By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin $BTC$88,311.53 recovered from overnight lows, though it remains below $90,000, weighed down by geopolitical tensions that keep it behaving more like a volatile tech stock than a haven asset.

The stabilization coincided with easing pressure in global bond markets. Japanese government bonds rebounded after a sharp selloff earlier in the week, with yields on ultra-long debt falling after officials called for calm. The move helped provide a cushion for riskier assets.

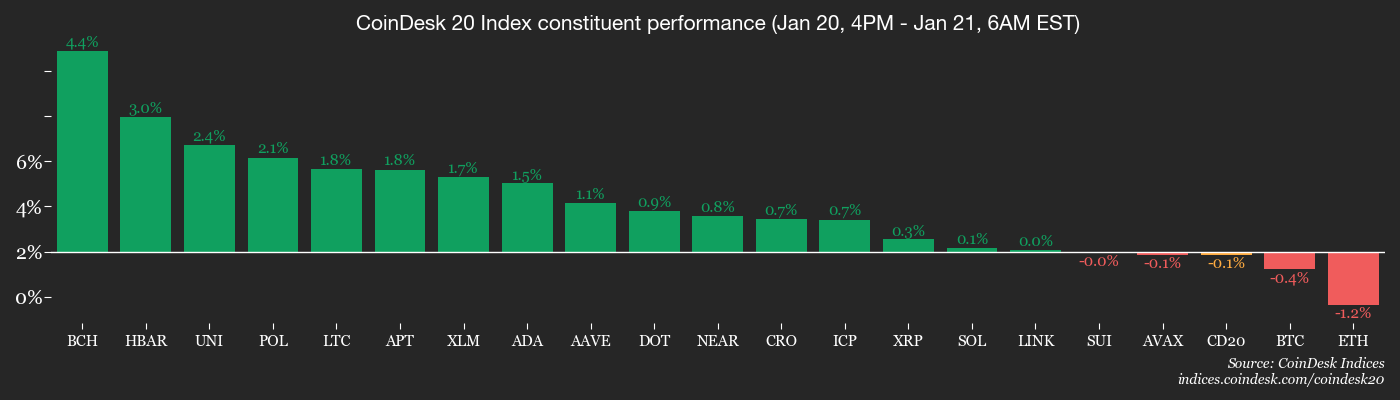

CoinDesk 20 (CD20) index has dropped about 2% in the past 24 hours, reflecting the selloff in cryptocurrencies and related equities during U.S. hours on Tuesday. Major crypto stocks are showing declines of less than 1% in pre-market trading after falling 5%-7% yesterday. U.S. equity index futures are down slightly.

Adding to the volatility is President Donald Trump’s call for U.S. control of Greenland, now paired with fresh tariff threats on several European nations. With European leaders preparing retaliatory measures, Trump's address at the World Economic Forum in Davos later today will be of interest.

In other news, Mike Novogratz, CEO and co-founder of crypto financial services firm Galaxy Digital, said on social media gold’s price is pointing to the U.S. dollar “losing reserve currency status at an accelerating rate.”

To Novogratz bitcoin's performance is “disappointing as it is still being met with selling.” Analysts at QCP Capital pointed out in a note that $BTC’s momentum “struggled to re-establish itself” with markets losing their appetite for risk.

“Rather than behaving as a hedge, $BTC is trading like a high-beta risk asset, highly sensitive to rates, geopolitics, and cross-market volatility,” the analysts wrote. “Until clearer policy signals emerge, crypto is likely to stay reactive rather than directional."

Stay alert!

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Jan. 21, 11 a.m.: VeChain to host an X Spaces session covering ecosystem updates.

- Macro

- Jan. 21, 8:30 a.m.: Address by U.S. President Donald Trump at the World Economic Forum in Davos

- Jan. 21, 8:30 a.m.: Canada Dec. PPI YoY (Prev. 6.1%); PPI MoM (Prev. 0.9%)

-

Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- BNB Chain is voting on a proposal to update five system parameters to align with the upcoming Fermi hard fork and the activation of BEP-619, which reduces the block interval to 0.45 seconds. Voting ends Jan. 21

- Unlocks

- Jan. 21: PLUME$0.01492 to unlock 39.75% of its circulating supply worth $23.6 million.

- Token Launches

- Jan. 21: Solana Seeker ($SKR) airdrop claims open.

- Jan. 21: Summer.fi (SUMR) token generation event to occur.

- Jan. 21: Seeker ($SKR) to be listed on Bitget, BingX, KuCoin, MEXC, and others.

