DeFi platform and HIP-3 provider Felix Protocol is collaborating with Ondo Finance to bring spot equities to the Hyperliquid ecosystem.

The activation will leverage Ondo Global Markets to launch more than 100 U.S. equity markets on Felix, with plans to expand to “1,000+ equities over the coming months.”

The launch will debut on Felix’s native trading interface on HyperEVM, Hyperliquid’s Layer 1 blockchain, and the team has not disclosed a timeline for launching the assets on Hypercore.

“We won't be interacting with Hyperliquid spot to start to avoid the need to bootstrap liquidity on each individual market, which has been a main pain point for spot equities onchain to date,” Charlie, a contributor to Felix Protocol, told The Defiant.

Through the integration with Ondo, the markets will have deep liquidity from launch without relying on automated market maker (AMM) liquidity, enabling “multi-million dollar equity orders Day 1,” per the announcement.

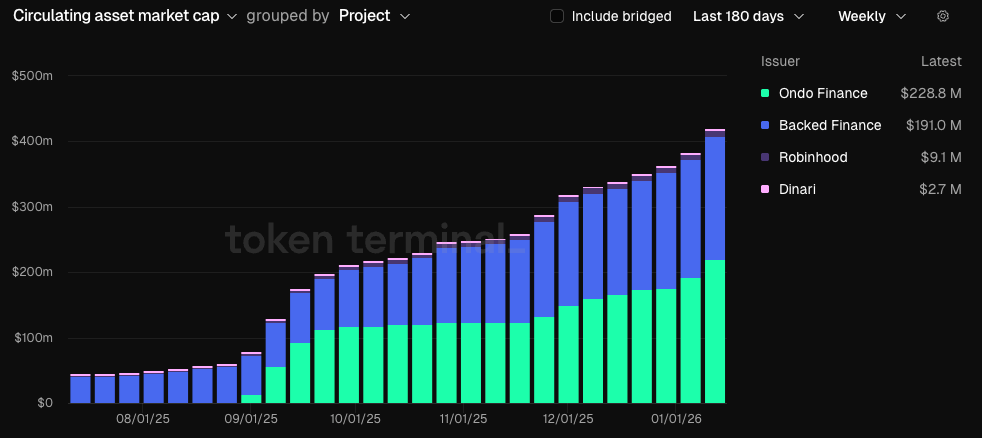

Ondo Global Markets will offer 24/7 exposure to supported assets, with all mints and redemptions routed through Felix’s smart contracts. Ondo is currently the largest issuer of tokenized stocks in DeFi, accounting for 53% of the total market with $228 million in circulating market capitalization.

Tokenized Spot vs Derivatives

The rise of tokenized equity perpetuals has sparked an ongoing debate within the decentralized finance (DeFi) community over the efficiency of 24/7 derivatives relative to stocks, which lack a 24/7 spot market.

While protocols that abide by spot market trading hours, such as Ostium, have strongly articulated their thesis for only offering trading when legacy stock markets are open, data shows that traders prefer derivative exposure, with Ostium recording $1.3 billion in volume since the beginning of 2026, compared to TradeXYZ’s $7 billion in derivatives volumes.

Despite differences across protocols, equity derivatives have become a focal point for modern exchanges, including Lighter, which recently launched its native token and equity perpetuals.

The growth of tokenized equity derivatives is also boosting the spot ecosystem.

The tokenized stock market capitalization continues to hit new all-time highs almost every week, and crossed the $400 million mark on Jan. 12. According to TokenTerminal, Solana commands the largest tokenized stock market capitalization in DeFi, accounting for 39.2% of the total market, compared to Ethereum’s 37.5%.