In one of the most important crypto news of the week, crypto investment products recorded $226 million in inflows last week. This positive trend follows a period of major outflows and marks nine consecutive trading days of capital entering the crypto fund market.

According to the latest CoinShares report, altcoins saw their first week of positive flows in over a month. The data shows that Bitcoin has held its dominance in attracting new investment.

Bitcoin dominates while altcoins stage comeback

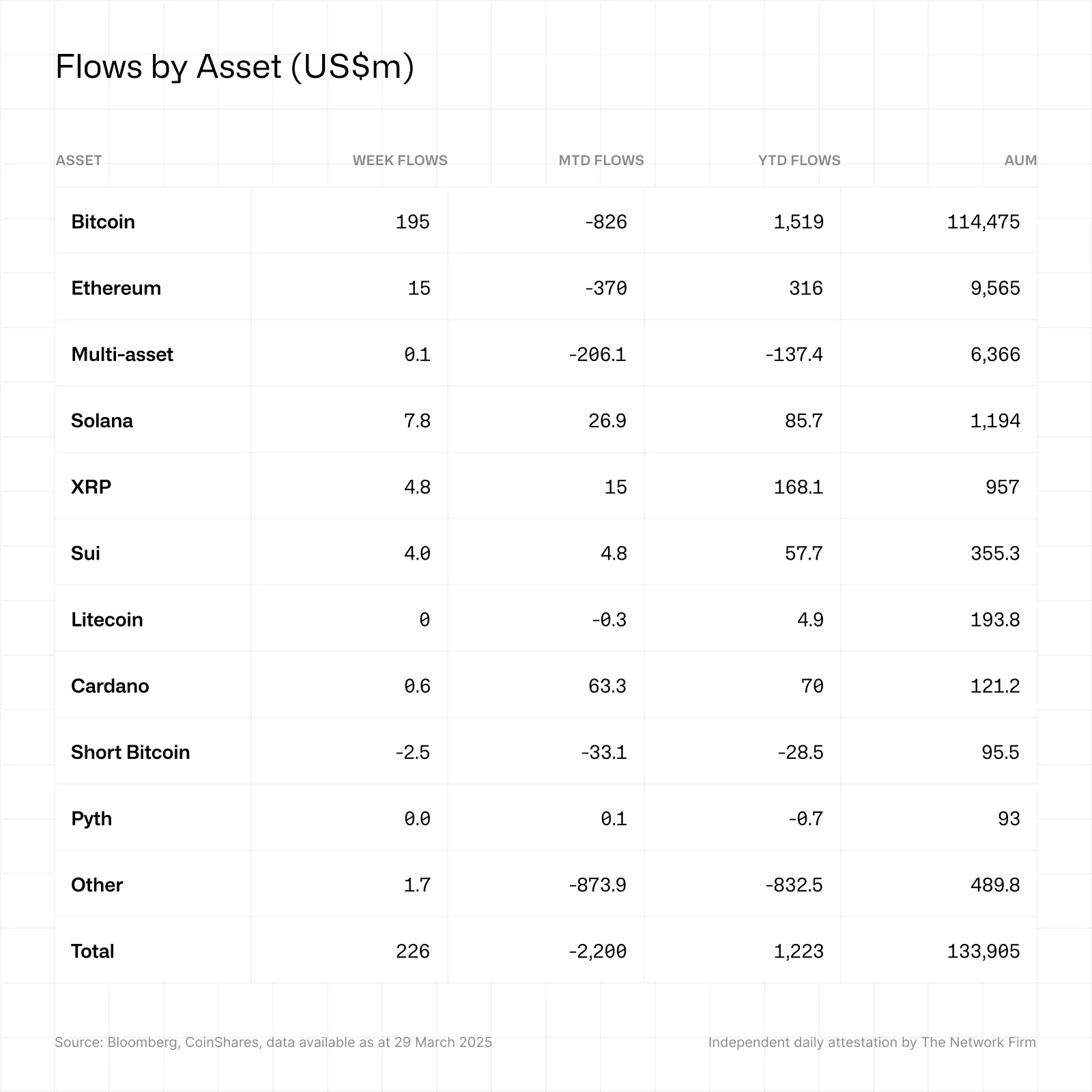

Bitcoin held the majority of investor interest with inflows totaling $195 million last week. This continued investment comes despite recent price volatility that has pushed Bitcoin global ETP’s total assets under management to their lowest level since just after the US election.

Short-Bitcoin investment products saw outflows for the fourth consecutive week totaling $2.5 million. This suggests investors maintain a generally bullish outlook on Bitcoin despite recent market fluctuations.

Altcoins collectively saw $33 million in new investment after experiencing four consecutive weeks of outflows that had previously totaled $1.7 billion.

The primary beneficiaries among altcoins were Ethereum with $14.5 million in inflows, Solana with $7.8 million, XRP with $4.8 million, and Sui with $4 million.

Crypto News: Regional flow distribution and market outlook

Regional data highlighted positive flows across all key markets, with the United States leading at $204 million in inflows. Switzerland followed with $14.7 million, while Germany recorded $9.2 million in new investment.

Smaller markets showed mixed results, with minor outflows observed in Hong Kong ($2.1 million) and Brazil ($1.3 million).

The weekly report noted that last Friday saw minor outflows totaling $74 million. This could likely be the reaction to core personal consumption expenditure data in the US coming in above expectations. This economic indicator suggests the US Federal Reserve may maintain a hawkish stance despite recent data pointing to weak economic growth.

Canada contributed $4.1 million to the weekly inflows. Australia on the other hand added a modest $0.9 million.

Sweden continued its outflow trend with $6.8 million leaving crypto funds. The “Other” category, encompassing various smaller markets, contributed $4.3 million in positive flows.

The United States maintains its position as the primary market for institutional crypto investment. The US accounted for over 90% of the week’s inflows. Year-to-date flows remain positive at $1.2 billion despite recent market volatility.

Multi-asset investment products that offer exposure to several cryptocurrencies recorded minimal inflows of just $0.1 million.

These diversified products have seen year-to-date outflows of $137.4 million. This suggests that investors currently prefer targeted exposure to specific cryptocurrencies rather than basket approaches.

Negative sentiment toward bearish Bitcoin positions continue as short-Bitcoin products experienced $2.5 million in outflows. This is a notable change in crypto news, which has changed the overall bullish sentiment within the market.

thecoinrepublic.com

thecoinrepublic.com