Michael Bentley, co-founder of Euler Labs, the team behind multi-chain lending protocol Euler Finance, said he will step back from the protocol’s day-to-day leadership after nearly six years at the helm.

In an X announcement on Monday, Jan. 12, Bentley said he planned to step down from his CEO role and move into more of an advisory and product-focused position, adding that he doesn’t want to “stand in the way” of the project’s current momentum.

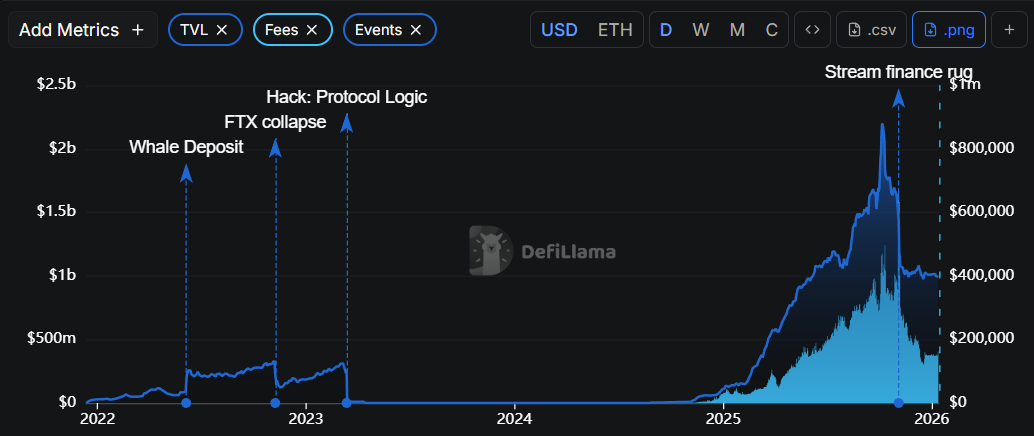

Bentley described last year as a period of revival for the protocol. “We brought the project back to life and grew to over $4bn in total deposits in under a year,” he wrote, referring to a rebound from the protocol’s earlier struggles, including the 2023 hack that saw approximately $200 million lost due to a flash loan attack.

Euler’s Institutional Pivot

In his post yesterday, Bentley acknowledged limits to Euler’s earlier approach, writing that the “fully permissionless vision” he and co-founder Doug Hoyte pursued in 2020 didn’t find “strong product market fit.” He added, “That does not diminish the work or the ambition behind it, but it does point clearly to the need for a change in direction and a fresh vision.”

Now, as Bentley explained, Euler Finance is “exceptionally well suited to building bespoke credit markets for novel use cases,” elaborating that Euler’s next phase will involve pivoting toward meeting the demands of institutional players:

“Leveraging the protocol to support tailored markets that meet the needs of fintech and institutional participants is a natural next chapter, and one for which many aspects of Euler’s design are uniquely well suited.”

Jonathan Han, who previously served as senior vice president of business development and partnerships at crypto market intelligence firm The Tie, will take over as Euler’s CEO. In a separate X post, Han said he wants to focus on building the “best vault infrastructure for our existing community and for the next wave of institutional, fintech, and retail users coming on-chain.” He added “DeFi is no longer an experimental frontier; it is rapidly emerging as core financial infrastructure.”

After the leadership change was announced, EUL, Euler Finance’s native token, fell more than 7% to $2.64, and is down 2% on the day at press time.

The Big Comeback

Euler’s growth since the hack is broadly considered one of DeFi’s greatest comeback stories. After the March 2023 exploit, the protocol’s total value locked (TVL) plunged to the low-millions from its previous high of around $333 million. It took Euler Finance a few years to recover, but by October of last year, Euler Finance’s TVL topped $2 billion, marking a massive resurgence above its previous highs.

However, market contagion after Stream Finance’s collapse in early November 2025 contributed to volatility across lending markets, and Euler’s TVL has fallen to around $1 billion by press time.