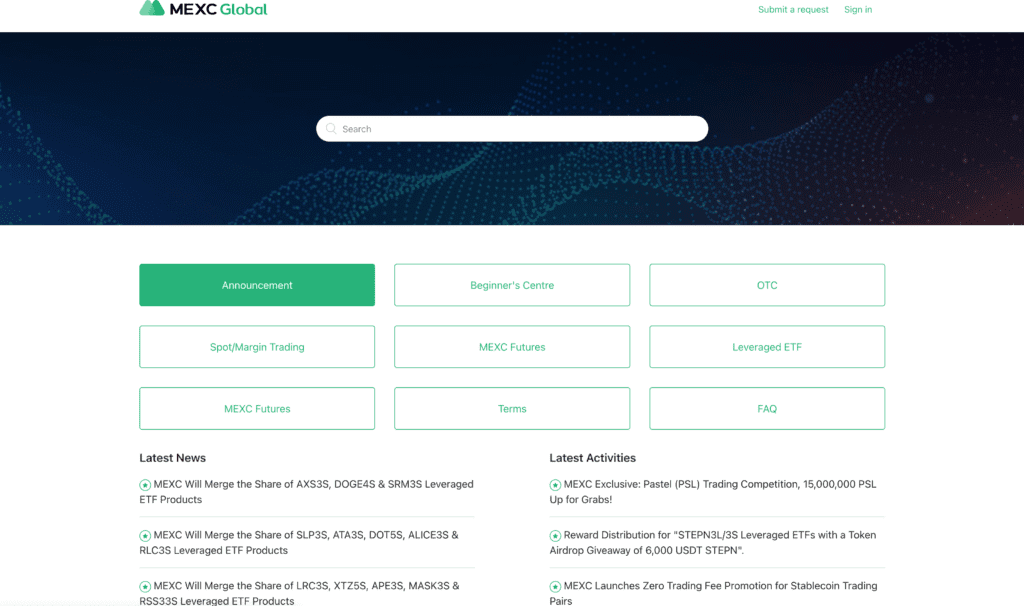

Customer Support

MEXC, like most other crypto platforms, has a help center to assist users with any problems they encounter. While the help center is extremely well-developed, it lacks as many images/videos as you’d like and could use additional UX work.

Occasionally, it can be a little difficult to navigate, but the entire center is organized and unquestionably beneficial. It’s not quite as good as Exodus’s assistance center, but it’s undoubtedly above average.

In addition, a small tab on the far right centre of each page allows users to submit a support query or initiate a live conversation. The live chat window will enable you to use their help centre for faster, more practical support. These features are industry standards, but it’s still great to see them included, as they can be a significant inconvenience if overlooked.

