BlackRock (BLK), the world’s largest asset manager, highlighted cryptocurrency and tokenized assets as important investment themes in a new report exploring the trends it says are shaping markets this year.

Though artificial intelligence and energy infrastructure take center stage, crypto still earns attention, with bitcoin BTC$90,226.42, ether ETH$3,005.51 and stablecoins all mentioned in the 2026 Thematic Outlook. The team, led by Jay Jacobs, the company's head of U.S. equity exchange-traded funds (ETFs), included crypto among a broader list of “themes driving markets in unprecedented ways.”

Though brief, mentions of tokenization and digital assets carry weight coming from a firm managing over $10 trillion. The report positions blockchain less as a speculative play and more as an emerging tool for modernizing access to traditional asset classes.

The iShares Bitcoin Trust (IBIT), BlackRock’s spot bitcoin ETF, which debuted in January 2024, is singled out as the fastest-growing exchange-traded product in history. Its strong uptake, the report suggests, reflects sustained investor interest in gaining exposure to bitcoin as part of a broader thematic strategy. The fund's net assets now amount to more than $70 billion.

The report also points to tokenization, or the representation of real-world assets such as real estate and equities in a digital format, as gaining increasing traction. The process is part of a shift in how investors access markets, BlackRock said. Stablecoins, such as those backed by the U.S. dollar, are an early example of tokenized assets.

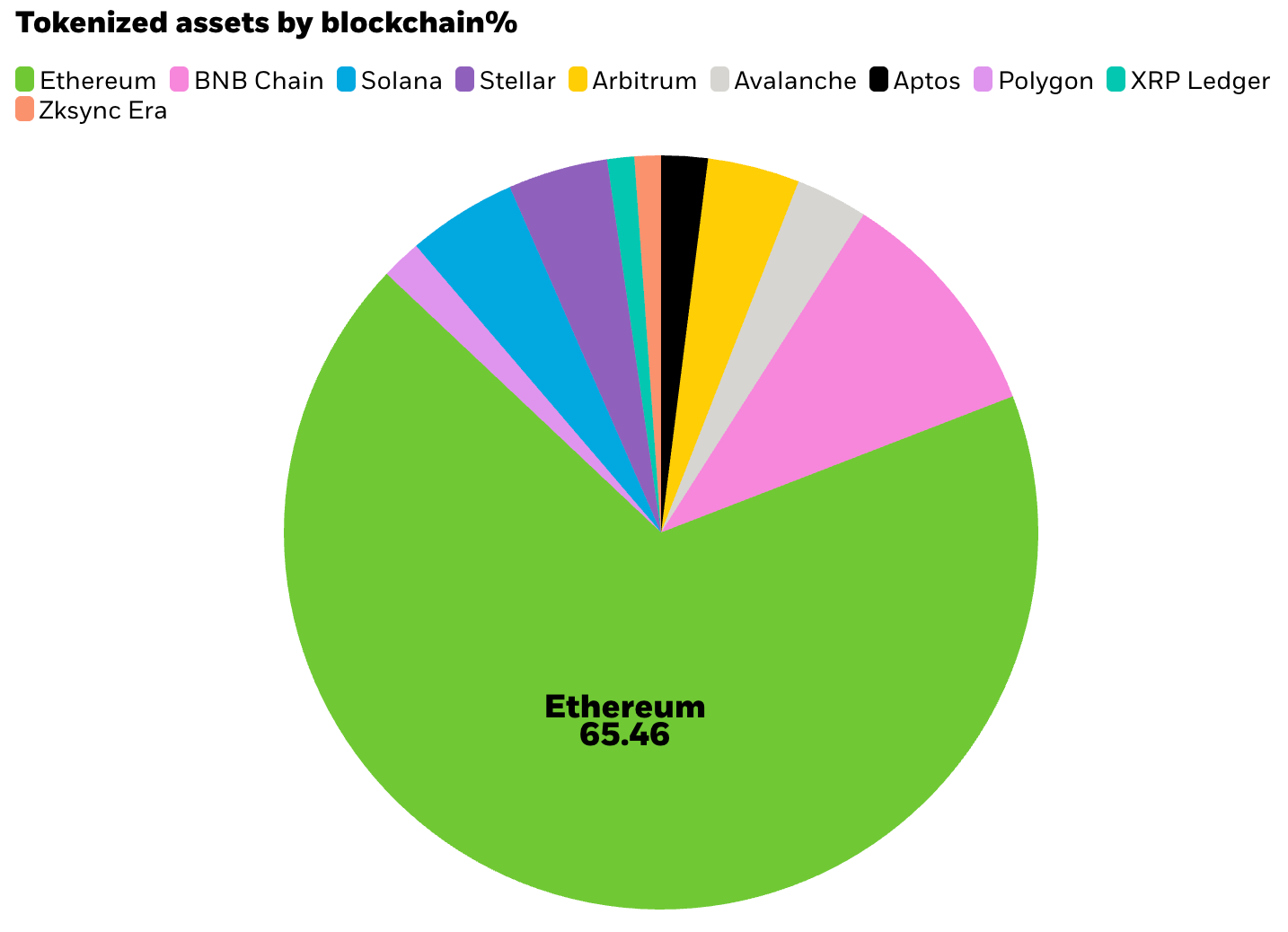

“In our view, as tokenization continues to rise, so will the opportunity to access assets beyond cash and U.S. Treasuries via the blockchain,” the report states. It specifically notes the Ethereum blockchain as a potential beneficiary of tokenization growth, a nod to its widespread use in building decentralized applications and token infrastructure.

The inclusion of crypto and tokenized assets — while not the core of the report — signals that BlackRock views digital assets as part of a larger set of transformative “mega forces.” These include growing demand for computing power driven by AI, geopolitical shifts in defense spending and global infrastructure buildouts. The firm suggests these trends are not only shaping economies, but also changing how portfolios are built and managed.

For crypto investors, BlackRock's message reinforces the idea that blockchain-based technologies are moving closer to the mainstream. While bitcoin’s price volatility and crypto’s regulatory challenges aren’t addressed directly, the report’s language makes clear that the firm sees real potential in the digital asset space, particularly in terms of how it may modernize financial infrastructure.

coindesk.com

coindesk.com