Since Friday, the cash-strapped cryptocurrency lender has repaid $95 million in debt to the two DeFi platforms.

Celsius Network, the crypto lender that froze client withdrawals due to liquidity issues, paid down $95 million to the Aave and Compound decentralised financing (DeFi) platforms to reduce its debt.

The operation unlocked $172 million in collateral secured as collateral on the platforms. Last week, Celsius used similar treasury management on the Maker platform to release $480 million in collateral.

In several transactions, a wallet associated with Celsius moved $35 million in DAI, MakerDAO’s dollar-pegged stablecoin, and $40 million in Circle’s USDC stablecoin, according to data from the Nansen Portfolio tracker. The wallet sent an additional $20 million USDC to the Aave protocol on Sunday night.

Celsius also traded several interest-bearing token derivatives on Aave for 1,647 WBTC (worth $33.4 million) and around $1.6 million worth of BAT and xSUSHI, a derivative of the native token of decentralised exchange SushiSwap that pays interest on the exchange’s staking platform.

The down payments allowed Celsius to redeem some of the debt collateral. Since Friday, the company has retrieved 8,436 Wrapped Bitcoin (WBTC) valued at $172 million. It also saved around $700,000 in COMP, the native token of the Compound platform.

The ongoing credit crisis in the crypto markets severely impacted centralised crypto lenders, with Voyager Digital declaring bankruptcy and BlockFi requesting a financial lifeline and rescue from the cryptocurrency exchange FTX. To prevent a run on its reserves, Celsius suspended all client withdrawals as of June 12 and hired restructuring specialists.

Celsius looks to be on track to repay the remainder of its debt to DeFi protocols and retrieve the digital assets provided as security for the loans.

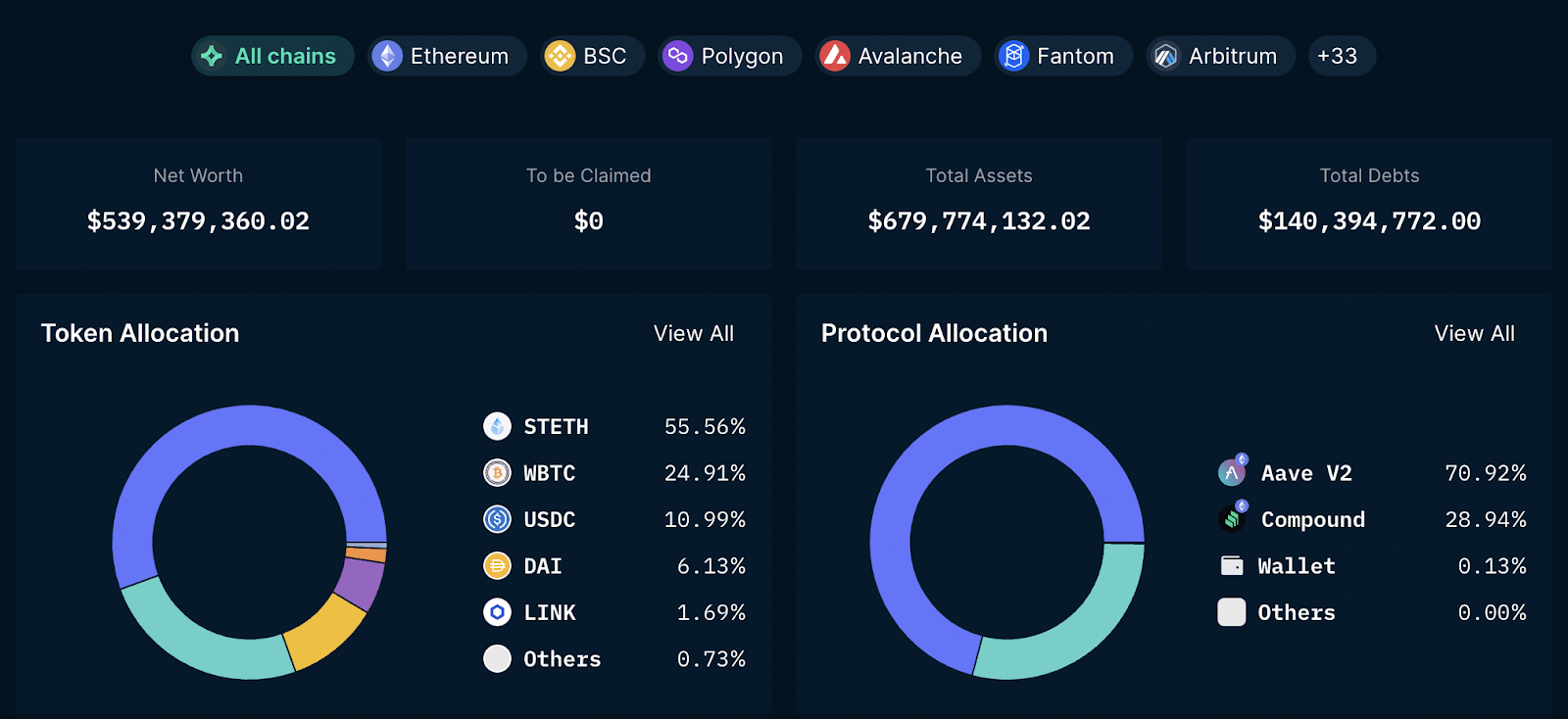

The company now owes $140 million to Aave and Compound, down from $235 million as of last Friday, according to Zapper.

The collateral Celsius placed against these loans was $680 million, down from $950 million, and should be released if Celsius pays the remaining debt in full.

Celsius still owed $90 million and $50 million in stablecoins to DeFI protocols Aave and Compound. Image: Nansen

Celsius still owed $90 million and $50 million in stablecoins to DeFI protocols Aave and Compound. Image: Nansen

coinculture.com

coinculture.com