The ICO boom of 2017 was the major reason behind many altcoins pumping massively. Several coins without proper resource allocations raised millions of dollars and delivered nothing, while coin holders took profits. However, SEC’s crackdown put an end to such scams and paved the way for other investment methods for people who wanted to launch new crypto-coins, some of which include STOs [Security Token Offerings] and IEOs [Initial Exchange Offering].

The latter became quite famous as it was spurred by the world’s largest exchange, Binance. The exchange made sure to migrate Binance Coin [BNB] from Ethereum blockchain to their own blockchain. This was followed by an announcement that allowed other projects to move from ERC20 platform to Binance Blockchain.

The launch of BNB on its mainnet was followed by the launch of Binance DEX and a platform called Binance Launchpad, for its famed IEOs. The launch of BitTorrent’s token sale on January 31 made approximately $7.2 million and in less than 15 minutes of launch, it had a hard cap of $7.2 million. The second token, Fetch.AI, sold out within 22 seconds of launching and had a hard cap of $6 million.

Unlike ICOs, IEOs bring trust back to the ecosystem by reintroducing centralization. It involves a middle man and centralized authority, in the form of an exchange platform.

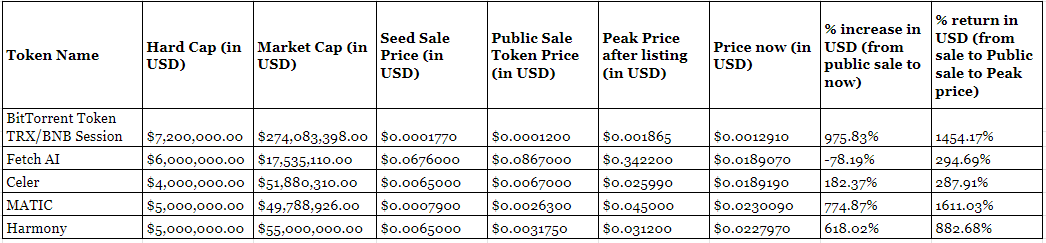

So far, Binance has listed 5 tokens excluding the Bread token, that was launched December 12, 2017. The other tokens include BitTorrent, Fetch AI, Celer, MATIC, and Harmony.

The above table tracks the percentage rise in the price of the tokens after being listed on the exchange. BitTorrent tokens were sold at $0.001865 during the public sale, with the price surging by a whopping 975% to the price at press time. However, the price of BTT surged by 1454.17%, after it hit an overall peak point of $0.001865.

Fetch AI, whose tokens sold out in 22 seconds, is currently down by -78.19%. However, at the peak price point, it surged by 294.69%, which was the second lowest surge of all Binance listed tokens.

Celer project which was listed on March 25, 2019 with a hard cap of $4 million did a peak surge of 287.91%. However, at press time, it was up by 182.37%. The largest surge was seen on MATIC token which was listed on April 26 and had a hard cap of $5 million. The total surge, at press time, was 774.87%, whereas the surge at peak price was 1,611.03%. The last token to be listed on Binance Launchpad/IEO was Harmony Token, which surged by 618.02% at press time, and had a peak surge of 882.68%.

CZ tweeted an excel sheet which tracked the returns of the coins listed on Binance IEO.

Projects that went through @binance Launchpad. Congrats! pic.twitter.com/YKIIGyHmJZ

— CZ Binance (@cz_binance) May 19, 2019

There is a clear surge in the price of the coins after being listed on Binance Launchpad, which is something similar to the effect seen on coins listed on Coinbase, which is informally termed as the “Coinbase Effect.”

XRP, the third largest cryptocurrency in the world, has a huge and probably the most active community right after Bitcoin’s, and saw a similar effect on its price when it was listed on Coinbase on February 25, 2019. The price of XRP against USD surged by approximately ~8.45% in under 3 hours whereas, the price surged, consolidated, and fell after 24 hours, i..e, it came down to ~3.35%.

XRP was the best coin listed after the “Coinbase Effect” was waning, so one can say that the effect wasn’t as much as the effect of previously listed coins that include Ethereum Classic [ETC], ZRX Token, Basic Attention Token [BAT], and Zcash [ZEC].

ZEC surged by the second lowest percentage within 3 hours of the announcement, i..e, 16%, with the surge falling down to 0.1% by the end of the day. ETC saw the highest surge after being announced i.e., it rose by 25.8% in 3 hours, ZRX surged by 29.8%, and BAT surged by approximately 20.6%. The Coinbase Effect faded as time passed by and it is hardly noticeable as of today, unlike the Binance IEO effect, which gives more returns than the Coinbase effect.

In retrospect, if an investor would have invested $1000 during the public sale of MATIC tokens, the investor would stand to gain ~$16,100 by holding them for only 25 days. If the same amount was invested in BTT, the investor would gain ~$14,500 for holding the tokens for 117 days. The best investment would be Harmony Token, if the user had invested $1,000, he would stand to gain $8,800 in only 5 days. The gain for all of the aforementioned tokens is after deducting the investment.

ambcrypto.com

ambcrypto.com