The value of ethereum (ETH), the second-largest cryptocurrency by market capitalization, has increased nearly 18% against the U.S. dollar due to speculation that the U.S. Securities and Exchange Commission (SEC) might approve some spot ether exchange-traded funds (ETFs).

Market Buzz Lifts Ethereum to $3,691

On Monday, ethereum (ETH) reached an intraday peak of $3,691 per coin amid swirling rumors on social media and forums about the potential SEC approval of several spot ETH ETFs. According to a report by Coindesk, three sources told the publication exchanges were allegedly instructed by the SEC to update their 19b-4 filings “on an accelerated basis.”

Additionally, Bloomberg analysts Eric Balchunas and James Seyffart raised their approval predictions from 25% to 75%. ETH experienced a substantial increase following the speculation, climbing from $3,140 at 3 p.m. Eastern Time (EDT) on May 20 to a high of $3,691 per coin by 6:30 p.m. EDT.

ETH has appreciated 17.96% against the U.S. dollar, gaining $551 in value over the past few hours. Ether’s dominance within the $2.58 trillion cryptocurrency market is 17%, with an overall market valuation of $436 billion.

It commands the third-highest trade volume of the day, with $26.99 billion traded in the last 24 hours. Today, ETH’s most traded pair is the stablecoin tether (USDT). Following USDT are FDUSD, USDC, BTC, and the Korean won.

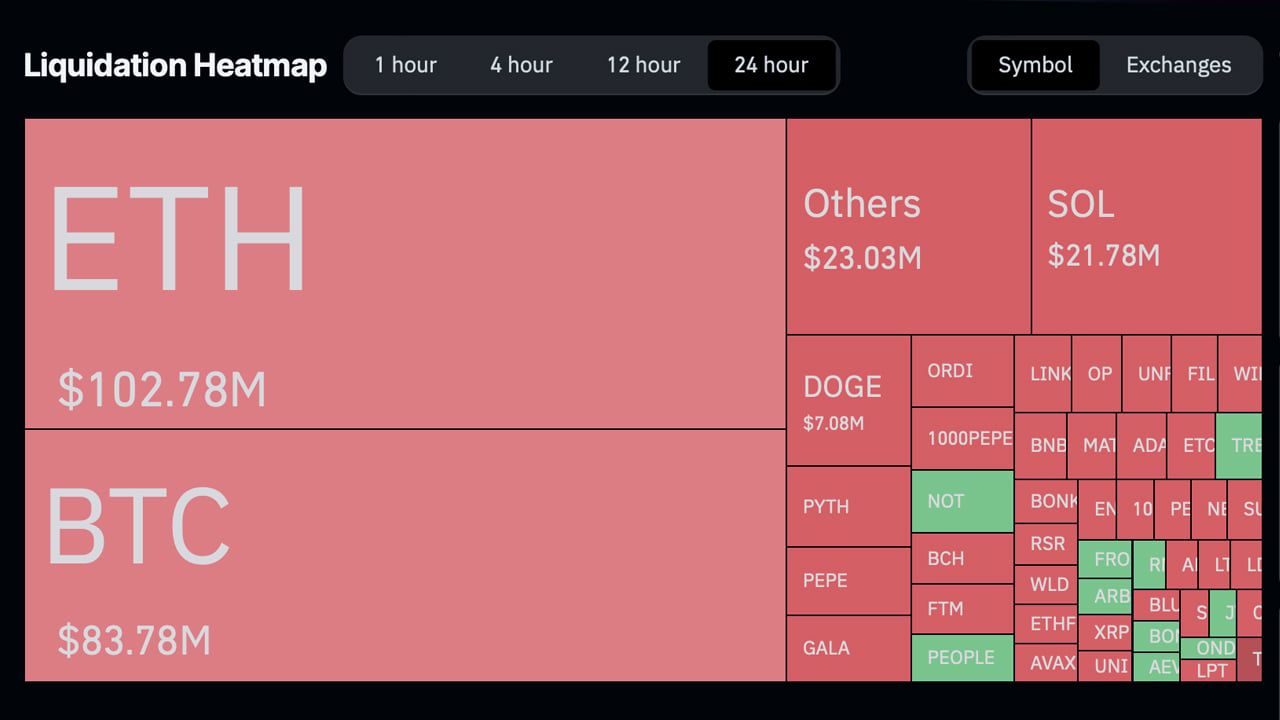

The won accounts for 1.67% of all ETH swaps in the past day. With the market rising so rapidly, $302.52 million in derivatives positions were liquidated, with ETH shorts leading the way at $102.78 million liquidated in the past day.

According to coinglass.com metrics, 76,107 traders were liquidated in the past 24 hours. The largest single liquidation order occurred on HTX with an ETH/USDT trade valued at $3.11 million. At the time of writing, at 8:05 p.m. EDT on Monday, a single ETH is changing hands for $3,668 per unit.

What do you think about ether’s substantial rise on Monday? Let us know what you think about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com