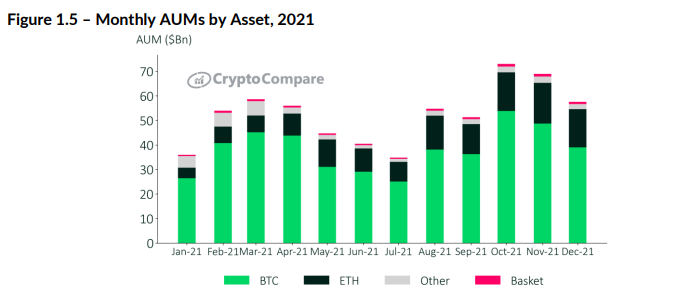

Institutional investors have continued to gain exposure to the crypto industry through digital asset management products as adoption grows. A digital asset management report has, however, revealed that these investors are turning their attention towards other cryptocurrencies rather than Bitcoin. It showed that the dominance of Bitcoin-based products fell in 2021 from 74.9% in January to 67.8% of total AUM by year-end.

Growth Of Institutional Focused Crypto Products

The report also emphasizes the rise of institutionally oriented crypto products. These investment vehicles saw the total AUM nearly double from $36 billion in January 2021 to $58 billion in December 2021. This development may also indicate the increased confidence from corporate investors as they dive into more volatile digital assets.

Traditionally, cryptocurrencies were viewed as a tool for disrupting the financial services industry. However, new uses of the technology have become prominent. The growth seen mirrors the recent emergence of diverse use cases and blockchains within the sector.

Non-fungible Tokens (NFTs) have continued to grow in 2022. By deploying blockchain tech to art, it has become perhaps the most viral subsector in the industry. Gaming in blockchain has also exploded with innovation as seen by the rise of P2E games like Axie Infinity. Meanwhile, Web 3.0 has become a prominent mainstream subject. The impact of these new use cases is so profound that large corporations like Meta—formerly Facebook— Microsoft, Adidas, etc. are all invested heavily.

Join our Telegram group and never miss a breaking digital asset story.

Crypto Volatility Attracts Investors

The volatile nature of cryptocurrency has seen it become a hotbed for venture capital (VC) investments. In 2021, VC firms invested over $30 billion in the industry, a 445% increase from 2020.

Bitcoin, the foremost digital asset, had its best year in 2021, despite only posting 60% returns. Ethereum, its closest contender, performed even better, gaining 400%. Despite both assets performing admirably, the real action was found in other projects that tackled challenges within the ecosystem.

Solana, for example, has risen to be one of Ethereum’s most popular competitors due to its meager fees and rapid transaction speed. Last year, it returned 11,154%. Similarly, Terra, which seeks to address the issue of decentralization in issued stable coins saw its native token LUNA grow by 12,953%. The performance of these protocols points to how much the industry scaled up as they raked in VC funds.

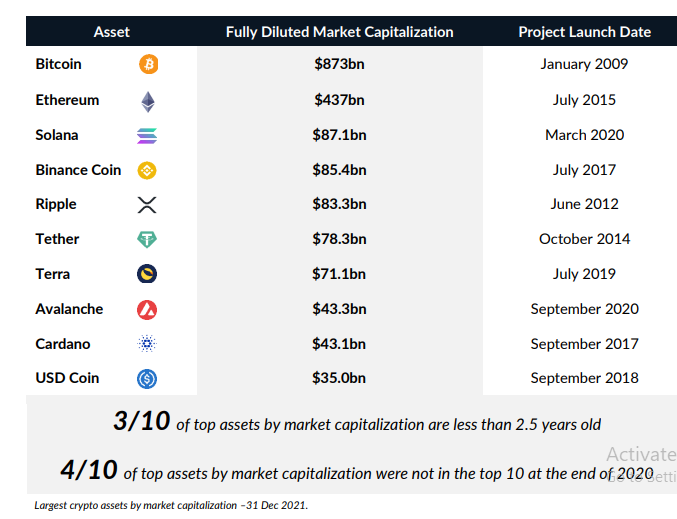

These new protocols are establishing ecosystems that were previously centered solely on Bitcoin and, to a lesser extent, Ethereum. Looking at the top ten projects by market capitalization at the end of 2021, three among them are relatively new. Solana, Avalanche, and Terra were all established less than three years ago. Meanwhile, four of them were not on the list at the end of 2020.

Venture funding is expected to continue in 2022, especially as the blowoff top anticipated in Q4 2021 failed to happen. With the pump in price now expected in 2022, most of the institutional money could flow into projects that offer more utility to their users instead of flowing into Bitcoin-based products.

Do you think investments in other blockchain-based products will continue to erode the dominance of their Bitcoin-based counterparts? Let us know in the comments below.

tokenist.com

tokenist.com