The post-election period is driving a reassessment of all crypto sectors. DeFi is one of the areas to see potential change, in expectations of a crypto-friendly US administration.

The potential for a crypto-friendly regulatory climate in the USA is driving a repricing event for top DeFi tokens. The electoral victory of Donald Trump sparked hopes of shifting attitudes to crypto and on-chain finance.

The latest developments are starting to affect different crypto sectors, leading to outsized recoveries. DeFi and DEX tokens were one of the hottest trends in the past few days, with expectations of a bright future under Trump’s administration.

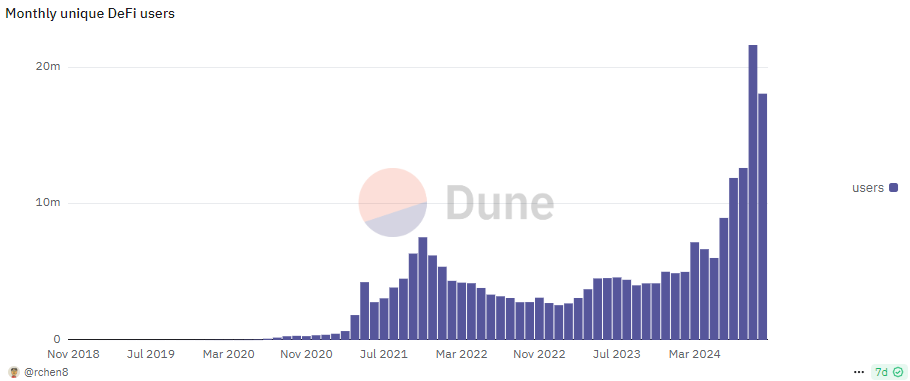

The DeFi sector carries close to $89B in value locked, close to the market cap valuation. However, not all projects have the same ratio of value locked, returns, and market capitalization. There is no standard for DeFi, with experimental approaches and breakthroughs, as well as incentives to invite users. DeFi users also increased in the past couple of months, with more than 21M in September and above 18M in October.

Trump himself tested out DeFi with his World Liberty Financial, which took a cautious approach with a locked token launch. The existence of this financial vehicle, along with other crypto products, will add to the demand for new regulations.

The other big concern of crypto is Gary Gensler, the chairman of the US Securities and Exchange Commission. In the past few years, the SEC started a series of aggressive lawsuits against functioning crypto and DeFi projects. The victory of Donald Trump set expectations of shifts in the SEC team, removing Gensler for a more crypto-friendly chairman of the SEC.

One of the latest attacks of the SEC was against ImmutableX, which has served as a chain for gaming. IMX also rallied by more than 20%, rising to $1.21, on the news of a renewed SEC leadership.

Top DeFi tokens repriced for wider adoption

Through bull and bear markets, Web3 and DeFi projects continued to innovate and build infrastructure. There is no unified standard for DeFi, but some hubs were able to handle value transfers and mitigate risk. Over time, several tokens emerged as blue-chip DeFi, carrying the largest locked value. Most are tied to the Ethereum ecosystem and include forms of staking and other passive yield instruments.

Without the threat of a cease-and-desist notice or other regulatory overreach, top DeFi tokens rallied in the immediate aftermath of the US election. Lido (LDO) added up to 39% in the past day, to $1.33. Strong recoveries also arrived for Ethena (ENA), Raydium (RAY), Aave (AAVE), and others. Part of the recovery was due to the overall crypto enthusiasm, but the DeFi sector outpaced other token classes.

As a whole, the DeFi sector expanded its valuation to above $99B. Top DeFi tokens like Uniswap (UNI) had the strongest rallies, gaining 32% in the past day to $9.43. Uniswap faced SEC scrutiny in the past months, and may benefit from the more lenient regulatory climate.

A big part of DeFi is tied to infrastructure, such as Data Availability layers. However, DA projects also offer passive returns and incentives, potentially triggering regulation. Without excessive oversight, those projects could continue to innovate and grow their influence.

Even without direct pressure, DeFi projects changed their value proposals in the past years. Following the crash of FTX and several large funds, crypto and DeFi protocols sought out conservative investments.

Crypto projects like Maker, Tether, and others use US T-bills as partial collateral, diminishing potential contagion events tied to crypto collaterals. The DeFi sector has seen multiple stress tests and emerges as a stronger value proposal in 2024.

The lowered regulatory scrutiny can also revert investor interest to serious projects with complex value propositions. One of the reasons for a shift to meme tokens was the threat of a regulatory crackdown on complex projects. Memes do not have to explain their utility and have not been targeted by securities regulators.

DeFi was especially at risk for crackdowns, though some of the platforms only offer the code to perform operations, without being a financial intermediary.

cryptopolitan.com

cryptopolitan.com