Decentralized finance (DeFi) protocols Ethena and Based released a Hyperliquid and HIP-3 frontend, HyENA, on Dec 9.

More than $50 million of total volume was traded on HyENA in its opening two days, making it the second-largest permissionless perpetual market on Hyperliquid, only trailing Hyperunit’s TradeXYZ.

The launch comes less than a month after Hyperliquid rolled out “growth mode,” which lowered HIP-3 fees by 90% to incentivize activity and development.

While HyENA leapfrogged most of the competition, it still makes up less than 5% of TradeXYZ’s volumes, which crossed $1.1 billion over the same 48-hour period. It is worth noting, however, that a majority of TradeXYZ’s volumes come from its tokenized equity perpetuals, which HyENA does not offer.

HyENA is built on top of Hyperliquid’s HIP-3 protocol and leverages Ethena’s $USDe synthetic dollar as margin. Via HIP-3, HyENA can launch new $USDe-denominated markets, and it currently offers BTC, ETH, SOL, and HYPE.

HyENA has an ongoing points program set to last 24 weeks, but the documentation states that there will be no separate HyENA token and that Ethena Exchange Points are separate from Ethena’s ongoing Season 5 points program.

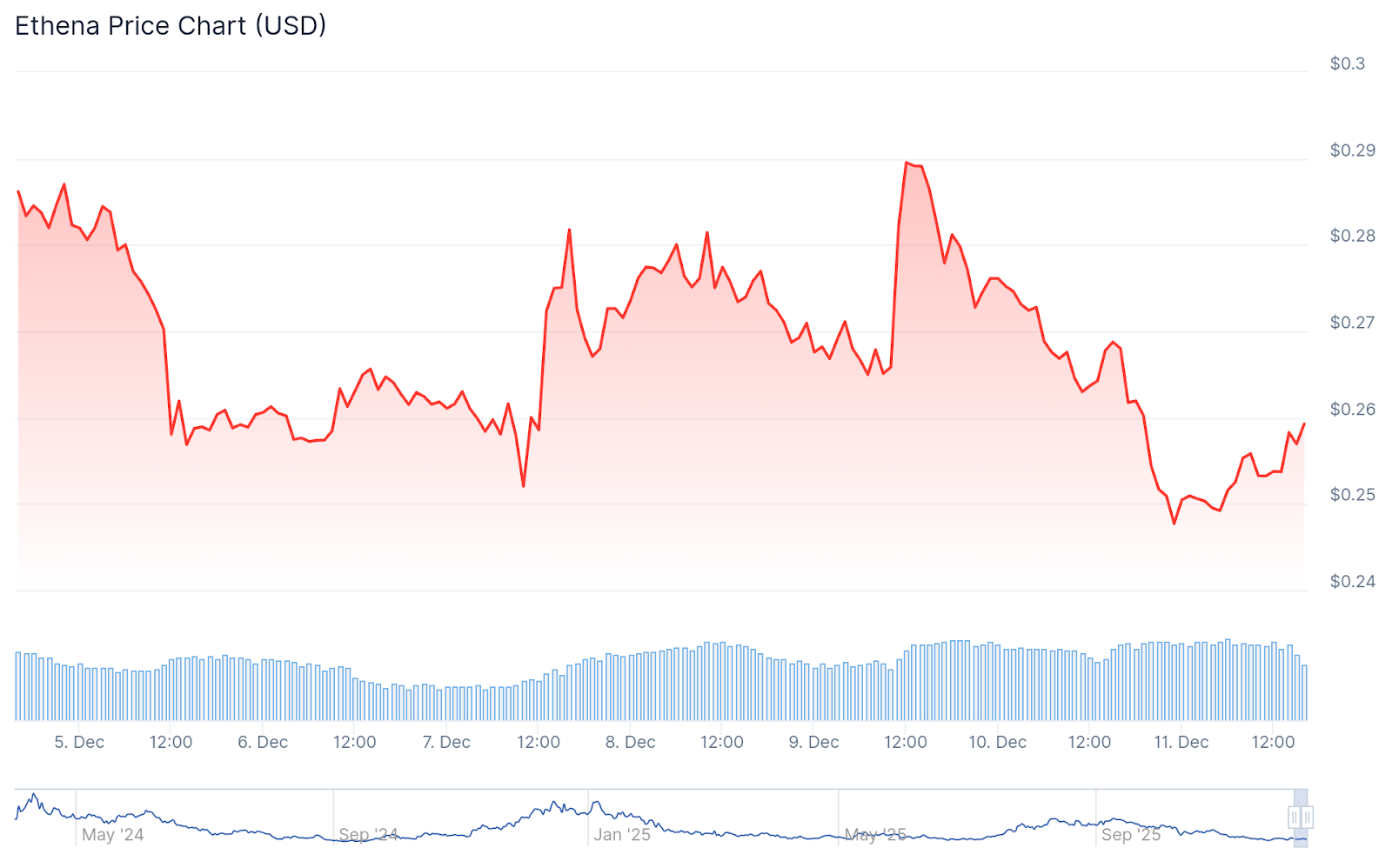

Despite HyENA’s success, the $ENA token has struggled, down 9% over the last week and 3.3% over the last 24 hours.