[beg-green-box-list]

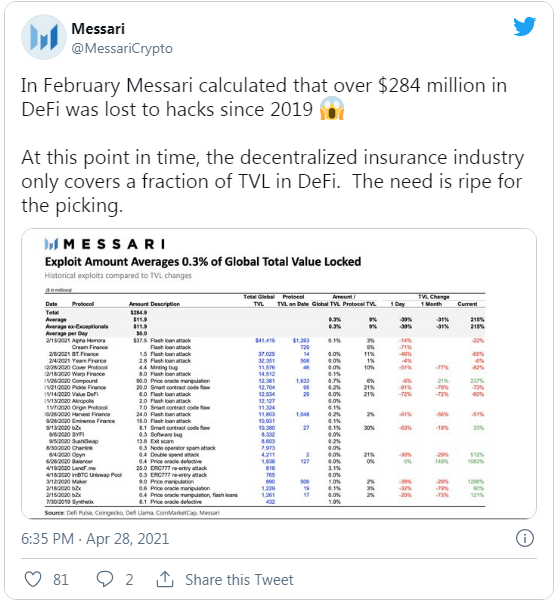

- About $284 million in Decentralized Finance (DeFi) outfits based on Ethereum have been lost through hacks and exploits since 2019.

- The popularity and unprecedented growth of decentralized finance (DeFi) have seen the sector become a soft target for exploiters and hackers.

The research outfit stated that only a fraction of the lost fund is covered by the DeFi insurance, emphasizing the importance of insurance growth in the sector. Although $284 million is a large amount of money, it is important to note that at the moment, about $117.6 billion is locked in different DeFi platforms.

The report shows that flash loan attacks account for about 50 percent of all the hacks. This offers extra evidence that this is the most common exploitation method in the DeFi segment. It is no doubt that the majority of DeFi hacks have been in the form of flash loan attacks which in most cases capitalize on temporary price flaws.

Although there was a notable decline in crypto hacks last year, DeFi heists and attacks accounted for over half of the total attacks in the crypto sector during the year. This year, Cream Finance and Alpha Homora have fallen victims to unscrupulous attacks leading to the loss of huge amounts of funds. In February, Alpha Homora suffered the worst single attack in the DeFi sector, losing about $37.5 million.

DeFi hacks and exploits are not only found in the Ethereum chain since the Binance Smart Chain (BSC) has also suffered attacks in the recent past. A BSC-hosted platform, Uranium Finance, suffered a $50 million heist. The platform realized that the attacker took advantage of bugs within the platform’s smart contract siphoning the money during the expected token migration occasion.

Messari’s report explains that the time is ripe to embrace insurance protocols currently on the rise. Protocols such as Etherisc and Nexus Mutual can offer valuable cover to such hacks and exploits. These protocols can ensure investors do not lose their money when an attack occurs.

The research outfit stated that only a fraction of the lost fund is covered by the DeFi insurance, emphasizing the importance of insurance growth in the sector. Although $284 million is a large amount of money, it is important to note that at the moment, about $117.6 billion is locked in different DeFi platforms.

The report shows that flash loan attacks account for about 50 percent of all the hacks. This offers extra evidence that this is the most common exploitation method in the DeFi segment. It is no doubt that the majority of DeFi hacks have been in the form of flash loan attacks which in most cases capitalize on temporary price flaws.

Although there was a notable decline in crypto hacks last year, DeFi heists and attacks accounted for over half of the total attacks in the crypto sector during the year. This year, Cream Finance and Alpha Homora have fallen victims to unscrupulous attacks leading to the loss of huge amounts of funds. In February, Alpha Homora suffered the worst single attack in the DeFi sector, losing about $37.5 million.

DeFi hacks and exploits are not only found in the Ethereum chain since the Binance Smart Chain (BSC) has also suffered attacks in the recent past. A BSC-hosted platform, Uranium Finance, suffered a $50 million heist. The platform realized that the attacker took advantage of bugs within the platform’s smart contract siphoning the money during the expected token migration occasion.

Messari’s report explains that the time is ripe to embrace insurance protocols currently on the rise. Protocols such as Etherisc and Nexus Mutual can offer valuable cover to such hacks and exploits. These protocols can ensure investors do not lose their money when an attack occurs.

bitcoinexchangeguide.com

bitcoinexchangeguide.com