The U.S. Treasury Department has proposed a 30% excise tax on the cost of powering crypto mining facilities.

A provision in the department’s “Greenbook,” its list of tax proposals and explanations for the U.S. President’s budget proposal, would create a phased-in excise tax based on the costs of the electricity used in crypto mining, imposed on the companies “using computing resources” to mine cryptocurrencies.

These companies would also be required to report how much electricity they use and what type of power was tapped. The tax would be phased in over the next three years, increasing 10% each year.

The provision explicitly makes the case that this type of tax may lower the overall number of mining machines in the U.S.

“The increase in energy consumption attributable to the growth of digital asset mining has negative environmental effects and can have environmental justice implications as well as increase energy prices for those that share an electricity grid with digital asset miners,” according to the document. “Digital asset mining also creates uncertainty and risks to local utilities and communities, as mining activity is highly variable and highly mobile. An excise tax on electricity usage by digital asset miners could reduce mining activity along with its associated environmental impacts and other harms,” the document added.

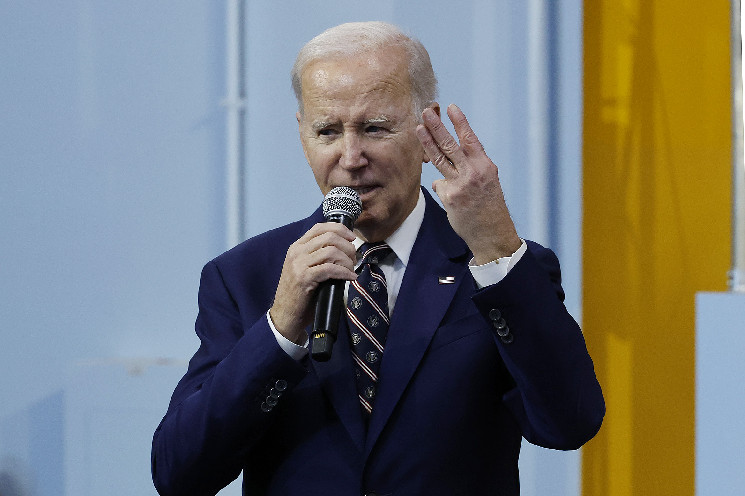

The House of Representatives and Senate have to pass a budget which includes these types of revenue-generating tax rules before they can be implemented. The Republican-led House is unlikely to adopt the Democratic president’s proposal as-is. Still, the proposal indicates Biden's fiscal priorities as he prepare to announce his bid for a second term as U.S. President.

Crypto tax rule updates

U.S. President Joe Biden unveiled his 2024 budget proposal on Thursday, highlighting a separate provision that would close a so-called wash sale loophole in the tax code. The move would block people from harvesting their tax losses by selling digital assets at a loss, marking that hit when they file their taxes and then immediately buying the same assets again.

The greenbook mentioned this provision, alongside a third crypto-related proposal that would expand the securities loans rules to include digital assets.

“The proposal would amend the securities loan nonrecognition rules to provide that they apply to loans of actively traded digital assets recorded on cryptographically secured distributed ledgers, provided that the loan has terms similar to those currently required for loans of securities,” the document said.

Yet another provision addresses Foreign Account Tax Compliance Act rules. Referencing the 2021 Infrastructure Investment and Jobs Act’s crypto tax reporting provision, Thursday’s greenbook proposes capturing foreign account-holders in the information reporting rules as part of the government’s ongoing information-sharing efforts on financial brokers.

Similarly, a fifth provision would require people with foreign financial accounts holding at least $50,000 in crypto to report these holdings in their tax reports.

Mark-to-market rules would be amended to include crypto in a sixth provision.

coindesk.com

coindesk.com