A market analyst has outlined a scenario wherein Shiba Inu (SHIB) could potentially reach a $0.0005 projected value, supported by the imminent completion of a fifth Elliott Wave on the weekly chart.

Shiba Inu has faced a roadblock on the journey to recovery as the broader market loses momentum. Following the sustained drop to a low of $0.00002057 on May 1, SHIB rallied 28% to reclaim a high of $0.00002632 on May 4 before witnessing resistance to the uptrend.

This resistance was felt throughout the broader market, with leading cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) also losing steam. After the roadblock, SHIB has held above the Fibonacci 0.382 level at $0.00002311, awaiting a resumption of the market momentum.

A Possible Spike to $0.0005

Amid the current market conditions, market analyst Big Mike has projected an ambitious price target for when Shiba Inu eventually takes off. Citing data from the weekly chart, the analyst noted that SHIB has been trading within a complex web of multiple Elliott Wave structures since last year.

$SHIB can break through the level marked off and confirm my higher targets pic.twitter.com/LPkLi40ZWW

— BigMike7335 (@Michael_EWpro) May 4, 2024

In the largest wave structure (designated in white), Shiba Inu completed the first wave when it soared to a high of $0.00001135 in early August 2023. After this, the second wave pushed SHIB to the low of $0.0000661 in October 2023, marking a correction of over 41.7%.

Shiba Inu is currently on the third wave, which Big Mike expects to help recover the losses incurred from the second wave. Wave 3 could also help SHIB breach both this year’s peak of $0.000045 and the all-time high of $0.00008845, with projections of a rally to $0.0005059. This would mark a 1,941% increase from the current price of $0.00002478.

Shiba Inu Faces Prevalent Bearishness

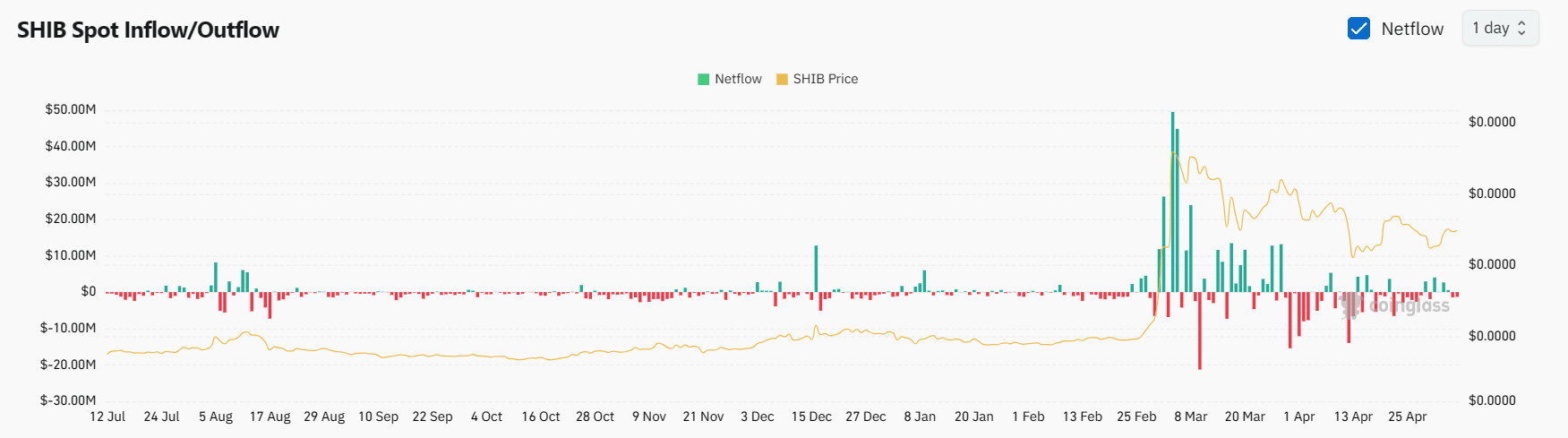

However, the current market realities could pose problems to a substantial Shiba Inu rally, as sentiments have remained largely bearish. Since April 22, investors have deposited a net value of $11.359 million in Shiba Inu to exchanges amid the market turbulence, per Coinglass data.

