Uniswap Labs, the leading developer of the decentralized trading platform on Ethereum, asserted that the US Securities and Exchange Commission’s (SEC) potential enforcement action against it lacks merit.

According to the New York-based startup, crypto tokens should not be classified as securities. Instead, they are files similar to PDFs.

Why Crypto Tokens Are Not Securities

On Tuesday, Uniswap Labs contested the allegations that it operates an unregistered exchange and broker-dealer. This response follows a Wells notice served by the SEC’s Enforcement Division last month, indicating plans to recommend legal action against the company.

Marvin Ammori, Chief Legal Officer of Uniswap Labs, spoke at a press conference, emphasizing the SEC’s flawed assumption that all tokens are securities. Uniswap Labs also argues that now, the SEC risks an adverse decision that could limit its authority over crypto tokens.

“Tokens are, in fact, simply a file format. They are a file format for value and they are not inherently securities. The SEC has to essentially unilaterally change the definitions of exchange, broker and investment contract in order to try to capture what we do.” Ammori said.

Read more: How To Buy Uniswap ($UNI) and Everything You Need To Know

In a 40-page response, the company expressed its readiness to litigate if necessary, asserting confidence in its legal standing.

SEC Chairman Gary Gensler has consistently argued that decentralized exchanges fall within the SEC’s regulatory scope. He has stated that many digital assets are unregistered securities subject to SEC rules.

However, Uniswap Labs maintains that $UNI tokens, its governance tokens, do not qualify as securities under the Howey Test. This legal standard from a Supreme Court ruling defines investment contracts.

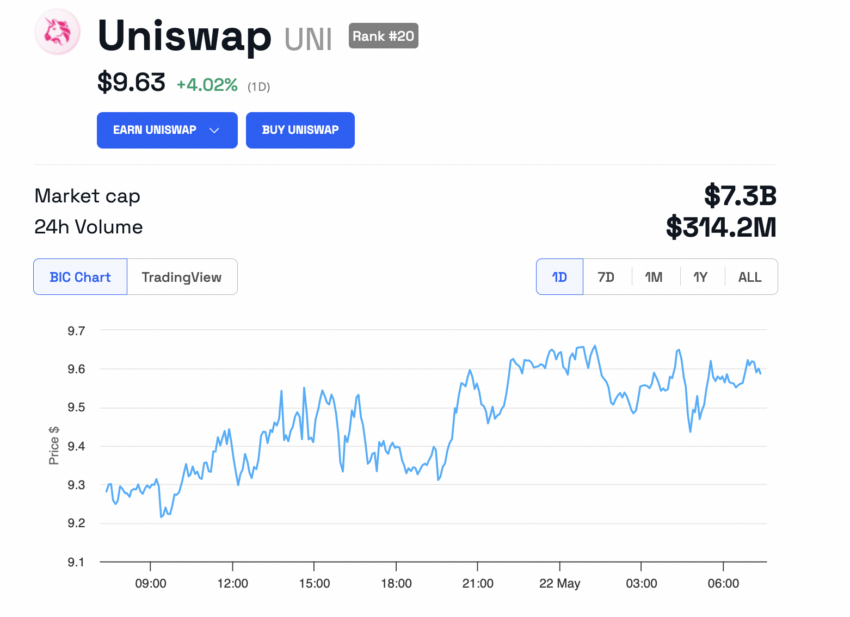

In light of these developments, Uniswap’s $UNI token saw a 4% increase in value over the past 24 hours, trading at $9.63.

The broader crypto market closely watches the SEC’s actions, especially as the US election approaches and crypto becomes a significant political issue. Some believe that the SEC’s stance on crypto may be shifting. Also there are expectations that the SEC will approve spot Ethereum ETFs on May 23.

This anticipated approval is believed to result from political pressure. Crypto enthusiasts speculate that the Biden administration and former President Donald Trump might have realized the crypto community’s growing influence.

Not to mention, Trump’s campaign recently allowed donations via crypto, signaling a more crypto-friendly approach.

Read more: What Does It Mean To Receive a Wells Notice From the SEC?

“Biden and Trump now trying to outdo each other pandering to the crypto bros. Flawless victory,” Venture capitalist Nic Carter said.

beincrypto.com

beincrypto.com