-

Crypto.com integrates Morpho on Cronos for stablecoin lending

-

Users can deposit wrapped ETH/BTC (CDCETH/CDCBTC) and borrow stablecoins to earn yield via Morpho vaults.

-

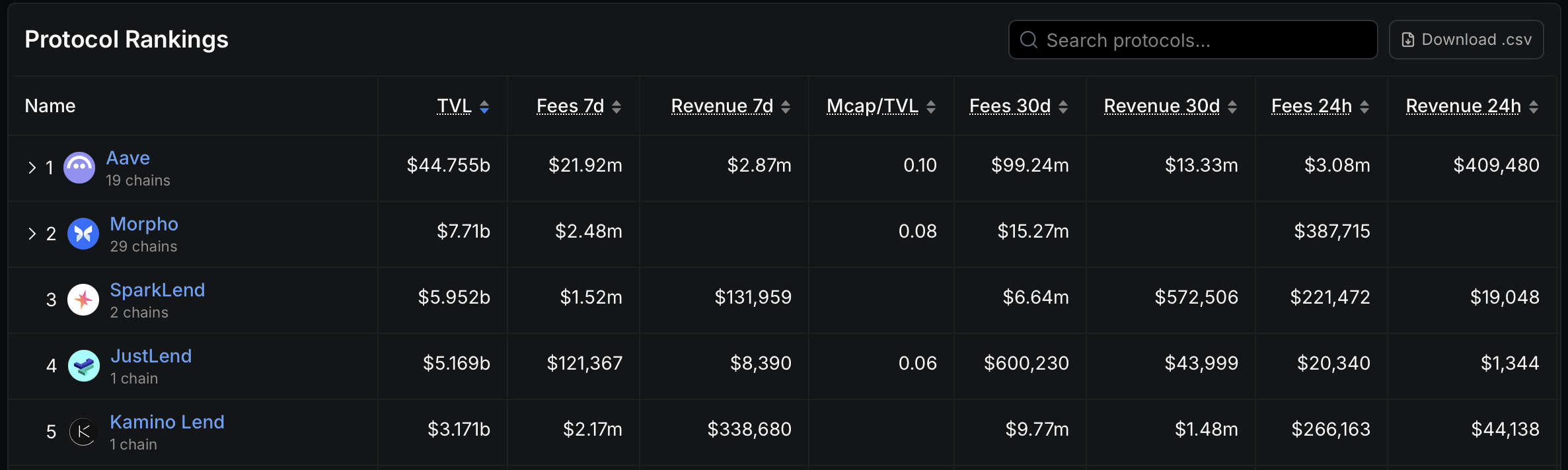

Morpho is the second-largest DeFi lending protocol with ~ $7.7B TVL (DeFiLlama); similar Coinbase integration reported yields up to 10.8%.

Crypto.com Morpho lending on Cronos enables wrapped BTC/ETH deposits to borrow stablecoins and earn yield — learn how vaults work and what it means for stablecoin yields.

How does Morpho’s stablecoin lending work on Cronos?

Morpho matches lenders and borrowers on top of existing lending markets (e.g., Aave, Compound) and will open stablecoin lending markets on Cronos. Users deposit wrapped assets such as CDCETH and CDCBTC, then borrow stablecoins against them to earn yield from lending spreads and optimized routing.

Industry data shows Morpho has grown rapidly, with a total value locked (TVL) of around $7.7 billion, per DeFiLlama. Coinbase’s similar integration cited potential yields up to 10.8% for on-chain USDC lending versus ~4.5% holding rewards on-platform.

Why does wrapped crypto matter for Cronos lending?

Wrapped tokens (CDCETH, CDCBTC) mirror value from their source chains and enable ETH/BTC liquidity to be used on Cronos without native chain transfers. This brings deeper collateral options to Cronos DeFi markets and expands on-chain lending capacity for Crypto.com users.

Will US users have access to these vaults?

Yes. Morpho’s co-founder confirmed the protocol will be accessible to US users. The Genius Act (July 2025) bans interest-bearing stablecoins but does not explicitly prevent exchanges or platforms from offering lending-derived yields, a distinction Morpho and Crypto.com cite to support access.