On July 23, Samara Cohen, BlackRock’s Chief Investment Officer of ETF and Index Investments, joined CNBC’s “Squawk on the Street” to talk about the launch of spot Ether ETFs and the potential they hold.

The discussion began with the host, Bob Pisani, acknowledging the much-anticipated launch of Ether ETFs. Cohen confirmed the launch, noting that the ETFs were already actively trading both in the pre-market and post-open sessions. She emphasized that these ETFs are indeed tracking Ether, trading with tight premium discounts, tight spreads, and receiving broad market maker support. This marks a significant step in integrating cryptocurrencies into the traditional finance ecosystem, with over 20 market makers actively participating.

Here's where we at after 90 minutes. $361m total. As a group that number would rank them about 15th overall in ETF volume (about what $TLT and $EEM trade), which is Top 1%. But again compared to a normal ETF launch, which rarely see more than $1m on Day One, all of them have… pic.twitter.com/R5UgQFR1L6

— Eric Balchunas (@EricBalchunas) July 23, 2024

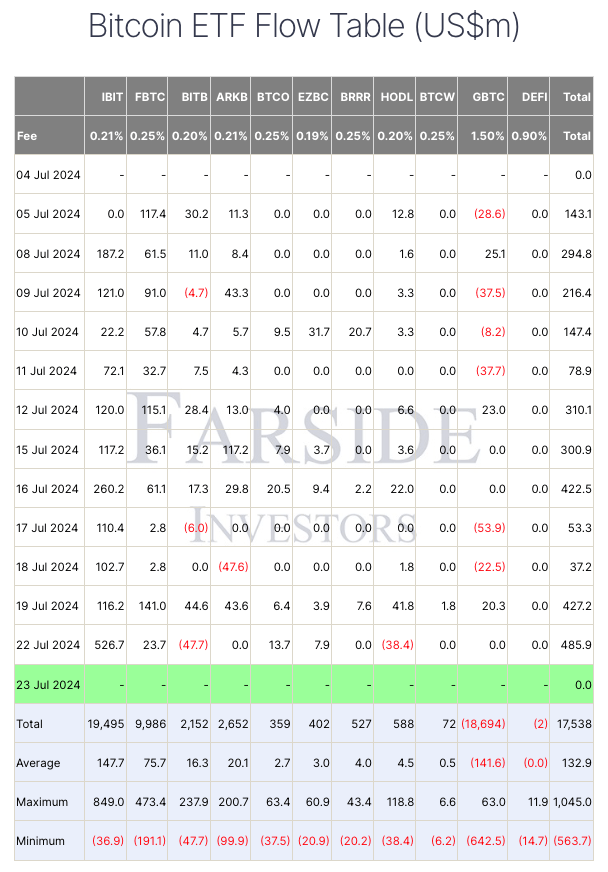

Cohen addressed comparisons with spot Bitcoin ETFs, which have seen significant inflows since their launch seven months prior.

She pointed out that while Bitcoin boasts a market cap of approximately $1.3 trillion, Ethereum’s market cap is around $400 billion, roughly a third of Bitcoin’s size. Despite the difference in market caps, she stressed the early stages of spot Ether ETFs, highlighting that they had only been trading for a few hours compared to spot Bitcoin ETFs’ six months and the respective blockchain histories of 15 years for Bitcoin and 9 years for Ethereum.

One of the core points Cohen made was the fundamental difference in use cases between Bitcoin and Ethereum. While Bitcoin is known for its finite supply and status as “digital gold,” Ethereum is celebrated for its utility. Ethereum’s programmable blockchain enables developers to build decentralized applications (dApps), making it a versatile platform for innovation. This distinction is crucial for investors interested in the future of market technologies and the deployment of new tech to create innovative applications.

Pisani questioned whether investors would grasp the distinct technological advantages of Ethereum compared to Bitcoin. Cohen acknowledged that Bitcoin’s high-level pitch as digital gold might be simpler for investors to understand. However, Ethereum’s breadth of applications and potential use cases present a compelling narrative for those willing to delve deeper. She believes that Bitcoin and Ethereum complement each other, offering unique benefits to portfolios.

Cohen was also asked about the potential impact of political developments on cryptocurrency enthusiasm, particularly with former President Trump labeling himself as the crypto president. She suggested that recent bipartisan support for digital assets legislation has been more influential in driving market activity. This legislative interest aims to create competitive and resilient U.S. markets, allowing investors to participate in cryptocurrencies via ETFs.

In conclusion, Cohen touched on the future landscape for spot crypto ETFs. She indicated that while Bitcoin and Ether currently meet the necessary criteria for liquidity, market quality, and tracking, the door remains open for future developments. Cohen humorously noted that further discussions on this topic would warrant another appearance on the show.

Featured Image via Pixabay

cryptoglobe.com

cryptoglobe.com