Quick Take

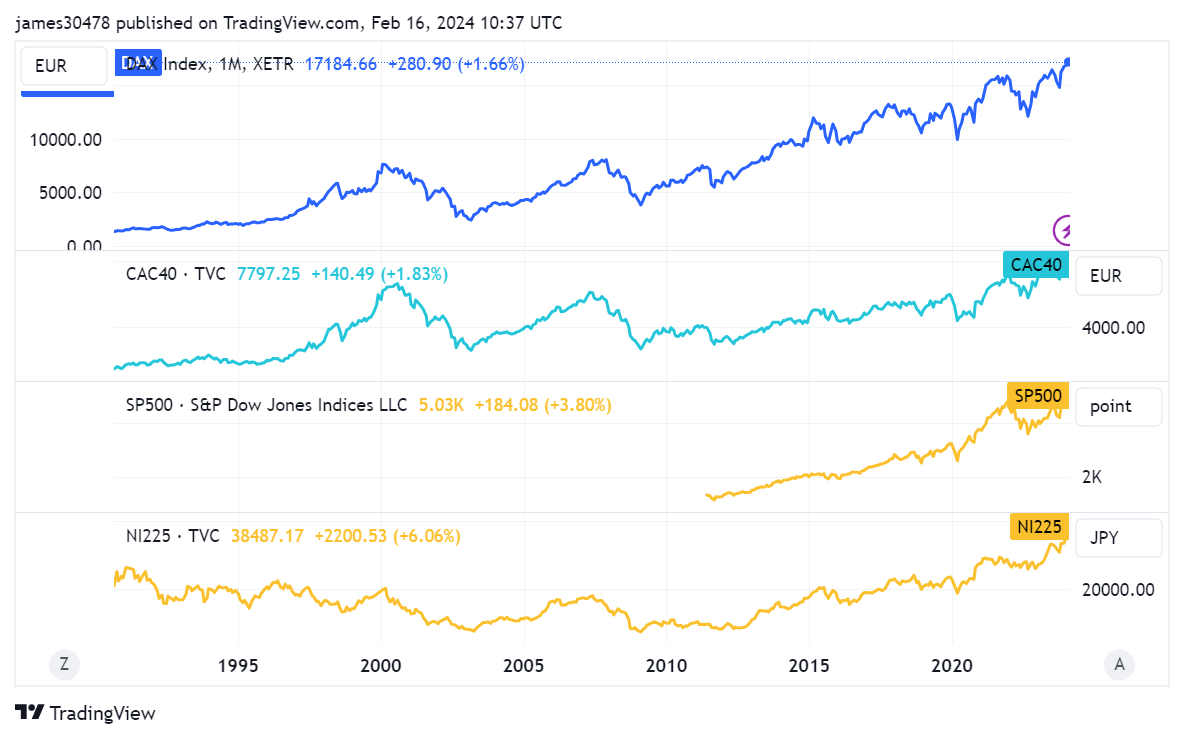

Despite the seeming prosperity indicated by stock market highs in major economies, including the S&P 500 in the US, DAX in Germany, CAC40 in France, and Nikkei 225 in Japan, a contrasting narrative of technical recessions and growing inequality is emerging.

Notably, the United Kingdom and Japan have entered technical recessions – defined by two consecutive quarters of negative growth – with the latter losing its position as the third-largest economy, according to Bloomberg.

The dichotomy between flourishing markets and struggling economies can be partly attributed to the concentration of wealth. As reported by Geiger Capital, the top 1% now officially holds more wealth than the entire middle class of America. This wealth accumulation has been primarily powered by investments in stocks and real estate.

Meanwhile, the specter of stagflation looms as most Western economies grapple with low to no growth, high inflation, and potential high unemployment. The US is still battling inflation despite reverting to historically normal interest rates. This evolving economic landscape invites a comparison with previous decades of stagflation and the subsequent performance of gold. Will Bitcoin, the digital gold, replicate or even surpass this historical trend?

cryptoslate.com

cryptoslate.com