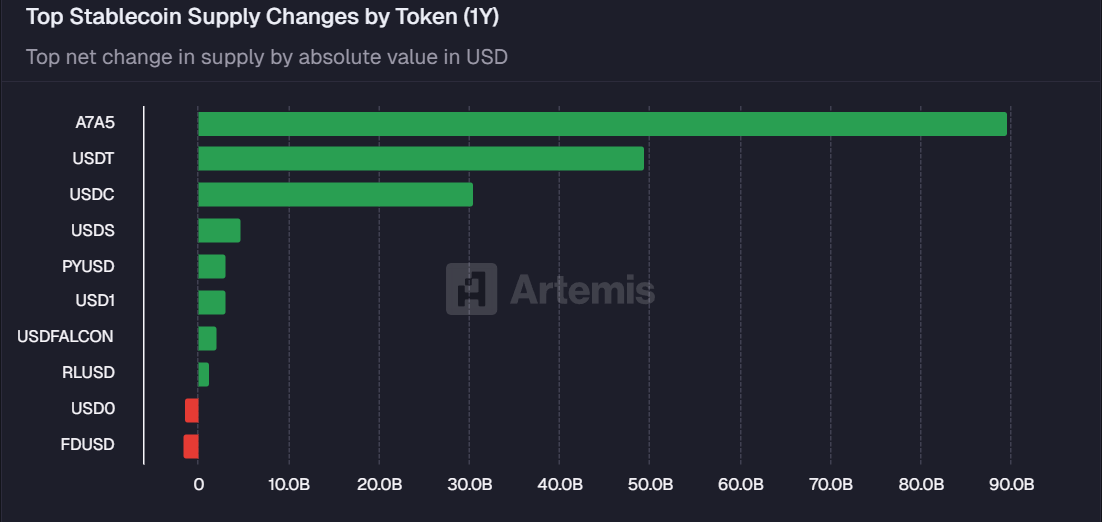

A ruble-denominated stablecoin outpaced the biggest dollar-pegged tokens last year, adding almost $90 billion in circulating supply even though its backers are sanctioned by Western governments.

The token, A7A5, was introduced in January 2025 by A7 LLC, a cross-border payments firm linked to Russia’s state-owned Promsvyazbank and Moldovan businessman Ilan Shor, who has also been convicted in a $1 billion bank fraud case

Issued through a Kyrgyz entity and circulating on the Tron and Ethereum blockchains, A7A5 is used to facilitate cross-border payments for Russian users facing banking restrictions, while also providing a route into market leader USDT liquidity through decentralized finance (DeFi) protocols without holding dollar stablecoins directly.

USDT, the market leading stablecoin issued by Tether, added $49 billion, and Circle Internet's (CRCL) USDC, the No. 2, added about $31 billion, according to data from Artemis.

Despite sanctions and weak underlying fundamentals, the ruble has surged more than 40% against the dollar this year, making it one of the world’s best-performing currencies, largely thanks to aggressive capital controls and central bank intervention.

A7A5 was a sponsor of the recent Token2049 conference in Singapore. The sponsorship was allowed because Singapore's sanctions on Russia only apply to licensed financial institutions not individuals or other entities.

CoinGecko data shows that A7A5 isn't available on any centralized exchange and trades only via Uniswap.

coindesk.com

coindesk.com