Table of Contents

Lista DAO launched open access to its Real-World Asset platform on January 12, 2026, making it the first native RWA offering on $BNB Chain. Users can now deposit $USDT and earn yields from tokenized traditional finance products without leaving the $BNB ecosystem. The platform moved from whitelisted beta to full public access after testing since late November 2025.

The launch connects $BNB Chain users to institutional-grade returns backed by established funds. Lista partnered with Centrifuge for asset tokenization and Chainlink for price feeds, adding verification layers for transparency.

What Yields Are Available?

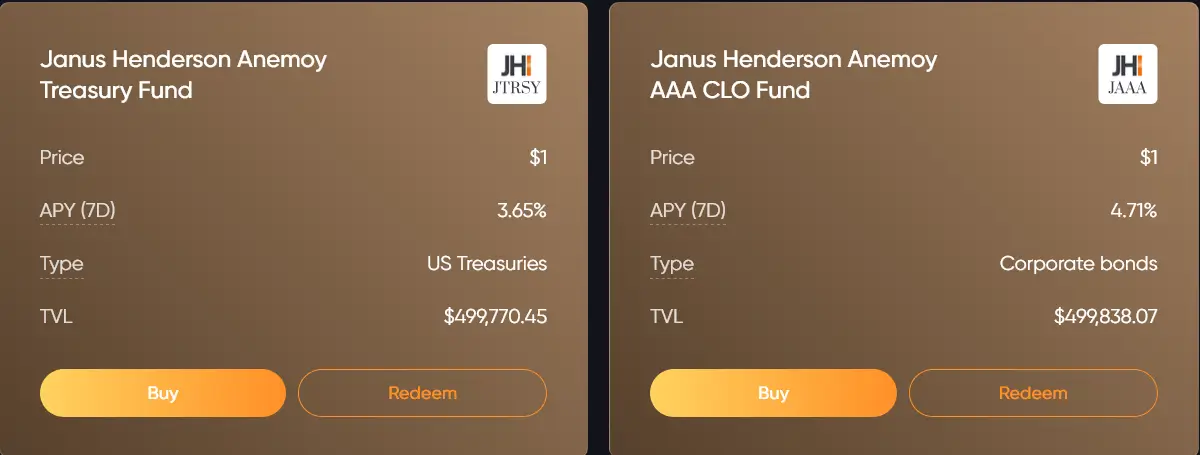

Two tokenized products launched at open access, both managed by Janus Henderson through the Anemoy framework.

The first option is $USDT.JTRSY, backed by short-term U.S. Treasury Bills. This fund currently yields 3.65% APY based on 7-day data. Treasury Bills represent one of the lowest-risk investment categories globally, and tokenization brings this yield directly on-chain. Early total value locked reached approximately $500,000 during the beta phase.

The second option is $USDT.JAAA, backed by AAA-rated Collateralized Loan Obligations. These diversified pools of high-quality corporate loans currently yield 4.71% APY. The AAA rating indicates minimal credit risk while offering a modest premium over Treasury yields. This fund also showed around $500,000 in early TVL.

Both products work through a straightforward process: deposit $USDT, purchase tokenized RWA shares, earn accruing yield, and redeem when ready. Lista takes a 5% performance fee from generated interest.

Why Does This Matter for $BNB Chain?

These returns fill a specific gap in the DeFi landscape. During periods when native DeFi yields compress, RWA products offer stable alternatives without the volatility of crypto-native strategies. The 3.65% to 4.71% range sits above many stablecoin pools during quiet market periods.

The platform appeals to users seeking passive exposure to traditional finance returns while staying on-chain. The beta interface already shows clean buy and redeem functions with real-time net asset value tracking.

Lista's move also positions $BNB Chain competitively in the growing RWA sector. Tokenized asset value across blockchains has reached into the billions, and being the first native provider on $BNB Chain gives Lista an early position in this expanding category.

What Comes Next?

Community response has focused on potential additions to the RWA lineup. Lista indicated plans to issue more tokenized assets in the first half of 2026, suggesting this launch signals a broader strategy rather than a standalone product.

The RWA platform expands Lista DAO's offerings beyond its existing liquid staking and lending products. This diversification could attract a range of user segments, from retail yield seekers to institutions seeking compliant on-chain exposure.

In a market often driven by speculation, stable yields from tokenized traditional assets offer an alternative path. For $BNB Chain users interested in exploring RWA exposure, Lista's platform provides direct access to this emerging category.

Visit Lista DAO atlista.org/rwa or follow@Lista_dao on X for updates.

Sources

- Lista DAO official announcement on the January 12, 2026 open access launch and product specifications

- Centrifuge documentation on asset tokenization infrastructure and institutional fund partnerships

- Chainlink integration materials covering price feed implementation for RWA products

bsc.news

bsc.news