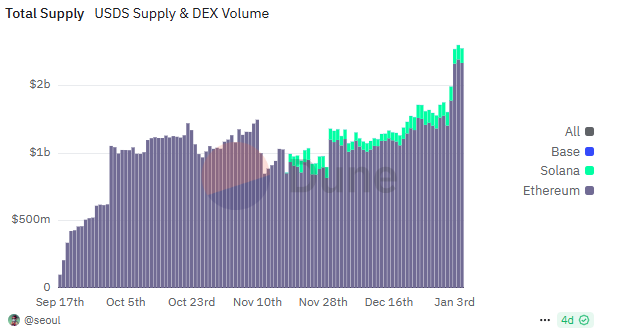

Sky Protocol, formerly Maker, keeps expanding the supply of USDS, reflecting the growing demand for passive yield. The protocol retains some of the legacy $DAI supply, which is also actively used in decentralized trades and lending.

The stablecoin of Sky protocol, USDS, reached a new supply peak above 1.8B, after accelerated swaps from $DAI. Both the new and the legacy stablecoin have a total supply of over 5.8B and are used in active and passive DeFi activities. USDS is still in the process of minting, as the swap mechanism from $DAI is still open.

The chief driver of the growing supply of USDS is the 12.5% annualized yield for the token. A total of 2.1M USDS and $DAI have been locked for staking in exchange for the yield.

The new supply milestone arrived after USDS surpassed 1.5B tokens as of January 3. The token expanded in the first days of the new year, reaching peak supply with rapid growth on Ethereum and smaller additions on Solana.

USDS total supply surpasses 1.8 billion and reaches a new all-time high. https://t.co/JW2MR3JzbG pic.twitter.com/GpWaUNIsvo

— Sky (@SkyEcosystem) January 10, 2025

The asset is in its initial stages of spreading to other networks. So far, around 1.53B of the tokens are on Ethereum.

The Solana version, with over 102K tokens, is a test for the later stage of fully launching Sky Protocol. The chief goal is to offer the same DeFi services and yield but on Solana’s much more scalable network.

USDS also prepared for its expansion on Base, by offering outsized yield for the first liquidity providers on Aerodrome. In the coming weeks, USDS will continue its inflows into Base, which already holds more than $3.5B in other stablecoins.

Sky Protocol and the legacy vaults of Maker are still some of the top DeFi apps for passive income. Some of the partnerships are achieved through the biggest subDAO, Spark Protocol, which has launched its own set of Aave vaults. Over time, Sky Protocol will aim to regain the former position of Maker as one of the top stablecoin issuers and providers of passive income.

USDS changes trading profile with representation on Solana

The growth of USDS also comes with increased activity and turnover on Solana. The shift came in November, as Sky strategically made its move to the new chain, displacing the volumes on Ethereum.

The highly active USDS on Solana points to a trend of adopting some of the legacy protocols on Ethereum. The last few months saw Solana activity rise, with potential demand for passive yield to lock in gains.

The total value locked on Solana increased to $8.54B, expanding more rapidly in the last three months. The TVL increased not only due to the higher nominal price of SOL but with token and stablecoin inflows.

The stablecoins on Solana have already reached $5.79B, with a predominance of $USDC usage. The USDS market share has climbed to around 1% of the entire supply, still getting ahead of other niche stablecoins.

In this early stage, USDS usage on Solana is more limited. On Ethereum, USDS transactions reach over $30,000, while the Solana version carries on average transactions of around $3,000 as the asset is still building up its adoption.

The USDS on Solana is still spread among a handful of whale wallets. One of the leading addresses holds 1.5M USDS and is one of the biggest yield recipients. The top 4 addresses on Solana hold more than 50% of the supply of USDS, as retail wallets are still catching up with whales. The expansion of USDS started from November 19 onward, with a rapid spike in activity.

USDS is also trading on Raydium and Aerodrome, though with a warning for being a mintable and freezable asset. This means some of the holders may have to consider the possibility of locked tokens if they fail to fulfill the terms and conditions of Sky Protocol.

The Raydium USDS/$USDC pair has over $69M in liquidity, while Aerodrome carries $1.2M. The token is mostly meant for staking and passive yield and is not a part of the meme token ecosystem.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.

cryptopolitan.com

cryptopolitan.com