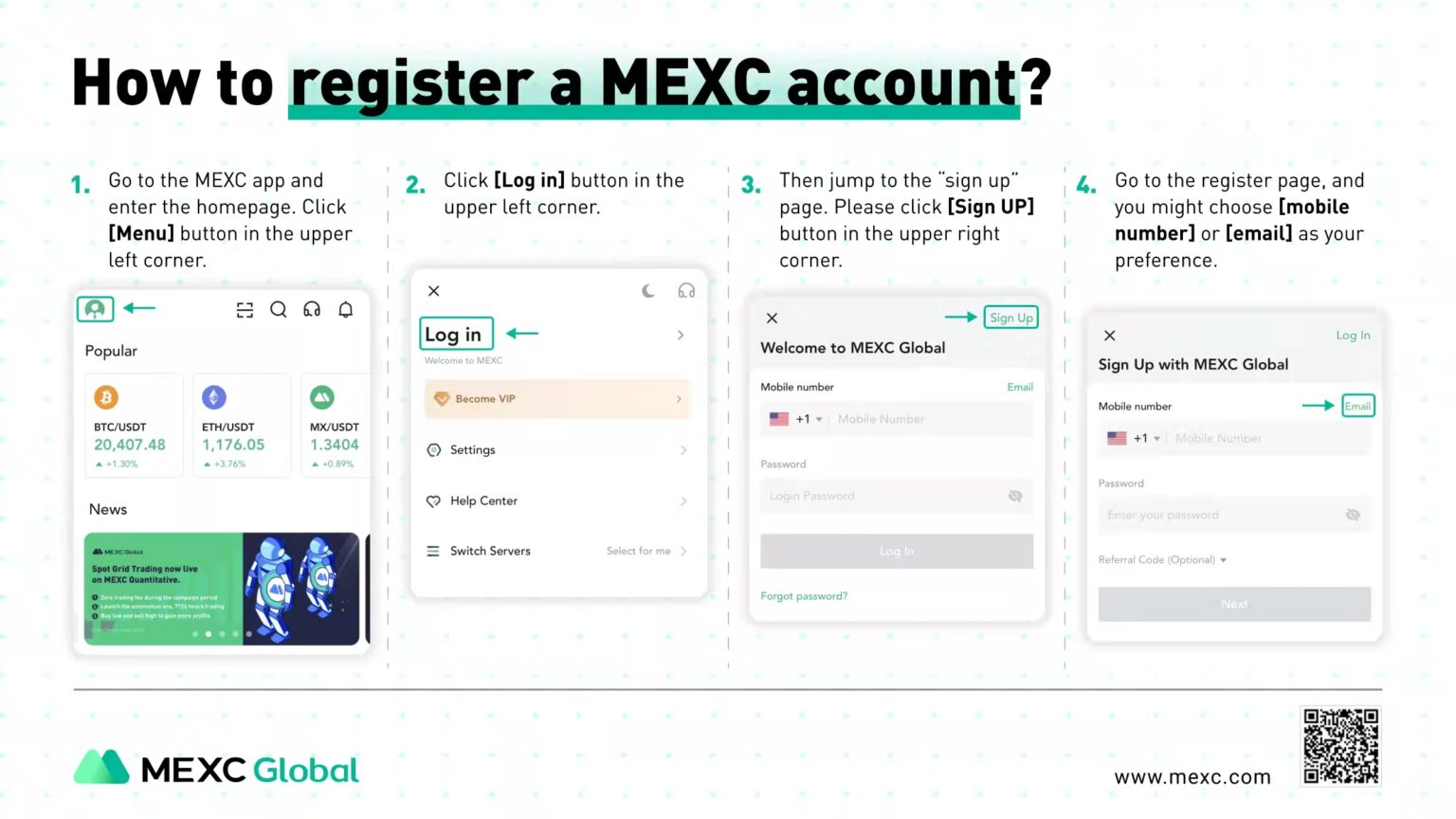

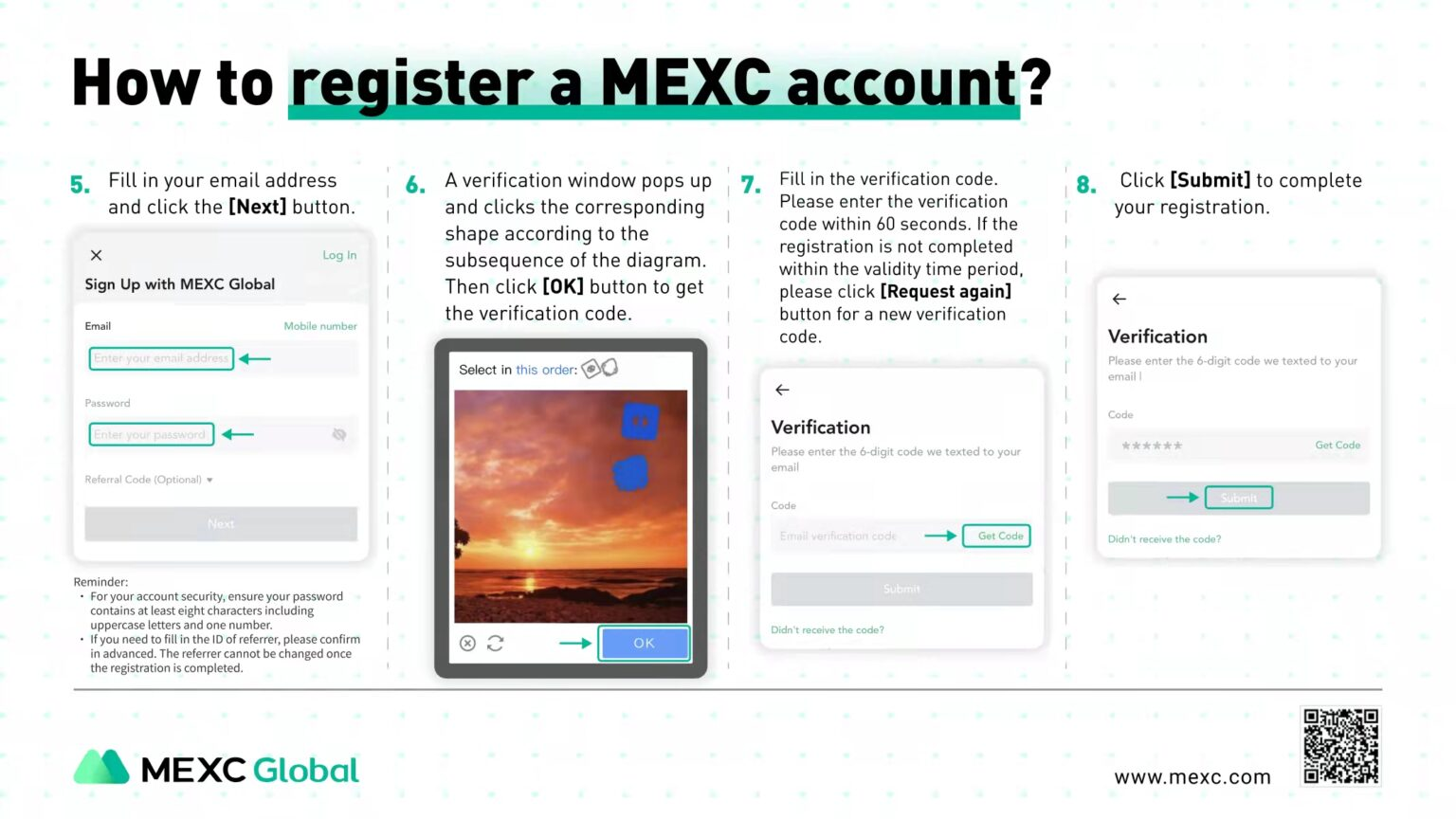

MEXC Account Registration

Access the homepage of the MEXC. Click the [Menu] icon in the upper left-hand corner, then the [Login] link in the upper-left corner.

Then, proceed to the registration page. Please select [Register] in the upper right-hand corner.

Navigate to the register page, and select [Register with mobile] or [Register with email], depending on your preference. Email registration is used as an illustration here.

Enter your email address and press the [Next] button.

A verification window appears, and the user selects the corresponding shape based on the diagram’s subsequence. Click [Confirm] to receive the verification code.

Please enter the verification code before the timer expires. You can select [Request again] for a new verification code if the registration is not completed within the given timeframe.

Set your password. Ensure your password contains at least eight characters, including uppercase letters and numbers.

Select [Next] to finish the registration process.

FAQs About MEXC

Is MEXC exchange secure?

MEXC uses a cutting-edge cold storage wallet to bolster the security of the platform’s accumulated funds. Regarding cryptocurrency deposits, MEXC Exchange handles $500 million in 24 hours. To date, no reports of security breaches have surfaced. This MEXC review finds the platform to be secure.

Is MEXC legal in the U.S.?

The United States is one of the five countries where the exchange is accessible. MEXC Exchange was granted the MSB license of the U.S. Therefore, it stands to reason that MEXC is legally permitted to conduct business in the United States.

