The United States Securities and Exchange Commission (SEC) has moved to dismiss its high-profile lawsuit against Ripple CEO Brad Garlinghouse and co-founder Chris Larsen.

The request follows a US judge’s denial of the SEC’s appeal from a July ruling favoring Ripple.

SEC Drops Lawsuit Against Ripple Executives

The legal maneuver began in 2020 when the SEC accused Ripple of gathering over $1.3 billion through an unauthorized digital asset securities offering. However, a landmark ruling in July declared that sales of Ripple’s XRP to the general public were not a security.

This latest development by the SEC to seek a dismissal signifies a major departure from its initial stance. Ripple’s Chief Legal Officer, Stuart Alderoty, said the agency’s move to drop the lawsuit was not a settlement but a “surrender.” This has resonated well with the industry as it may potentially impact the broader regulatory framework surrounding cryptocurrencies.

Ripple CEO Brad Garlinghouse emphasized being,

“Targeted by the SEC in a ruthless attempt to personally ruin [him] and the company so many have worked hard to build for over a decade.”

Still, he celebrated “another win” and condemned the SEC for,

“Repeatedly [keeping] its eye off the ball while secretly meeting with the likes of Sam Bankman-Fried.”

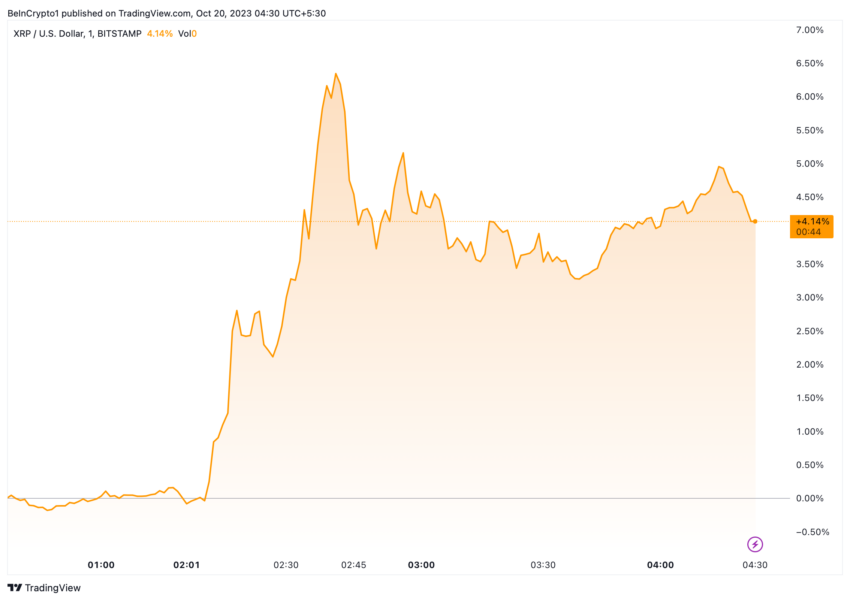

The effects of this legal shift were felt in the crypto market. XRP’s price experienced a noticeable uptick of over 6%. Although it slightly retreated from its highs, the positive market response underscores the significant implications of this legal turnaround.

Read more: Why a $1,896 Target for Ripple’s XRP Is an Outrageous Lie

Following the dismissal of the lawsuit against Ripple CEO Brad Garlinghouse and Chris Larsen, the SEC and Ripple will engage in further discussions. The goal is to outline a potential briefing schedule on suitable remedies against Ripple. This move towards a resolution is a win for Ripple and sets a precedent for crypto regulation in the US.

beincrypto.com

beincrypto.com