We all love to use emojis to express ourselves, but the next time you use a “to the moon” rocket ship emoji, beware, as you could be offering financial advice. A New York judge has ruled that Dapper Labs, the creators of NBA Top Shot Moments, used the emojis to indicate a return on investment for investors.

Dapper Labs is facing a class-action lawsuit from investors who claim that it violated securities laws through the sale of its NBA Top Shot Moments NFT collection. The company, whose fortunes have drastically turned amid the NFT sales dip, has been fighting to dismiss the lawsuit. One of its arguments hinged on social media promotions of the Moments collection.

As a former Securities and Exchange Commission (SEC) official revealed recently, a New York judge has ruled that the company offered investment advice using emojis on Twitter.

A federal court judge ruled that these emojis 🚀📈💰objectively mean "one thing: a financial return on investment." Users of these emojis are hereby warned of the legal consequence of their use. #emojis #rocketshipemoji #DapperLabs https://t.co/4yRfWBH96R

— Former SEC Branch Chief Lisa Braganca (@LisaBraganca) February 23, 2023

In his 64-page ruling, Judge Victor Marrero of the Southern District of New York subjected the Moments NFT collection to the Howey Test. Under the third prong —a security is a transaction in which there’s an expectation of profit—Judge Marrero ruled that the company’s use of emojis led investors to believe they would make a profit by purchasing the NFTs.

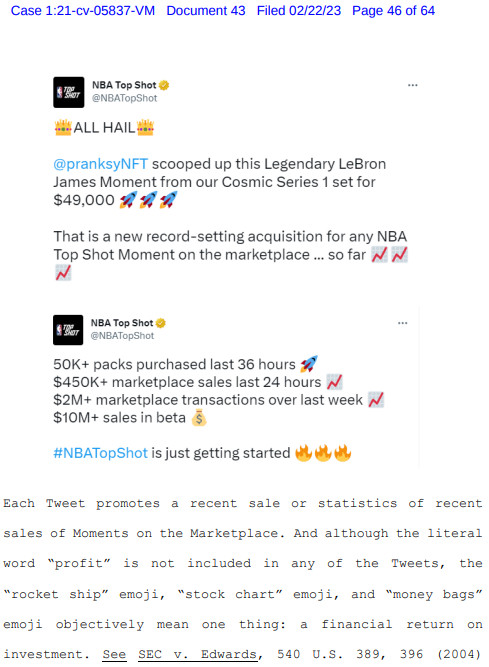

Judge Marrero picked out two tweets where Dapper used the rocket ship, positive stock chart, and money bag emojis.

“Each Tweet promotes a recent sale or statistics of recent sales of Moments on the Marketplace. And although the literal word “profit” is not included in any of the Tweets, the “rocket ship” emoji, “stock chart” emoji, and “money bags” emoji objectively mean one thing: a financial return on investment,” Judge Marrero ruled.

The emoji uproar

The tweets and emojis were not the only instances in which Dapper and its founder Roham Gharegozlou led investors to expect profits. Gharegozlou, for instance, allegedly promoted Moments as “younger generations’ opportunity to benefit financially.” He also repeatedly claimed his Moments NFT stash was “valuable.”

However, the emoji accusation has sparked the most heated debate within the digital asset industry and beyond.

“This should be another reminder to any crypto entrepreneur: What you say in public and what you put in a tweet is important,” said Henri Arslanian, the founder of digital asset hedge fund Nine Blocks.

Oscar Tan, the chief legal officer at Enjin blockchain network, believes this “dangerous ruling” is an infringement on the right to ‘shitposting.’

“Courts should protect the edgy, freewheeling messaging in NFT communities because shitposts and emojis are part of free speech too,” he said.

Tan further questioned why similar standards aren’t maintained for other industries which leverage emojis and messaging rooted in inducing fear of missing out (FOMO).

But as many in the industry obsess over the emoji ruling, Judge Marrero’s verdict had much more to it. Dapper’s use of its own Flow blockchain could be much more significant in the final ruling than the emoji verdict.

Since Moments was only issued on Flow, which Dapper controls, investors relied solely on the efforts of the company and its continued success. If Dapper collapsed, NFTs held on its blockchain could be worthless.

10/ By privatizing the blockchain on which the Moments NFT value depends and by restricting the trade of Moments to only the Flow blockchain, purchasers must rely on Dapper Labs' expertise and managerial efforts, as well as its continued success and existence.

— Henri Arslanian (@HenriArslanian) February 23, 2023

This hints that the judge’s ruling would have been significantly different if Moments were released on a public network like the BSV blockchain. It also might be the distinction that exempts holders of Crypto Kitties—an NFT collection also by Dapper but on Ethereum—from securities violation lawsuits.

Watch: Blockchain Venture Investments Driving Utility for a Better World

coingeek.com

coingeek.com