Is MEXC a decentralised exchange?

No. MEXC is a centralised exchange for cryptocurrencies, meaning that MEXC administers its users’ deposits and transactions. Centralised crypto exchanges are suitable for both novice and experienced merchants. You can learn more about centralised exchanges and decentralised exchanges.

Is the MEXC exchange legit?

MEXC exchange is legitimate and secure. The platform possesses compliance certificates from nations such as Australia, the United States, and Canada. It also has a multi-cluster, multi-layer security system that protects it from malware and other cyber intrusions.

Does MEXC global require KYC?

You must complete the KYC procedure to trade on MEXC. The exchange employs KYC to distinguish between legitimate and illegitimate merchants, thus making it a requirement for trading on the platform.

How does MEXC differ from others?

MEXC Global differs from other crypto exchanges in several ways. Significant distinctions exist in its digital assets, trading options, supported countries, transaction fees, security features, and customer service.

Final Verdict

MEXC is one of the most popular crypto exchanges for derivatives and DeFi products. The platform imposes no fees for limit order trading, has a user-friendly trading platform, high liquidity and volume, and 24/7 customer support. However, the MEXC exchange does not permit withdrawals in fiat currency, which can be problematic for those unfamiliar with cryptocurrency withdrawals.

coinculture.com

coinculture.com