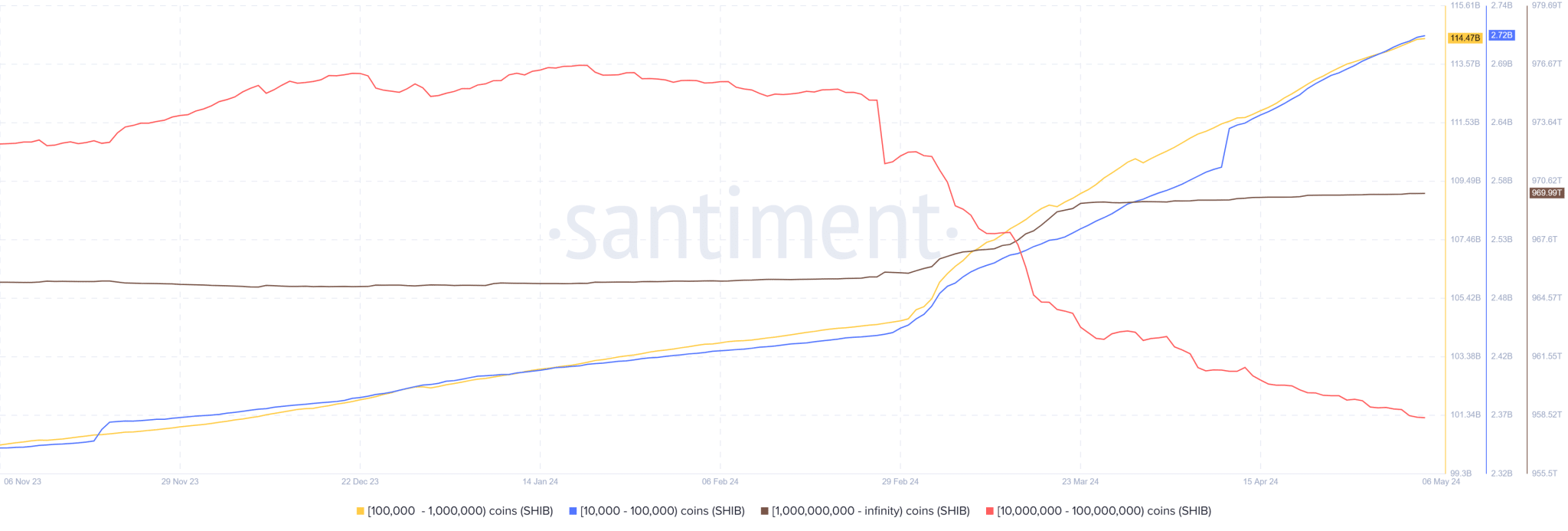

Increased deposits to exchanges typically bolster selling pressure, presenting a roadblock to an upward momentum. Data from Santiment further confirms this selling pressure, as addresses holding between 1 million and 1 billion SHIB have continued to sell off or distribute their holdings, as observed in the chart below.

The biggest cohort of sellers are those holding between 100 million and 1 billion tokens. Notably, these wallets have sold off 1.98 trillion Shiba Inu since Feb. 24, with their cumulative balance now sitting at 19.73 trillion.

In addition, while Shiba Inu Open Interest (OI) has increased 2.57% to $65.19 million in the last 24 hours, its long/short ratio has seen a steady drop, currently sitting at 0.8443. This signals an increase in short positions, as traders bet on an imminent price drop.

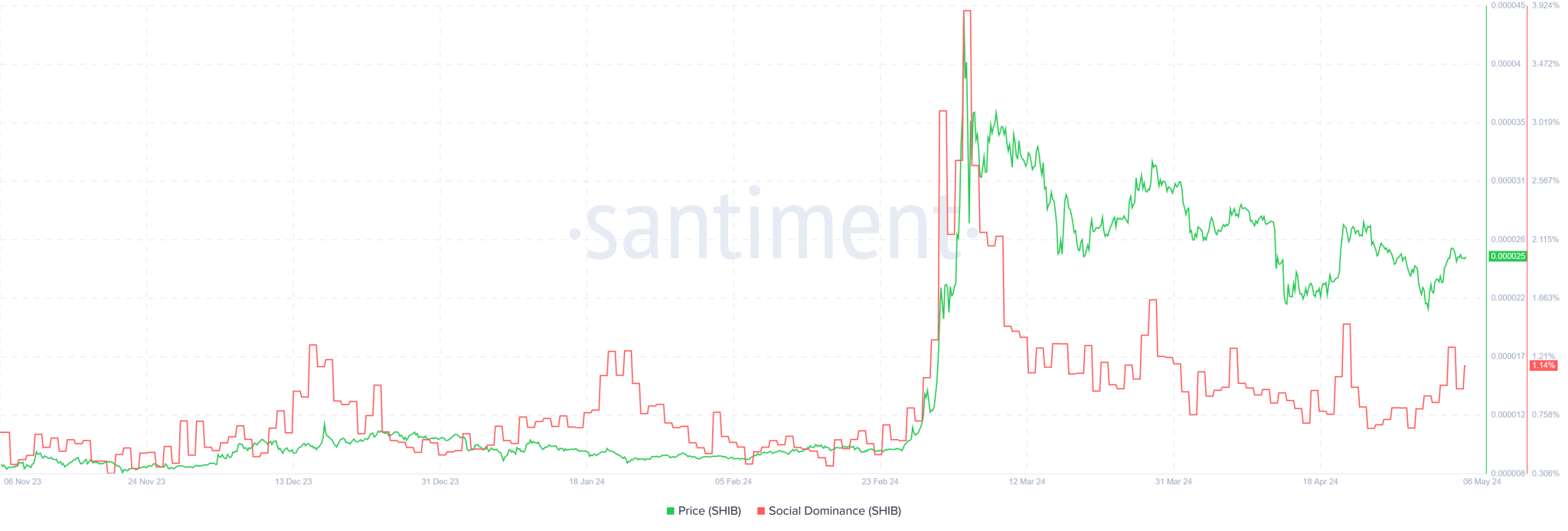

Despite the prevalent bearishness, Shiba Inu is seeing a gradual uptick in social dominance, a trend that often precedes an imminent price increase. SHIB’s social dominance has spiked from a low of 0.6595 on April 30 to the current value of 1.14%. As of press time, Shiba Inu trades for $0.00002478, up 1.64% in the last 24 hours.

thecryptobasic.com

thecryptobasic.com