A new subset of tokens comes from AI agents with DeFi capabilities. The category is still relatively small but saw a recent spike in volumes and total market capitalization.

AI agents are trying to stand out with specific capabilities. Most early agents focused on personality, content, or entertainment. A few offered utility, by aggregating data or performing on-chain analysis. The most attractive feature of DeFAI would be the potential for personalized portfolio management and automated revenues.

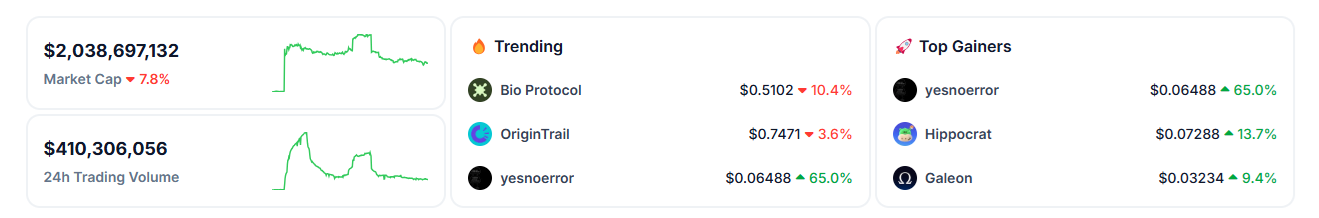

AI agents with trading capabilities are also shortened to DeFAI tokens. The collection is relatively small, with a total market capitalization still under $1B. However, the last few days saw the beginnings of more lively trading and a potential breakout for the sector. The DeFAI sector may follow the scenario of DeSci, a sector that grew its market capitalization by 500% within weeks.

Only around 1% of DeFAI tokens have posted net gains, with most in various levels of correction. For those tokens, a reversal may boost a new selection of AI assets. For now, the sector remains subdued, as AI agent platforms are still the bigger and more liquid narrative.

The appearance of DeFAI follows the saturation of the market by reply bots and an inflow of unwanted content. Trading or profit-maximizing agents aim to bring utility and real use cases to what otherwise looks like another meme market.

DeFAI trend taps Solana, Base chains

Despite Ethereum being the leading hub for DeFi, AI agents with trading capabilities have chosen Solana and Base. Those two chains offer smaller fees when testing out agentic behaviors.

So far, there is no standard on how AI agents can interact and produce safe, verifiable actions with no human oversight. AI agents have only owned tokens, usually donated from other projects.

Some DeFAI projects focus on building an abstraction layer to receive human instructions. The leaders in that space are also some of the top tokens, including GRIFFAIN, Hey Anon (ANON), and ORBIT (GRIFT).

Autonomous trading agents are just appearing, with the ambitious goal of tracking the market much faster than a human, and then implementing a trading strategy to achieve the prompt’s goals. Projects like Almanac are trying to find the tools to allow AI agents to access decentralized trading or other forms of DeFi.

Can DeFAI outperform the market?

In the early stages, all DeFAI tokens may be extremely volatile. The whole category followed Thursday’s market dip, erasing some of its valuations. The small number of tokens in that category is one of the factors for the low valuation.

For the coming months, the category is expected to establish more influence and reach a higher valuation. AI agents as a whole peaked above $17B in total capitalization, later sinking to $13.4B.

Tokens like GRIFFAIN and ANON have rallied previously, boosted by whale activity. Tokens like NEUR and QUAIN are also inviting early investments. The appearance of a new sector can bring more retail traders out of FOMO, expanding the category as a whole.

The Griffain project has the most ambitious approach, starting with swaps based on natural language inputs. The agent may also be able to independently launch tokens on Pump.fun, with the potential to increase human-driven traffic. An AI trading agent may be able to perform actions such as identifying whale wallets, tracking social media, and noticing trends.

ANON expands the potential actions with DeFi, including borrowing and staking. DeFAI agents may also be capable of participating as liquidity providers, managing pools and returns. All DeFi actions are potential tools for the agents, including bridging, staking, seeking out the best yield, and more. Some of the AI agent projects also branch out into the NFT market, unleashing faster analysis abilities. DeFAI projects also include a social media module for tracking trends and posting replies, data, or trades.

AI agents may add to the bot-driven traffic on multiple chains. In general, automated trading is one of the key elements of Solana, where speed is essential. The question of agentic trading raises both technical and regulatory concerns.

cryptopolitan.com

cryptopolitan.com