Money market traders are pricing in an ECB rate hike in the coming months, ending the period of relatively low rates. On the other hand, Polymarket predictions point to unchanged rates for most of 2026.

The credit landscape in 2026 may include ECB rate hikes and an increased economic outlook for the Euro area, after a period of unchanged interest rates and low inflation.

On the one hand, money market traders are pointing to a potential hike in 2026, as the Euro area economy is showing signs of a faster recovery. On the other hand, traders are pointing to more than a 50% chance that the European Central Bank will increase interest rates after a week of hawkish remarks.

The Euro area inflation remains relatively low, but the period of extremely low rates in Europe may be ending.

Despite the interest rate cuts in 2025 and a dovish Fed, the expectations are that in 2026, quantitative easing may stop, and some central banks may return to rate hikes.

Based on money-market swaps, traders expect 13 basis points of ECB rate hikes by the end of 2026. The market shifted from an expectation for a rate cut last week. At the end of November, ECB Chief Christine Lagarde stated that the current rate level of 2% is correct and reflects the desired effect on Euro Area inflation.

The expectation for rate hikes affected Euro area bond markets, with German 5-year bond yields still rising to 2.49%. The shift reflects ongoing preparation for the end of the rate cut cycles for most major central banks.

Prediction markets see stability for ECB rate

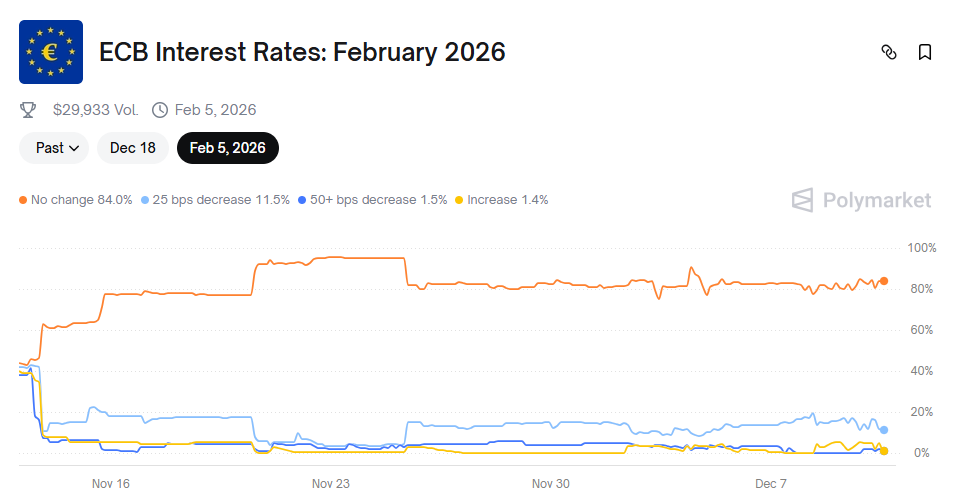

Polymarket traders see no surprises from the ECB, with 99% of the bets on no rate hikes in December, awaiting resolution as the market’s time runs out.

For 2026, Polymarket traders show a different opinion, expecting the ECB to retain its current rates.

Around 84% of market participants expect no hike from the ECB. The market has a limited volume below $20K, but may become more active as the date of decisions approaches.

The ECB rate market is considered undervalued, but is closely watched for whales positioning and the potential for fast gains in the case of early rate hikes from the ECB. Polymarket is not pricing in rate cuts, and some traders believe this is a likely scenario, though it clashes with the signal from money markets.

ECB rate decision hinges on positive outlook

The European Central Bank may issue a more optimistic outlook for economic growth in the next few days. ECB Chief Lagarde pointed at upgraded predictions from the recently completed projections, and may announce an improved outlook by the end of the year.

The Euro Area has proven more resilient to the US tariffs, said Lagarde during the Financial Times Global Boardroom event. The euro has not depreciated from those measures, leaving little pressure for changing the rates to boost the economy.

A positive outlook may also add another argument for a rate hike before the end of 2026.

cryptopolitan.com

cryptopolitan.com