- Jan. 21: ETHGas (GWEI) to be listed on Binance Alpha, MEXC, BingX, and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 3 of 4: Web3 Hub Davos (Switzerland)

Market Movements

- $BTC is down 0.41% from 4 p.m. ET Tuesday at $89,219.16 (24hrs: -2.24%)

- $ETH is down 0.93% at $2,965.90 (24hrs: -4.51%)

- CoinDesk 20 is down 018% at 2,736.36 (24hrs: -2.22%)

- Ether CESR Composite Staking Rate is up 1 bps at 2.84%

- $BTC funding rate is at 0.0046% (5.0020% annualized) on Binance

- DXY is unchanged at 98.67

- Gold futures are up 2.18% at $4,869.70

- Silver futures are up 0.23% at $94.86

- Nikkei 225 closed down 0.41% at 52,774.64

- Hang Seng closed up 0.37% at 26,585.06

- FTSE is down 0.12% at 10,114.19

- Euro Stoxx 50 is down 0.61% at 5,856.25

- DJIA closed on Tuesday down 1.76% at 48,488.59

- S&P 500 closed down 2.06% at 6,796.86

- Nasdaq Composite closed down 2.39% at 22,954.32

- S&P/TSX Composite closed down 1.03% at 32,750.28

- S&P 40 Latin America closed up 0.81% at 3.371,58

- U.S. 10-Year Treasury rate is down 1 bps at 4.285%

- E-mini S&P 500 futures are up 0.15% at 6,840.00

- E-mini Nasdaq-100 futures are unchanged at 25,146.00

- E-mini Dow Jones Industrial Average Index futures are up 0.08% at 48,705.00

Bitcoin Stats

- $BTC Dominance: 59.81% (0.10%)

- Ether-bitcoin ratio: 0.03321 (-0.11%)

- Hashrate (seven-day moving average): 1,005 EH/s

- Hashprice (spot): $38.54

- Total fees: 2.74 $BTC / $248,316

- CME Futures Open Interest: 122,830 $BTC

- $BTC priced in gold: 18.3 oz.

- $BTC vs gold market cap: 5.97%

Technical Analysis

- Given the rejection at the 50-week exponential moving average (EMA) for $BTC/USD's weekly chart, the core level to now monitor is the current support at $88,120.

- Barring a clean break above the 50-week figure, the expectation would be a range-bound move between the EMA price and the highlighted support.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $227.73 (–5.57%), -0.43% in pre-market at $226.75

- Galaxy Digital (GLXY): closed at $32.10 (–6.44%), -0.62% at $31.90

- MARA Holdings (MARA): closed at $10.37 (–8.71%), -0.10% at $10.36

- Riot Platforms (RIOT): closed at $18.10 (–5.93%), -0.33% at $18.04

- Core Scientific (CORZ): closed at $18.36 (–2.81%), -0.33% at $18.30

- CleanSpark (CLSK): closed at $12.76 (–4.56%), –0.78% at $12.66

- CoinShares Bitcoin Mining ETF (WGMI): closed at $48.21 (–5.58%)

- Circle Internet Group (CRCL): closed at $72.70 (–7.52%), -0.27% at $72.56

- Bullish (BLSH): closed at $38.97 (–0.10%), –0.46% at $38.75

- Exodus Movement (EXOD): closed at $16.48 (-0.72%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $160.23 (–7.76%), udown 0.44% in pre-market at $159.53

- Semler Scientific (SMLR): closed unchanged at $20.33

- SharpLink Gaming (SBET): closed at $9.95 (–9.55%), –2.46% at $9.70

- Upexi (UPXI): closed at $2.03 (–12.12%), -0.49% at $2.02

- Lite Strategy (LITS): closed at $1.31 (–8.39%)

ETF Flows

Spot $BTC ETFs

- Daily net flows: -$479.7 million

- Cumulative net flows: $57.32 billion

- Total $BTC holdings ~1.31 million

Spot $ETH ETFs

- Daily net flows: -$230 million

- Cumulative net flows: $12.7 billion

- Total $ETH holdings ~6.21 million

Source: Farside Investors

While You Were Sleeping

Bitcoin stages rebound to nearly $90,000 as traders await Trump’s Davos talks (CoinDesk): Bitcoin rebounded toward $90,000, clawing back recent losses as traders turned cautious ahead of President Donald Trump’s Davos remarks.

$ETH, $SOL, $ADA drop 5% as Trump trade threats and bond selloff spark crypto risk-off (CoinDesk): $ETH, $SOL and $ADA slid ~5% as Trump’s trade threats and a bond selloff sparked a broader risk-off move.

$XRP pattern echoes Feb. 2022, putting recent buyers under pressure (CoinDesk): $XRP is flashing a technical pattern reminiscent of February 2022, raising the risk of further downside and putting recent buyers under pressure.

Stocks gripped by geopolitical tensions as Trump heads to Davos; bonds steady (Reuters): Trump’s renewed Greenland-linked tariff threat has revived “Sell America” trade fears, hitting equities and pushing the dollar lower as euro and sterling firm.

Europe to suspend approval of US trade deal as global markets fall (BBC): Europe is set to suspend approval of July’s U.S. trade deal after Trump’s Greenland tariff threats, reviving trade-war concerns.

Trump Seeks ‘Decisive’ Options for Iran as Assets Move Into Middle East (The Wall Street Journal): Trump’s team is weighing military options to pressure Iran, raising renewed Middle East escalation risks.

coindesk.com

coindesk.com