Solana (SOL) is attracting more stablecoins in the past day, as liquidity shifts to the most promising markets. A shift to DeFi lending and DEX activities is driving the trend.

Solana (SOL) is setting out as one of the most active chains for 2024. Solana saw increased stablecoin inflows in the last days of the year, surpassing all other chains. Based on data by Lookonchain, Solana attracted more than $454M in stablecoin inflows in the past week. Methods for tracking inflows differ, but the overall trend is for more active bridging of stablecoins into Solana’s apps and lending pools.

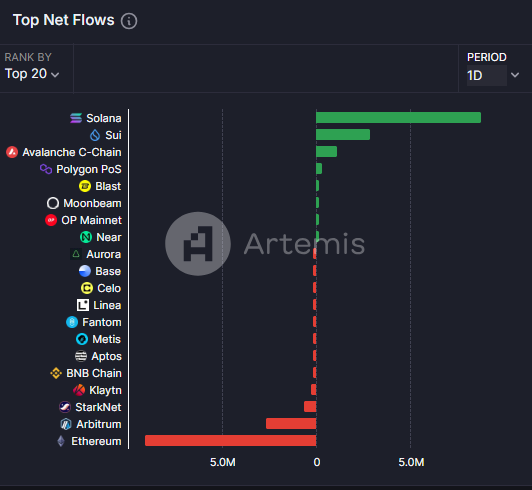

Solana also surpassed Base despite the recent rush to AI agent tokens. Stablecoin flows can shift depending on the available earnings potential of various chains. Arbitrum, formerly one of the key L2 chains, saw the biggest stablecoin outflows.

Despite the L2 narrative, not all chains managed to attract value in the year to date. Former DeFi star ZKSync Era saw an outflow of more than $2B net, along with Linea, Blast, and Avalanche.

On a year-to-date basis, stablecoins have boosted Optimism, Base, Solana, Arbitrum, and SUI. Ethereum remained the most active chain in hosting USDT, adding to the available liquidity. Overall, stablecoins crossed the $200B barrier, driven by Tether, in addition to new mints for DAI, USDS, and Ethena’s USDe.

Ethereum remains a stablecoin donor, traffic shifted to Solana and Base

Stablecoin flows shift in the short term, and Solana achieved its leading position as of December 30. The chain saw $8.8M in netflows for the day, followed by SUI’s $2.9M in netflows. Solana competes with Base for fund inflows, though it has only made second place for the past three months.

In the year to date, Base remains the most significant target for stablecoin inflows. For 2024, the chain attracted $7.8B in inflows, with $3.5B retained as net inflows.

Solana attracted $5.3B in new inflows while retaining $2.1B in net flows for the year to date. The chain recently added more than 100M USDS from the Sky ecosystem as it aims to expand DeFi lending.

As a result, Solana carries $5.254B in bridged stablecoins, with a total value locked rising to $8.58B. Solana lagged in attracting value, only peaking in December at above $9B in various tokens and stablecoins. Jito Liquid Staking and Kamino Finance made the bulk of value locked, but DEX, like Raydium and Jupiter, also drew in $4.47B in their liquidity pairs.

Stablecoin flows measure bridging activity, which varied depending on the available apps. Arbitrum was one of the EVM-compatible chains with highly active bridging. For Solana, the bridging from Ethereum was more rare, but once funds were sent to Solana, they were more likely to stay. Arbitrum, on the other hand, had a much more active turnover.

The recent trend in stablecoin flows shows that trader expectations have shifted in the year to date. The trend accelerated as Solana and Base became the top chains that carried AI agent tokens. As the only source for those tokens, bridging stablecoins for trading was key to accessing the new markets.

Solana activity moved from memes to DeFi

Meme tokens were one of the main drivers of growth on Solana in the past months, with two significant series of expansion. Despite this, not all traffic on Solana was of the same quality. The chain carried multiple low-value transactions, with up to 35% transaction failures.

In the past year, Solana was also the leader in carrying out trading bot activity. Routing and bot usage were key for Solana to ensure a successful DEX trade or token sniping.

Up to 86% of all bot traders use Solana as their destination chain. Most of the Solana traffic is also from wallets with 0.01 SOL as a balance. However, the inflow of stablecoin activity shows value is also accrued, usually linked to whale wallets using the protocols.

Solana’s lending expansion also hinged on meme tokens. Some leading memes, such as DogWifHat (WIF), were used as collateral on Kamino to borrow more stablecoins.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.

cryptopolitan.com

cryptopolitan.com